-

Revisions to the TILA/RESPA integrated disclosure that go into effect this fall drove the changes Ellie Mae made in its latest update to the Encompass loan origination system.

August 6 -

To keep winning business in an increasingly competitive loan channel, United Wholesale Mortgage is giving brokers more control of the borrower relationships that persist even after loans close.

July 13 -

United Wholesale Mortgage has set out to be an ally to mortgage brokers in unprecedented ways as CEO Mat Ishbia works to evolve the channel's transactional nature into a more relationship-driven dynamic.

July 13 -

When big banks bailed on brokers during the housing crisis, United Wholesale Mortgage doubled down. As third-party originations now make a comeback, the family-owned company is determined to chip away at retail lenders' dominance.

July 13 -

Impac Mortgage Holdings will sell up to $600 million of non-qualified mortgage loans to Starwood Property Trust over the next 12 months that will be securitized.

June 27 -

Incenter Mortgage Advisors is facilitating the sale of more than $10 billion in mortgage servicing rights tied to Fannie Mae and Freddie Mac loans originated by mortgage brokers.

June 21 -

Angel Oak Commercial Lending has acquired a controlling interest in lender Cherrywood Mortgage in order to strengthen its focus on small-balance commercial lending.

June 5 -

Impac Mortgage Holdings generated almost $4 million in net income during the first quarter as it continued to downsize to adjust for origination declines and benefited from servicing gains.

May 10 -

Carrington Mortgage Services' decision to offer subprime mortgage loans was a natural progression from its decision four years ago to concentrate on borrowers with credit scores under 640.

April 3 -

As mortgage brokers gain more leverage in the market, concerns about borrower poaching and retention are making channel conflict with lenders more prevalent.

March 12 -

If GSE reform leads to the 30-year mortgage's demise, homebuyers' monthly payments could soar by $400, according to a recent Zillow estimate. But lenders aren't convinced this housing finance staple is in any danger of being replaced.

March 12 -

Today's mortgage broker is tech savvy, sophisticated and better equipped to thrive in a wholesale channel that's far more competitive than in the past.

March 8 -

Mortgage lenders are embracing the broker-wholesale channel as a low-cost way to extend their reach and maintain volume in the face of rising home prices and interest rates that are putting a damper on origination activity.

March 8 -

Tight margins, regulatory clarity and a renewed appetite to expand have made mortgage brokers and the wholesale channel attractive again, at least to the small and medium mortgage lenders.

March 8 -

Ocwen Financial Corp. fired Otto Kumbar, executive vice president of lending, as the company significantly reduces its origination business.

February 13 -

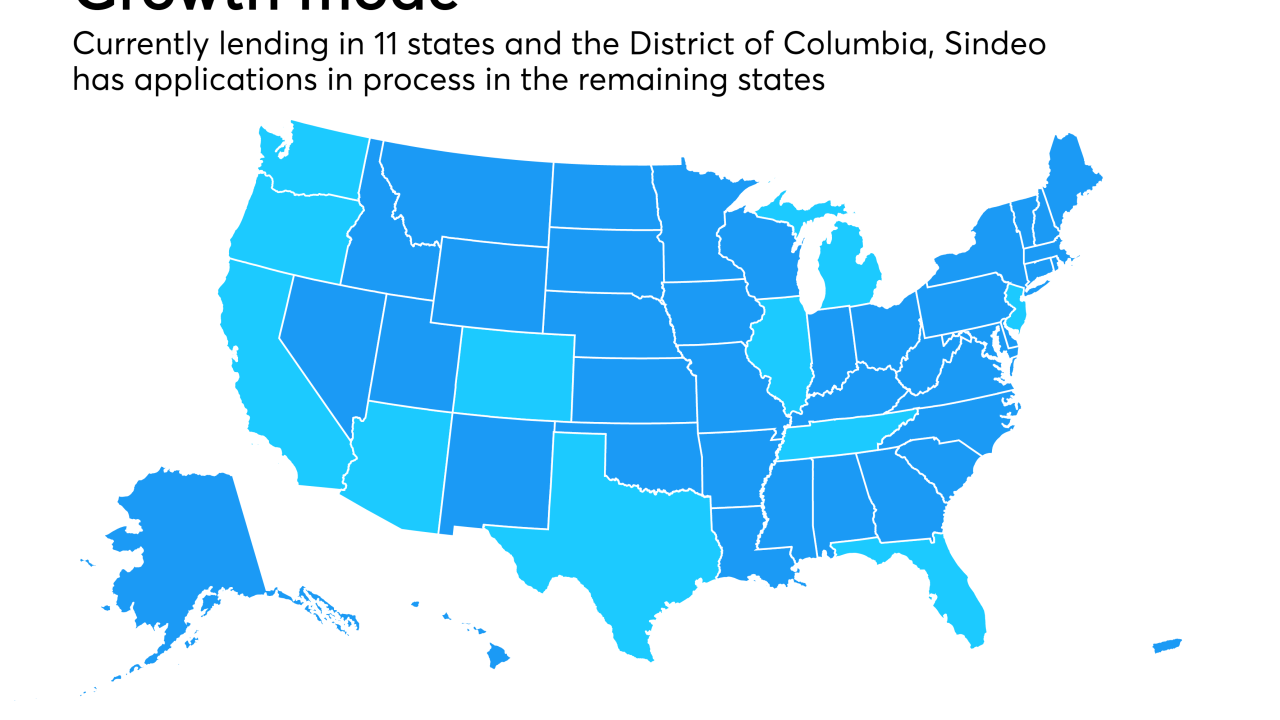

When a $40 million round of venture funding fell through at the last minute, digital mortgage broker Sindeo all but shut down this summer. Now recapitalized and rejuvenated, founder and CEO Nick Stamos explains why Sindeo is ready to grow again.

November 21 -

Mid America Mortgage's deal to acquire the assets of two Oklahoma City-based lenders will double the Addison, Texas, company's loan volume.

November 15 -

Walter Investment Management Corp. is looking to file for bankruptcy protection by Nov. 30, after lining up $1.9 billion of debtor-in-possession warehouse financing.

November 10 -

Impac Mortgage Holdings' nonqualified mortgage origination volume increased 248% year-over-year in the third quarter as the company accumulates loans for a planned securitization next year.

November 9 -

From Secretary Carson easing lending concerns to Fannie Mae announcing its expansion of Day 1 Certainty, here's a look at seven things we learned at the 2017 MBA Annual.

November 3