-

The offering touts closings in as few as 10 days and allows homebuyers to compete with deep-pocketed investors and iBuyers.

May 10 -

United Wholesale CEO Mat Ishbia criticized his Detroit mortgage rival for recent job cut announcements in a post that has generated hundreds of responses.

April 29 -

The company wants to redeploy resources into the wholesale mortgage channel that accounts for three-quarters of its production volume.

February 14 -

With a huge wave of consolidation expected soon, lenders must carefully adjust their mix of personnel and technology to stay profitable, whether they plan to continue to compete or sell.

October 11 -

The platform, built off a recent acquisition, looks to create efficiency in the growing wholesale lending market.

September 15 -

The deal comes just days after Figure closed on a capital raise that valued it at $3.2 billion.

August 3 -

“One” is the first in a series of non-agency mortgages the wholesaler plans to introduce this year.

July 15 -

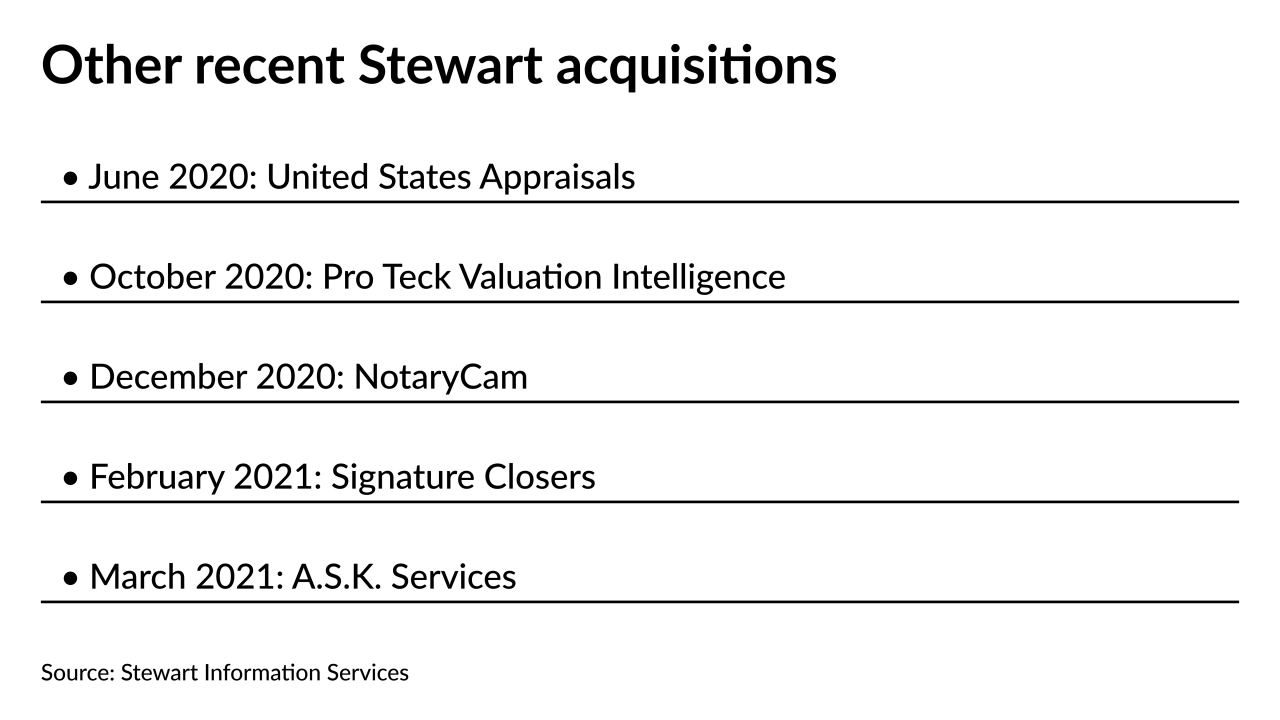

The deal adds to the burgeoning technology stack at the Houston-based title underwriter, which added NotaryCam in December.

May 25 -

The company provides a secondary market outlet for its retail and wholesale lending corporate sibling as well as for small balance commercial loans.

May 21 -

The move formalizes the use of the Rocket Mortgage moniker, which has been a major part of the company’s branding since 2016.

May 12 -

Despite a 1Q decline in origination volume, Chairman Mat Ishbia is optimistic for the second quarter, saying the company received 17,000 more submissions in April's higher interest rate environment than it had in February.

May 11 -

While the product was hard to find after the start of the pandemic, the Consumer Financial Protection Bureau’s recent changes to Appendix Q are giving a pair of large wholesalers the chance to offer it as a qualified mortgage.

May 10 -

The company is shifting some of its conforming-focused call center resources not just into the growing non-QM channel but to Veterans Affairs products as well.

May 7 -

The company, like many publicly-traded nonbanks, is looking for ways to address the downward pressure that a battle between two large competitors is putting on the wholesale channel’s profitability.

May 6 -

The company touted its investments in the wholesale channel while also reporting a slight quarterly drop in overall originations and gains on sale during an earnings call this week.

May 6 -

Fluctuating rules are redirecting some government-related loans to a disparate private market.

May 6 -

The company aims to use the additional capacity to get its non-qualified mortgage business back to producing $125 million per month, and anticipates more purchases of mortgage servicing rights, representatives said in its Q1 earnings call.

May 5 -

This is the first deal that serial acquirer FOA has announced since it went public on April 5.

April 28 -

The suit, filed in the U.S. District Court for the Middle District of Florida, seeks class action status.

April 27 -

Building timelines are finally stable enough for nonbank American Financial Resources to return to the conventional market following the pandemic-related disruption, according to a company executive.

April 23