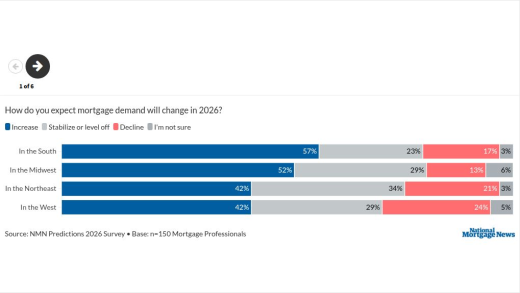

More mortgage professionals told National Mortgage News they expect their companies to hire, or stand pat, rather than fire workers this year.

Primelending produced a pretax loss of $5.2 million in the fourth quarter, significantly lower than the loss of $15.9 million in the same period a year earlier.

The pending agreement would resolve claims over a 2021 hack which affected 5.8 million customers of Lakeview, Community, and Pingora Loan Servicing.

Leverage is moderate in Saluda Grade's pool, yet the junior liens carry slightly more LTV and DTI risk, on a weighted average (WA) basis.

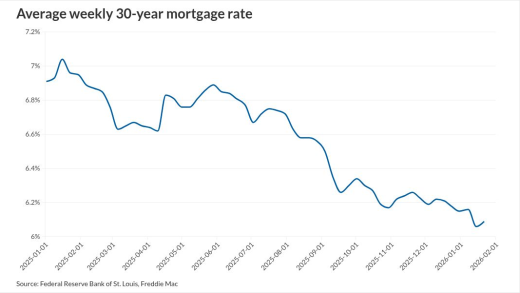

Federal Reserve Gov. Lisa Cook said in a speech Wednesday night that the central bank's credibility depends on its ability to bring inflation back to its 2% target.

-

After four years, the senior note classes will either pay a 100 basis-point increase to the fixed coupon or the net weighted average coupon (WAC) rate, whichever is lower.

-

Shaw, which was part of last year's standstill agreement with Third Point, said it will support shareholder-driven change on Costar's board.

-

Shore Capital Partners, a Chicago-based private equity firm founded by billionaire Justin Ishbia, has raised more than $400 million for its second industrial fund.

-

WomenVenture, a Minneapolis-based Community Development Financial Institution, was already under strain from stalled federal CDFI funding. The recent immigration crackdown added significant uncertainty for its customers as well.

-

Pulte says a GSE stock offering remains likely in 2026, but other policy paths are in play. NMN survey data shows the industry expects broader changes first.

-

Federal Reserve Gov. Stephen Miran, who had been on a leave of absence from his position as Chair of the White House Council of Economic Advisers since he was confirmed to the central bank in September, resigned his CEA role Tuesday to uphold his promise to resign his White House role if he remained past the expiration of his term, which concluded Jan. 31.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Treasury yield breakouts signal technical damage, with higher yields likely before any recovery despite choppy markets, according to the CEO of IF Securities.

-

Treasuries sold off sharply after reports Danish pension funds are exiting, steepening the yield curve as stocks fell and gold surged, according to the CEO of IF Securities.

-

AI can accelerate onboarding by providing recruits with real-time feedback, support compliance by flagging documentation issues, and close the confidence gap by offering reliable answers on the spot writes the CEO of Friday Harbor

New rules means sellers and servicers will need to have plans demonstrating proper oversight of their artificial intelligence and machine learning practices.

Mortgage companies see a lending future backed by artificial intelligence, but there may be as many questions as answers to what the path might look like.

- ON-DEMAND VIDEO

Get expert analysis of the May FOMC meeting, inflation outlook, and Powell's comments.

- ON-DEMAND VIDEO

Mike Goosay, Chief Investment Officer of Global Fixed Income at Principal Asset Management, breaks down the Federal Open Market Committee meeting, Chair Powell's press conference and the SEP.

- ON-DEMAND VIDEO

A week ahead of inauguration day, Scott Colbert, executive vice president, director of fixed income and chief economist at Commerce Trust, takes a look at how the Federal Reserve and the economy will fare in President-elect Donald Trump's second run in the White House.