Steeper rate declines contributed to a deeper quarterly net loss at Ocwen Financial, forcing it to extend its timeline for returning to profitability.

"To allow for the necessary adjustments to offset the impact of the current market environment, we have decided to extend the upper end of our time range for return to profitability on a pretax basis," Glen Messina, Ocwen president and CEO, said during the company's earnings call.

"As a result we believe we can return to profitability in seven to 13 months, assuming there are no adverse changes to current market and interest rate conditions or legal and regulatory matters."

The company previously expected to achieve profitability outside of nonrecurring charges within 10 months.

Ocwen's loss of nearly $90 million in the second quarter compared to a quarterly loss of $30 million

At a loss of $0.67 on a per-share basis, the company's earnings underperformed consensus estimates by $0.26, according to Seeking Alpha. Ocwen's more than $274 million in revenue missed estimates by nearly $14 million.

Nearly $41 million in "unfavorable interest rate and valuation assumption-driven fair value charges" and more than $10 million in re-engineering costs contributed to Ocwen's second-quarter loss.

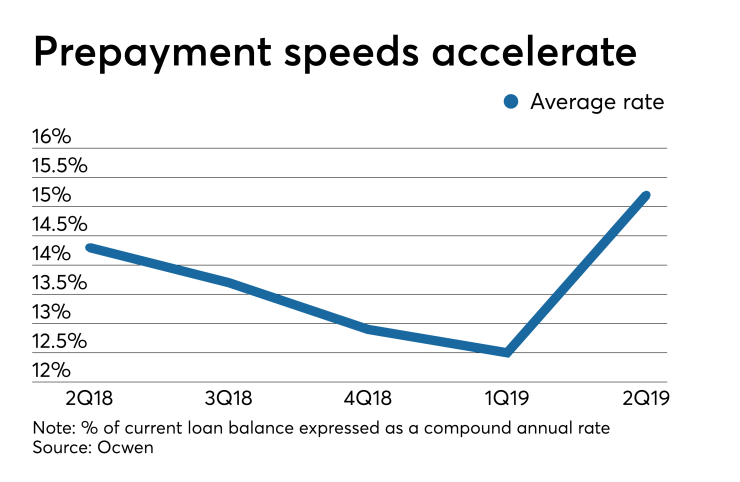

Lower rates hurt the value of servicing by increasing loan prepayment speeds. Ocwen's average prepayment rate for the quarter was the highest it's been in the last 12 months.

Although lower rates set back Ocwen's schedule for achieving profitability, its cost savings from re-engineering are running ahead of expectations, according to the company.

And while lower interest rates hurt some business lines, they bolstered others.

Contrasting the larger servicing business' $59 million pretax loss, the company's lending unit generated more than $8 million in net income.

Ocwen expanded its lending business in the second quarter by re-entering the correspondent channel it had previously

In addition, Ocwen completed the final phase of its