The Department of Housing and Urban Development announced the FHA-insured loan caps for low- and high-cost areas, which are set based on conforming loan limits.

The move will lead the New Jersey-based bank to eliminate over 100 employees, primarily within its mortgage lending operations, according to a state filing.

ICE Mortgage Technology also added 20 new Encompass clients in the first quarter, but the unit still had an operating loss for the period, its 10th in a row.

Marshall is tasked with bringing Sagent's Dara servicing platform implementation up to scale, replacing Geno Paluso, who is vice chairman during the transition.

-

The Massachusetts Democrat requested to see records related to second liens that banks were required to expunge per terms of the 2012 mortgage settlement.

-

Existing-home sales in the US barely rose in November, as a recent moderation in price growth and mortgage rates motivated buyers at the margin.

-

More than 80% of mortgage brokers expect business to grow in 2026, mainly through the strengthening of referral networks and the expansion of non-QM offerings.

-

The move formalizes acting leadership roles both have had in different segments of the government-backed mortgage market serving many first-time homebuyers.

-

Monthly excess spread will confer credit enhancement to the notes, KBRA said, and while it will be released it will not be available as credit enhancement in future payment periods.

-

The option for holders of older government-sponsored enterprise bonds that predated the move to uniform mortgage-backed securities now has a deadline.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

If passed, the Affordable Housing Credit Improvement Act introduced last week could spur development of 2 million rental units for low- and moderate-income households over the next decade, writes the president of Enterprise Housing Credit Investments

-

Lenders largely took a piecemeal strategy to technology adoption, gravitating towards a hybrid e-closing process as the latest industry “innovation,” yet this process is anything but, Rick Triola of NotaryCam writes.

-

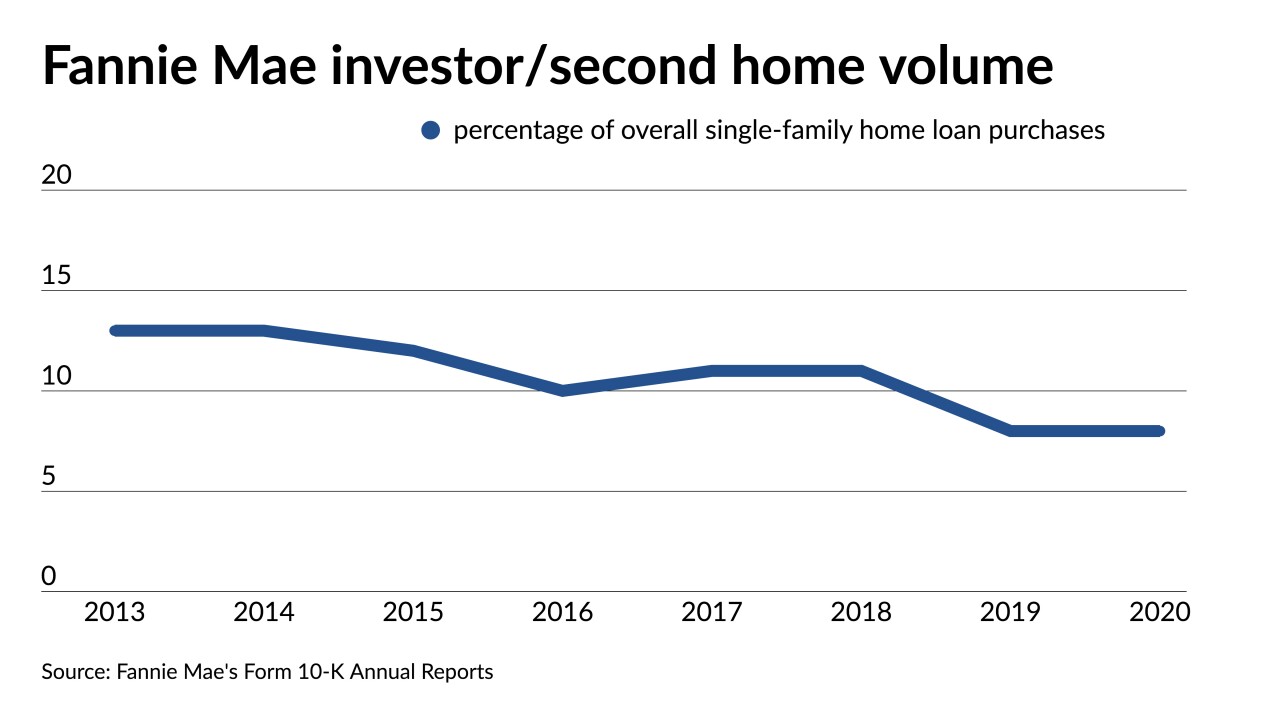

The new rules are disproportionate particularly in light of the GSEs’ recent record of profitability, the director of the Community Home Lenders Association writes.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

- Sponsor Content from Finicity

- Partner Insights from Optimal Blue

- Sponsor Content from Clarifire

- Sponsor Content from Clarifire