-

Blend, a provider of mortgage point of sale systems, is offering a new product that uses machine learning to streamline loan closings and analyze loan data quality.

September 18 -

Ellie Mae EVP Joe Tyrrell talks customer acquisition strategy. Crafting a personalized consumer experience, he says, starts with data.

September 18 -

Shifting to digital processes requires rethinking staffing levels and responsibilities. Mid-America Mortgage CEO Jeffrey Bode outlines how his company has adjusted.

September 17 -

LoanDepot's CEO Anthony Hsieh delivered a bracing message to mortgage lenders on Monday — strong new competitors are coming into this market, so they need to expand their offerings.

September 17 -

In its proposed “disclosure sandbox,” the bureau has eased restrictions on firms seeking a safe harbor from liability.

September 17 -

Loan officers whose habits are attuned to the refi market need to improve their relationship game to make it in this business, NBKC Bank's Dan Stevens told attendees at Digital Mortgage 2018.

September 17 -

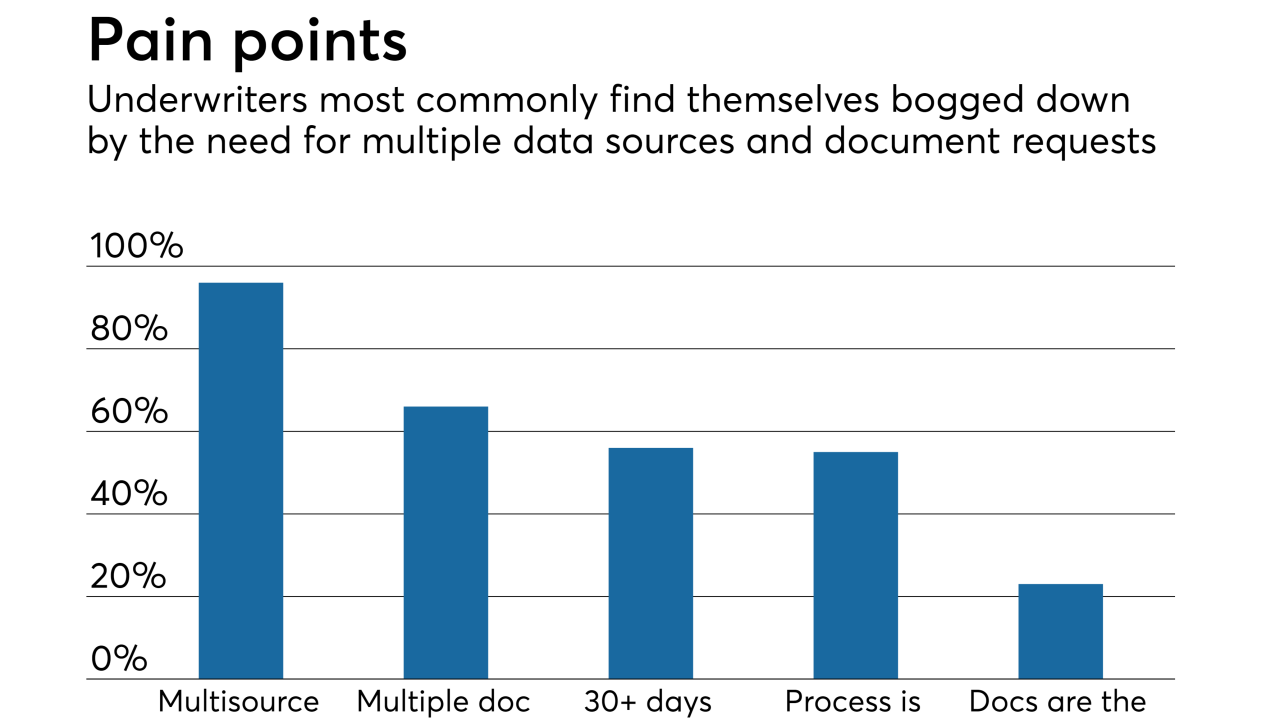

Accessing a mortgage applicants' data from a direct source goes a long ways toward shortening the origination process, according to 96% of mortgage underwriters responding to a recent CoreLogic survey.

September 17 -

Customers are increasingly demanding that their mortgage providers provide more than loans; they want help finding a realtor and handling all the pieces of the mortgage process, said Anthony Hsieh, CEO of loanDepot, during the opening keynote at Digital Mortgage.

September 17 -

Stearns Lending is buying large equity stakes in smaller mortgage banking companies as it looks to grow its retail loan production business.

September 12 -

A man from Hialeah, Fla., will face sentencing in November after pleading guilty to conspiracy in an $8 million mortgage and tax-refund scheme.

September 12