Michael Strauss faces massive Sprout liabilities as his wife and a former associate launch a new mortgage firm, raising questions about ties to the fallen lender.

United Wholesale Mortgage sees this branding partnership as an opportunity to recruit workers in its home market in the Detroit area, CMO Sarah DeCiantis said.

Rialto Capital allegedly engineered a way to keep it in default so that the company could win extra fees over time, according to a lawsuit filed Tuesday.

Michael Abbott founded Composite Software in 2001 and drives the technical vision of the company at the CTO. Prior to founding Composite, he was CTO and EVP of Electron Economy, a supply chain software company named to Upside's list of Top 100 companies of 2001. He has published widely and speaks regularly on database and XML topics and participates in a JSR Expert Group, is on the XML Query Working Group at the W3C, has served the President of the Silicon Valley BEA Users Group and was the founder/chair of the XML Sig for the Software Development Forum for the past three years.

The National Consumer Law Center is claiming the Credit Data Industry Association wants to suppress Consumer Financial Protection Bureau complaint filings.

-

Primelending produced a pretax loss of $5.2 million in the fourth quarter, significantly lower than the loss of $15.9 million in the same period a year earlier.

-

The high court, without comment, refused Emigrant Mortgage's appeal of a verdict holding it liable for no income, no asset verification loans to minorities.

-

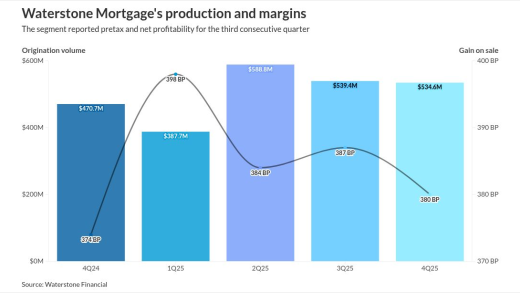

Fourth quarter pretax income of $900,000 and net income of $656,000 for the segment compared with year ago losses of $625,000 and $197,000 respectively.

-

Former Fed Gov. Kevin Warsh is a relatively known quantity to financial markets, but his embrace of President Trump's agenda and the White House's own contentious relationship with the central bank make it hard to know with certainty where — or even whether — he will lead the Fed.

-

The reverse mortgage companies squeezed thousands of dollars out of aging homeowners through various illegal fees, according to a new class action suit.

-

The judge said Nexa CEO Mike Kortas' testimony lacked credibility, ruling that $350,000 transferred to Platinum One was an investment, not loan.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Zohran Mamdani's vision for New York ignores the hard math: apartments aren't the affordable answer for families, writes the Chairman of Whalen Global Advisors.

-

Federal trigger lead bans will change borrower monitoring overnight. Lenders who act now on consent, predictive alerts, and clean data can protect their pipelines and gain an edge in a quieter market.

-

Pushing back on critics, VantageScore's Chief Strategist and Chief Economist says VantageScore 4.0 boosts competition and predicts risk better than FICO.

The second year of the pandemic unleashed unprecedented exogenous challenges for financial companies heading into 2022. What core trends will shape the industry moving forward?

Despite BLM, #MeToo and other movements for equality and justice, employers don't understand enough about the impact of neglecting DEI on company health.

- ON-DEMAND VIDEO

All eyes are on the Federal Reserve and monetary policy. Join us as Scott Anderson, chief U.S. economist and managing director at BMO Economics, breaks down the latest FOMC meeting.

-

The former Trump-appointed Federal Housing Finance Agency head offers insights on the road ahead for mortgage lenders and residential real estate at large.

- ON-DEMAND VIDEO

Two tax experts share the key strategies for financial planners and tax professionals to discuss with clients in the fourth quarter.