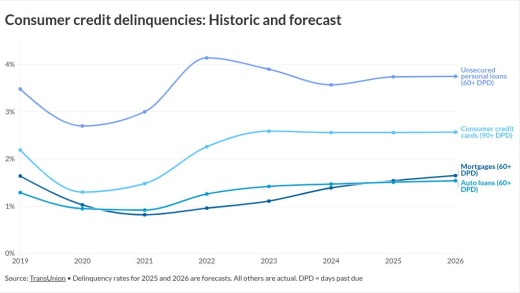

Overall performance is stable but inflation and unemployment have hurt newer borrowers in some cases, according to Transunion's 2026 consumer credit forecast.

Falling interest rates led to a rush in refinancing, but slowing purchase activity brought a decline in overall lock volumes, according to Optimal Blue.

Regulators should approve the deal because post-merger, the servicing market remains fragmented and the mortgage origination business is even more dispersed.

Vishal Sankhla is co-founder and CEO of

Sankhla has dedicated his career to building intelligent, automated systems that replace inefficiency with speed, clarity, and action. He previously led the platform team at Uber, was Director of Engineering at Facebook, and Head of Product at Ethos Life Insurance.

At Outmarket, Sankhla leads a team that delivers a comprehensive AI solution to the manual workflows, siloed data, and outdated processes that cost brokers and carriers billions in lost productivity each year. Outmarket is now trusted by over 200 of the world's most successful insurance agencies to streamline operations, reduce E&O exposure and drive growth. Connect with Vishal on

Fitch Ratings' outlooks for mortgage and title insurers this year are neutral, as housing deals with affordability challenges and a likely economic downturn.

-

Michael Hutchins, the two-time interim chief executive at the government-sponsored enterprise, will remain with the company in his role as president.

-

New-home purchase activity rose 3.1% year over year, but dropped 7% from October, the Mortgage Bankers Association said.

-

Higher unemployment has driven these indications of distress higher but most loans that financial institutions hold in their portfolios are still performing.

-

Nonfarm payrolls increased 64,000 in November after declining 105,000 in October, according to Bureau of Labor Statistics data out Tuesday.

-

Remote work helped fuel migration and erased the loss of rural residents that occurred in the decade prior to the arrival of Covid, Harvard researchers found.

-

The threshold regards loans where the annual percentage rate is at least 1.5 percentage points higher than the average prime offer rate on first liens.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Strong earnings expected in the next year will provide the best opportunity in decades to raise capital and monetize equity, Stephen Curry of Endurance Advisory Partners argues.

-

The key to preparation today lies in process automation that far surpasses pre-pandemic solutions for default servicing, Clarifire CEO Jane Mason says.

-

There are people creating a lot of unrealistic scenarios about market risk.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

- Partner Insights from Anow

- Partner Insights from Cloudvirga

- Partner Insights from Tavant Technologies

- Partner Insights from Visionet