Amid the economic fallout of the financial crisis, lots of big American cities passed local laws pressuring banks to invest more in their low-income neighborhoods.

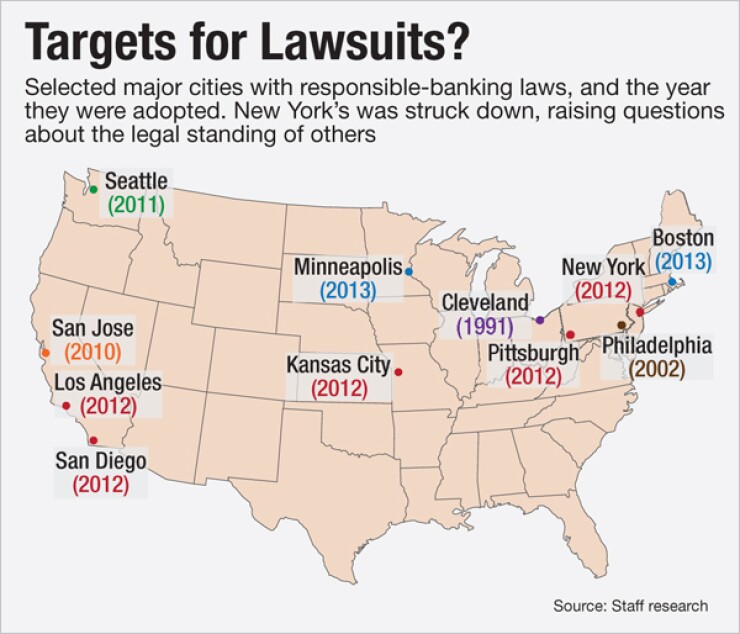

San Jose, Calif., passed its ordinance in 2010, followed by Seattle the next year. New York, Los Angeles, San Diego, Kansas City and Pittsburgh all took action in 2012. Laws in Boston and Minneapolis were enacted in 2013. These ordinances were the brainchild of community groups that turned to local officials in an effort to exert more pressure on banks than state and federal regulators were applying.

But now a federal court decision threatens to halt, and perhaps even reverse, the community groups' momentum. The ruling invalidates New York's ordinance and may have ripple effects in other cities.

"I would think this would discourage other municipalities from proceeding down a similar path," said Warren Traiger, a banking lawyer at Buckley Sandler who has kept tabs on the local ordinances.

Jesse Van Tol, chief of membership and policy at the National Community Reinvestment Coalition, said that some cities' laws appear to be less vulnerable to a potential legal challenge than New York's ordinance was. Still, he said, "I have no doubt that the banking industry will challenge a number of these."

For now, New York's law is believed to be the only so-called "responsible banking" ordinance that has been the subject of a lawsuit.

The three-year-old law was designed to pressure banks to invest more in local neighborhoods. It asked them to provide a raft of data to a new Community Reinvestment Advisory Board that goes beyond what federal regulators collect under the Community Reinvestment Act.

The information sought by New York related to banks' small-business lending, their efforts to prevent foreclosures, their lending for affordable housing and their branches in low-income communities, among other issues.

The Big Apple's law applied to a list of 21 banks — including Bank of America, Citibank, JPMorgan Chase, and other large institutions — that are eligible to hold the city's municipal deposits.

New York's Banking Commission was authorized to consider the new information when deciding where to park the city's sizable base of deposits. That gave the banks an incentive to invest more in New York neighborhoods.

Ex-New York Mayor Michael Bloomberg's administration concluded that the law was an overreach, since bank regulation is the exclusive purview of the state and federal governments, and declined to implement it.

But current Mayor Bill de Blasio's administration took steps this year to start collecting data from banks. That move led to a court challenge by the New York Bankers Association.

The 71-page decision by U.S. District Judge Katherine Polk Failla delved deep into the City Council's deliberations over the so-called Responsible Banking Act. She wrote that the law's structure "secures compliance through public shaming of banks" and concluded that the local law was an impermissible attempt to regulate depository institutions.

"The legislators who sponsored and who spoke in support of this bill did so with one voice: federal and state laws were seen as ineffectual in terms of both the collection of information and the influence over bank conduct regarding community reinvestment in New York City," the judge wrote.

She found that the local regulatory regime "conflicts with federal regulations" and the federal CRA, "which provide national banks with more circumscribed directives."

Banking industry officials cheered the ruling Monday.

"This is an important decision for the banking industry with nationwide ramifications," New York Bankers Association President Michael Smith said in an email. "The banks in New York will continue to be supervised by state and federal regulators, and will continue to reinvest in the communities in which they operate."

"This decision confirms the long-settled law that cities cannot regulate banks," added Robert Giuffra, a lawyer at Sullivan & Cromwell who represented the bankers association in the lawsuit.

A spokesman for New York's Law Department expressed disappointment in the ruling but did not say whether the city will file an appeal.

"The city has a vital role in understanding the effect banks are having on the economic health of our neighborhoods," the spokesman said in an email. "We are reviewing the decision and considering our options."

The ruling's impact in other U.S. cities may depend on how far each municipality's law goes in pressuring banks. Cities that merely use federal data collected under the CRA appear to be less vulnerable than those that ask banks to provide additional, otherwise confidential information.

If courts continue to overturn local laws, the cities could respond by taking other steps to keep the heat on banks.

For example, the city of San Francisco uses its contracting process to exert pressure on banks that want to hold its municipal deposits, according to NCRC's Van Tol.

He noted that changes in local laws are more enduring than revised contracting rules, which can easily be changed by a new mayor, but he also said: "The decision over the weekend doesn't significantly impact the energy and investment that cities are putting in to make sure that banks serve their communities."

It is hard to determine how much real-world impact the local ordinances have had — in part because many of them were passed fairly recently, and in part because it is difficult to measure their impact on bankers' decision-making.