Some lenders have a workaround for the Federal Housing Administration's suspension of reverse mortgage endorsements but fewer options exist in other instances.

Dugan is replacing Rich Gagliano, who is moving to executive chairman after 18 months in charge of the now stand-alone mortgage technology provider.

The announcement, made at the Mortgage Bankers Association's Secondary and Capital Markets Conference, underscores Ginnie Mae's role at the forefront of digitization efforts in the capital markets space.

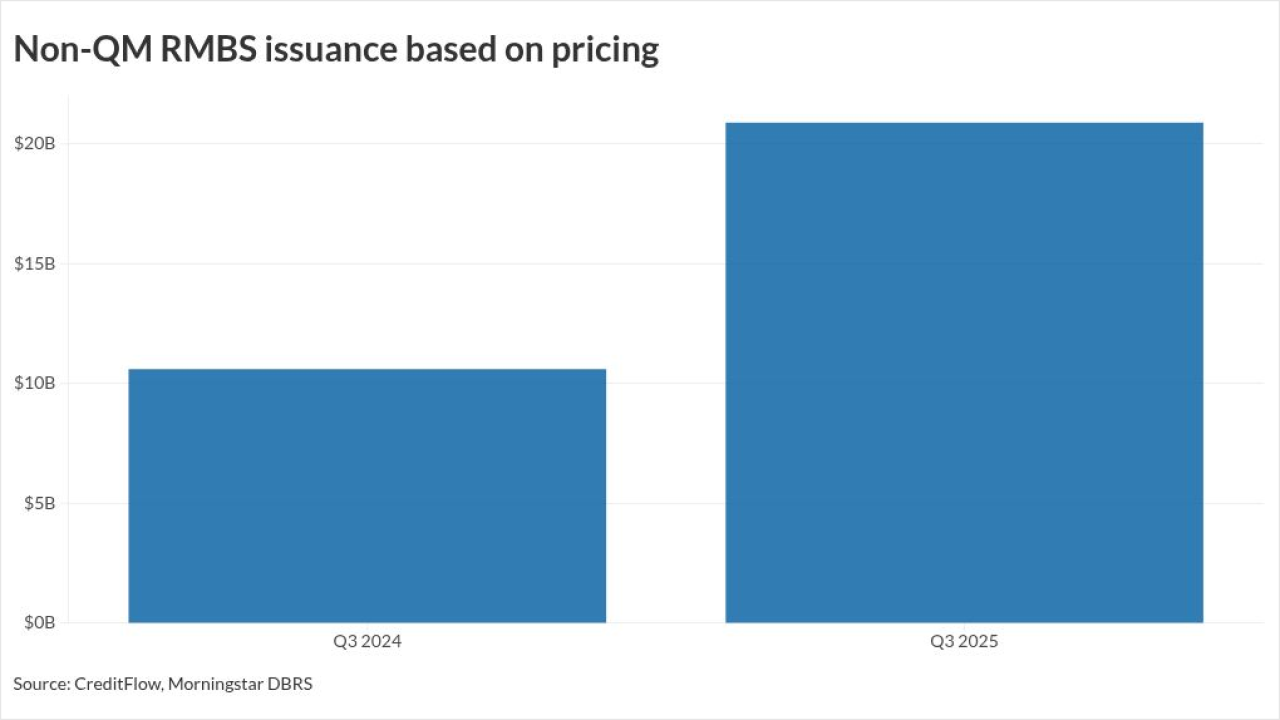

New private-label bonds collateralized by loans made outside the qualified mortgage definition hit highs for the month, quarter and year, CreditFlow data shows.

Luxury home prices rose 5.5% year over year in October to a median $1.28 million, far outgaining the 1.8% increase of nonluxury homes.

-

James is contesting charges brought earlier this month by a prosecutor whom President Donald Trump abruptly installed after her predecessor resigned under pressure.

-

FHA loans accounted for about half of the annual rise in foreclosure starts and 80% of the rise in active foreclosures in September, according to ICE.

-

The Federal Reserve Friday issued a set of proposed changes to its stress testing program for the largest banks that would disclose the central bank's back-end stress testing models, a move that the Fed had long opposed out of fear of making the tests easier for banks to pass.

-

Robert Hartheimer's arrest comes at a time when the bank is trying to recover from a consent order and the Synapse mess.

-

Companies reported positive numbers but see challenges in a sluggish housing environment, as federal pressure ramps up to address affordability.

-

On a year-over-year basis, Waterstone's mortgage business was able to grow pretax profits to $1.3 million in the third quarter, compared with $144,000 in 2024.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Nonbank servicers should proactively ask for guidance on the Consumer Financial Protection Bureau's muddled private-label servicing policies, as they are likely to soon be under scrutiny.

-

The persistent opposition to the Consumer Financial Protection Bureau which has been fierce since day one has been puzzling, and has been cloaked in misleading arguments about the structure of the agency.

-

New approaches to credit scoring lower the standard of the criteria required to receive a mortgage loan, at greater risk to the industry.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland