Rocket enters the crowded DSCR market with a product for experienced investors, joining rivals as non-QM lending grows and demand for single-family rentals stays strong.

The company identified opportunities and challenges amid market disruption in the quarter and revealed expansion in some mortgage-related business lines.

The Federal Housing Administration has released its first non-draft update of guidance on which defects it's most concerned about and what to do about them.

The move formalizes acting leadership roles both have had in different segments of the government-backed mortgage market serving many first-time homebuyers.

Monthly excess spread will confer credit enhancement to the notes, KBRA said, and while it will be released it will not be available as credit enhancement in future payment periods.

-

At issue is the CFPB's weekly publication of Average Prime Offer Rate tables, a key benchmark enabling the smooth operation of the $13 trillion residential mortgage market.

-

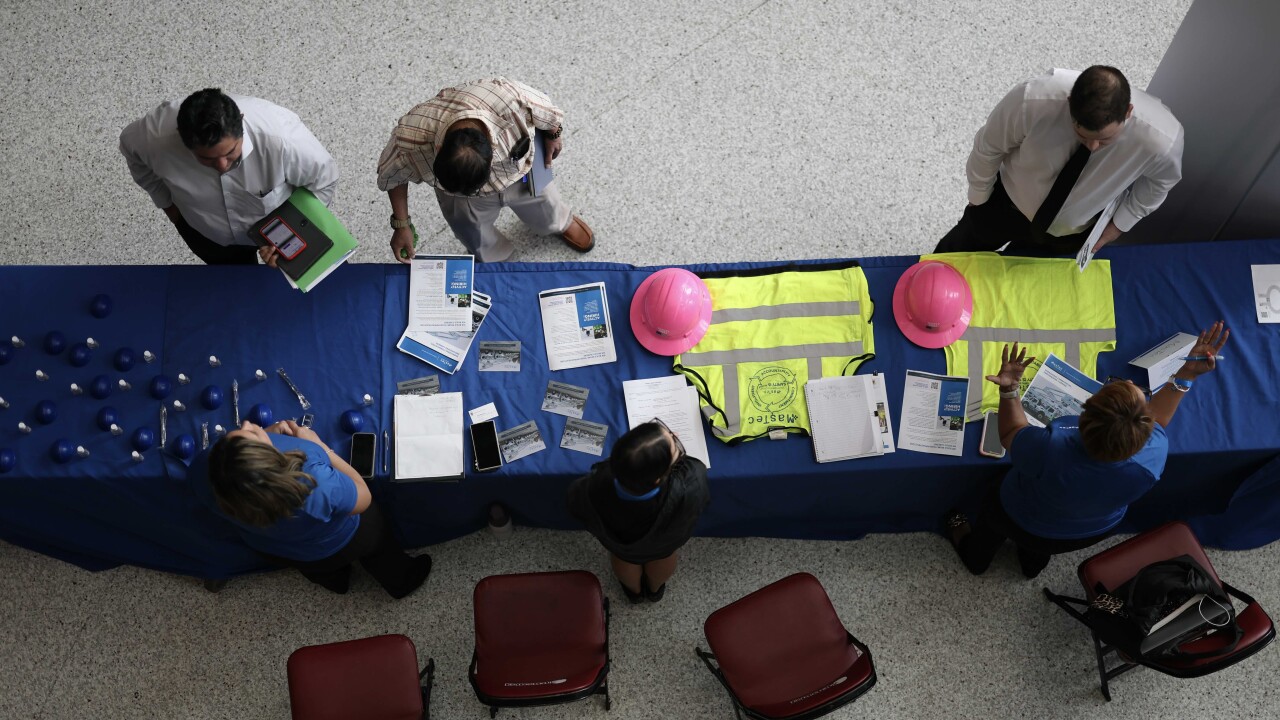

Private-sector payrolls decreased by 32,000, according to ADP Research data released Wednesday. Payrolls have now fallen four times in the last six months.

-

The contract rate on a 30-year mortgage dropped 8 basis points to 6.32% in the week ended Nov. 28, which included the Thanksgiving holiday, according to Mortgage Bankers Association data released Wednesday.

-

Declining issuances since 2022 led to a request for information regarding the future direction of the reverse mortgage program, and NRMLA and MBA responded.

-

In the New Jersey case, MV Realty and its principals agreed to pay $28 million in fines and restitution for these "Homeowner Benefit Agreements."

-

Absolute will add Fidelity Digital Mortgage's 55 producing loan officers to its team of roughly 190.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Consumer attorneys are filing more Telephone Consumer Protection Act lawsuits than ever and if a piece of follow-up legislation becomes law, the peril to mortgage lenders will grow.

-

Now is not the time for the government to cut Federal Housing Administration premiums and enter new segments of the housing market.

-

There are no statutory restrictions on the books in any state prohibiting lenders from conducting mortgage closings electronically or remotely.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

- Partner Insights from Factual Data

- Partner Insights from CBCInnovis

- Partner Insights from CBCInnovis

- Partner Insights from ReverseVision