-

Sens. Elizabeth Warren, D-Mass., and Doug Jones, D-Ala., cited research that found algorithmic lending can lead to higher interest rates for minority borrowers.

June 12 -

Home sales in Baltimore plunged in May amid the recent ransomware attack on city government computers, including those essential for completing real estate transactions.

June 12 -

Appraisals are viewed as a choke point in the mortgage process. As the ranks of appraisers dwindle and technology advances, a new, AI-driven approach may not be far off.

June 10 -

2019 has already seen billions of dollars in fintech M&A. The deals have come at a rapid enough pace that acquirers are often buying companies that are still absorbing deals of their own.

June 10 -

The agency's vote Thursday threatens to block many of the industry's communications with customers, though banks did win one concession.

June 6 -

Cutting the title insurance decision to nearly instantaneous will be the norm in the next 12 to 24 months, according to WFG Lender Services.

June 6 -

Many community banks have given up on national mortgage platforms as not worth the effort, but organizers of NXG Bank in Maryland say they have a plan to make one work.

June 4 -

Covius Holdings plans to buy several businesses from Chronos Solutions that support mortgage servicing and origination processes, including three delivery platforms that will increase the breadth of its technology offerings.

June 4 -

For four years running, consumer complaints about the three national credit reporting agencies — Experian, Equifax and TransUnion — have dominated the CFPB’s database. What do they keep doing wrong?

June 4 -

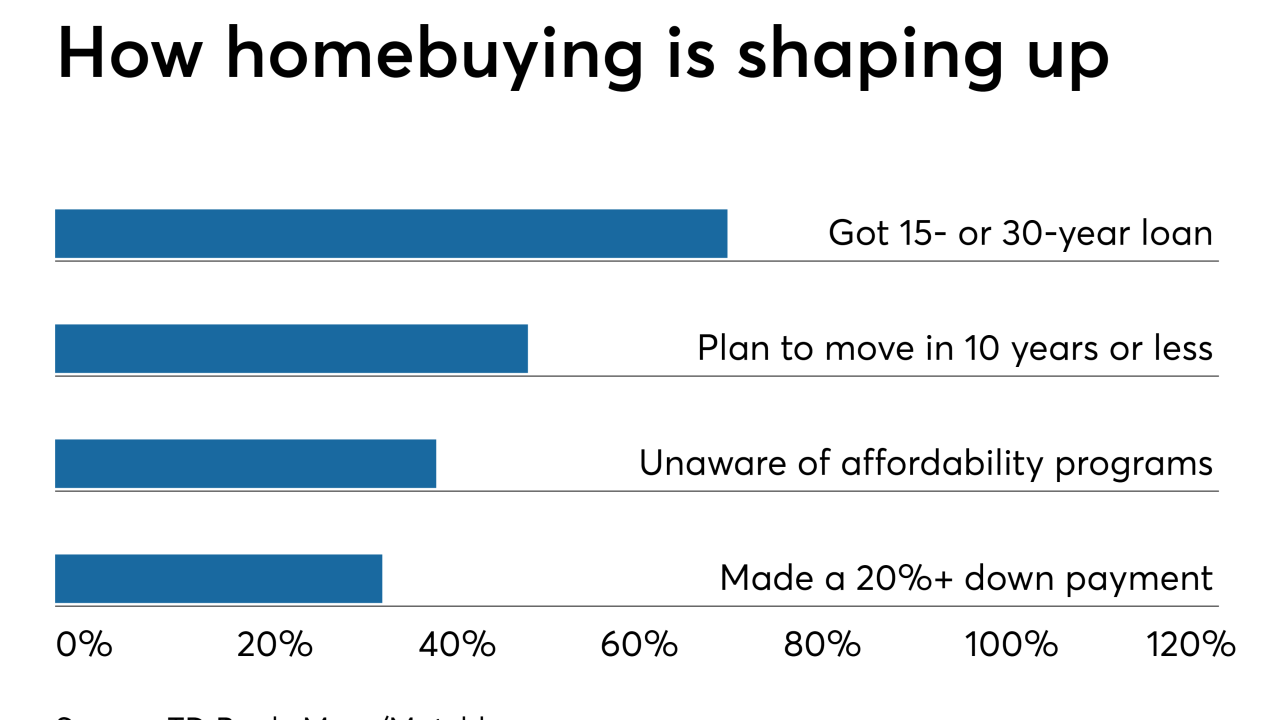

Increased use of the digital mortgage process contributes to improved closing times, but falls short when it comes to borrower education, according to a TD Bank survey.

May 30