President Donald Trump's recently filed lawsuit against megabank JPMorganChase and its CEO Jamie Dimon is not expected to succeed in court, legal experts say.

Patrick Terrance Donlon, CEO of Trusted American Mortgage, settled allegations from 21 states another person took industry education courses for him.

The company posted its best quarter for funded loan volume and shared other green shoots including greater margins on less reverse mortgage business.

Overall, three-quarters of those in a National Mortgage News survey believe loan production will increase during 2026, but just 15% felt strongly about it.

-

Prepayment speeds approached recent highs last month, but distressed borrower data paints a mixed picture about the current housing market, according to ICE.

-

United Wholesale Mortgage, which was sued twice in December for alleged violations, put the blame for some text messages on an independent mortgage broker.

-

President Donald Trump's recently filed lawsuit against megabank JPMorganChase and its CEO Jamie Dimon is not expected to succeed in court, legal experts say.

-

Trump, during his return from Davos, signaled reluctance to allow 401(k) withdrawals for home down payments, but other tax-advantaged options remain on table.

-

The moderate leverage reflects the quality of RMBS pools from recent issuance years. Borrowers have a non-zero WA annual income of $1 million, with liquid reserves of $594,348.

-

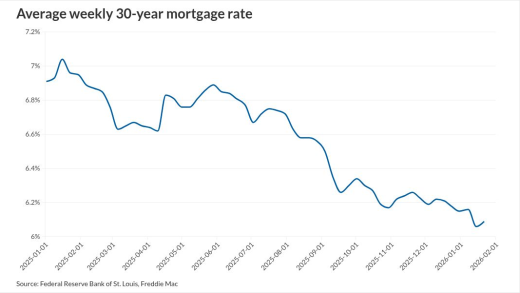

Many servicing metrics look weaker amid lower rates although valuations can vary depending on companies' models, operations and portfolio composition.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Pandemic era changes to credit reporting have dangerously distorted credit scores for mortgage borrowers. The market is in worse shape than we realize, writes a former Federal Housing Finance Agency director.

-

Changes to the regulatory regime surrounding the Federal Home Loan banks should be carefully calibrated so as to do no damage to their successful support for housing and the provision of liquidity to members.

-

Institutional investors have an opportunity to "do well while doing good" while advancing a flagship public/private partnership model writes the Chief Growth Officer of Rocktop.

- ON-DEMAND VIDEO

Scott Colbert, executive vice president and chief economist at Commerce Trust Co., will discuss the Federal Reserve's monetary policy decision and where they go from here.

- ON-DEMAND VIDEO

Join Maggie Kimberl, President of the Bourbon Women Association for a peek behind the scenes of the bourbon industry. Learn more about the women that are rising in the male-dominated spirits sector, the proper bourbon tasting technique and a little bit of the history of bourbon.

- ON-DEMAND VIDEO

New research shows that young Americans are finding it increasingly difficult to buy a home of their own. The co-author of a series of reports will delve into discoveries around the factors why.

- Sponsor Content from Lender Price

- Sponsor Content from Lender Price

- Sponsor Content from Lender Price

- Sponsor Content from Lender Price