-

The company increased and diversified its income streams beyond the mortgage sector but expenses associated with stock-based compensation and a recent acquisition outweighed these gains.

November 11 -

But overall, customers are less satisfied with their origination experience compared with the 2020 survey, according to J.D. Power.

November 11 -

The two fintechs look to streamline document capture and credit decisioning for lenders.

November 8 -

With today’s generation of home buyers so rooted in a digital world, how will the financial services industry need to change to meet their needs? What new consumer technology will they need to adopt to meet consumers where they are? How will those approaches differ from how things have been done historically in the industry? Join us in a discussion with Blend’s Founder, Nima Ghamsari as we chat through how banks and financial institutions need to think through these questions.

-

If lenders build this technology, data suggests that borrowers will come walking out of the cornfields for it — but Congress needs to pass the SECURE Act first.

October 29 NotaryCam

NotaryCam -

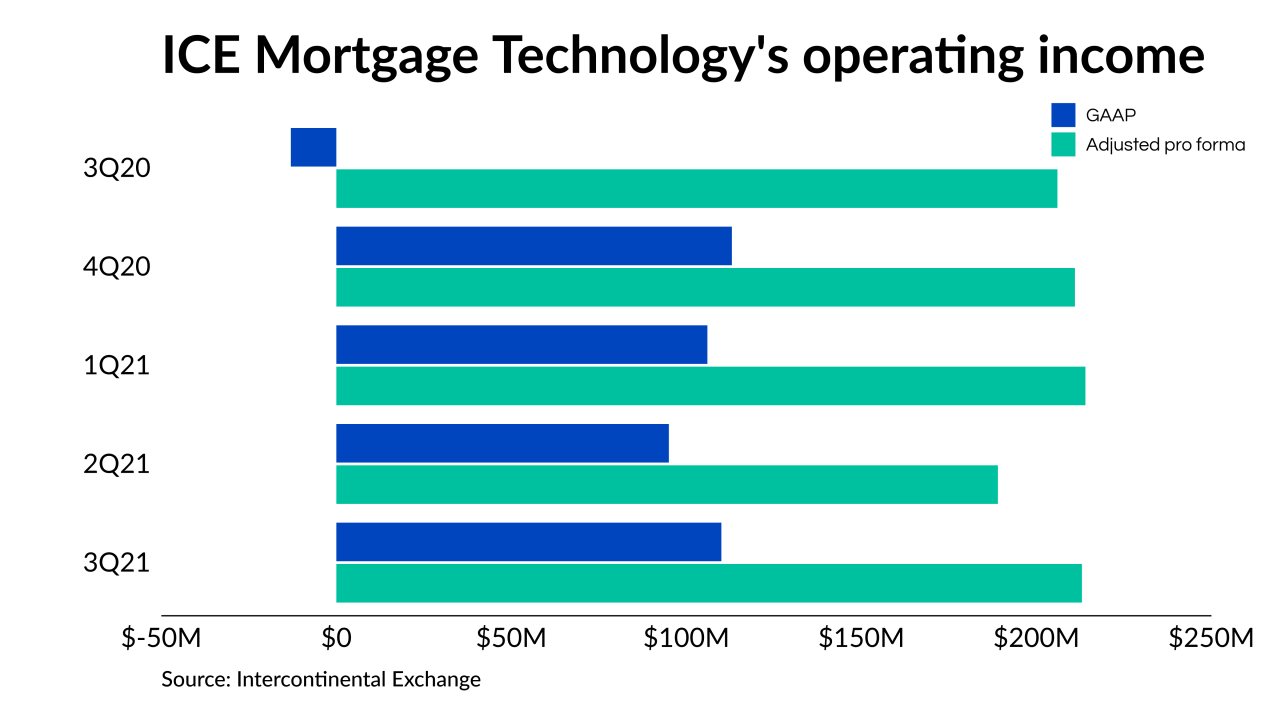

The company is making progress on a focus shift to recurring revenues from transactional activities.

October 28 -

The credit bureau's $638 million deal to buy the ID verification firm is its second M&A agreement in a little over a month to broaden its line of products and services that help customers combat fraudsters and identity thieves.

October 27 -

The MI Estimated Rate Quote application programming interface is built upon the JSON standard, used in server-to-mobile communications.

October 26 -

The average of 8% of total expenses that lenders put toward technology has a value, but it shows up more in broader organizational goals and productivity, the study found.

October 26 -

Button Finance intends to use the capital to develop its underwriting platform and increase hiring.

October 25