The former CEO of the Broker Action Coalition left that post after 10 months following that group's split from the Association of Independent Mortgage Experts.

Prices fell 0.5% from September, the fourth consecutive monthly decline for a seasonally adjusted measure of home prices in 20 large cities, according to the S&P CoreLogic Case-Shiller index.

Nationstar’s next securitization of defaulted or inactive home equity conversion mortgages will have a higher-than-average exposure to properties with steep leverage, as well as ties to judicial foreclosure states.

The equity-backed loan offers Rocket customers funds for down payments and closing costs on a new purchase while giving them six months to sell their existing property.

Federal Reserve Chair Jerome Powell testified in the House Tuesday on the heels of yet another pointed social media post from President Donald Trump. But House Republicans largely avoided landing political blows against the central bank chair.

-

Federal Housing Finance Agency Director Bill Pulte is the new chair for both and he has removed several members while adding a few new names at each.

-

New residential construction increased 11.2% to an annualized rate of 1.5 million in February, according to government data released Tuesday.

-

The private market is increasingly testing credit metrics aimed at growing originations without adding risk as a larger effort to this end has slowed.

-

Included among the social media posts made by the new FHFA director was a request for public comment on how Fannie Mae and Freddie Mac might be improved.

-

President Donald Trump's executive order severely limiting the Treasury's Community Development Financial Institution Fund has thrown the industry into confusion as financial companies try to quantify the damage.

-

President Trump's selection of Federal Reserve Gov. Michelle Bowman as the next vice chair for supervision comes as banking groups and their allies in Congress asked the administration to fill the position quickly. Bowman was the preferred choice for many in the industry.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

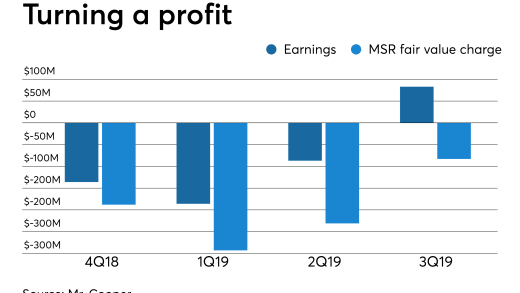

Originations volume for the third quarter came to $486 billion, a hot quarter indeed.

-

Prospect Mortgage has been hiring some heavy hitters of late, causing tongues to wag.

-

One of the most important government actions affecting the farmland bubble goes back to before it was inflated.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland