-

Small, often intangible quality-of-life perks are a big part of what makes some fintechs the best ones to work for.

March 31 -

The Utah fintech encourages a playful attitude by devoting the first floor of its offices to entertainment and comfort with video games, Ping- Pong, a pool table and a lounge area.

March 31 -

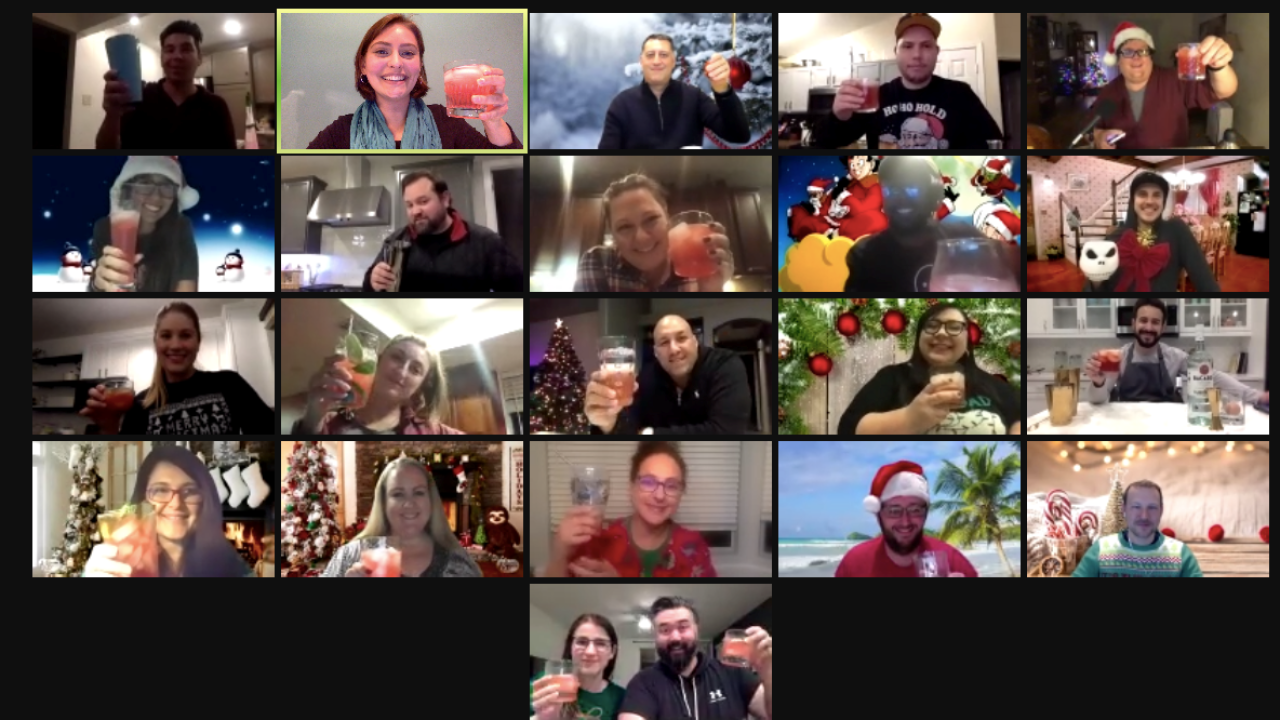

Without its funhouse office, annual trips or volunteering events, the executive found ways to engage his staff virtually.

March 31 -

Known for giving away its signature canary-hued Converse to employees and clients, this small API-centric fintech is poised to become a significant player in open banking thanks to parent company Mastercard and its vendor status with Fannie Mae and Freddie Mac.

March 31 -

Half of Facet Wealth’s employees haven’t met face-to-face. Here is how the fintech is working to strengthen community.

March 31 -

This venture-backed company, which specializes in creating banking and payment platform APIs for other fintechs, attracts new recruits through a culture of learning.

March 31 -

As credit remains tight, Opportunity Financial’s work with consumer financial services Brightside firm aims to offer a wider swath of borrowers access to small loans.

March 31 -

Point of sales providers are bringing improvements to their systems as loan officers look for ways to keep their pipelines active.

March 30 -

New entrants in the market may believe: “We’re doing everything right. Fraud isn’t a problem, and we have a fraud alert tool in place anyway.” This, of course, is exactly when fraud risk grows, warns Paul Harris of First American Data & Analytics.

March 29 First American Data & Analytics

First American Data & Analytics -

Five transactions in the past week provided cash infusions for tech companies that are developing products for real estate finance.

March 26