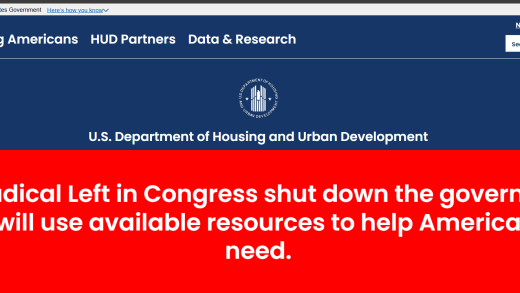

Department officials pushed back on criticism that a banner on its homepage violated a statute meant to curb partisanship in government operations.

The postponement would pertain to Federal Housing Administration-insured single- and multifamily loans and other final determination dates that have not passed.

But the number of properties whose mortgage is more than 90 days late is at its lowest since 2006, ICE Mortgage Technology said.

Trump's remarks — made in a joking tone — come amid increased pressure on the administration from voters to lower the cost of living.

The economy added an unexpectedly robust 119,000 jobs in September, though unemployment edged up to 4.4%. The report, delayed by the federal government shutdown, continues a trend of sluggish job growth in recent months.

-

A failure at an Amazon Web Services data center in Virginia caused widespread outages, hitting services at several banks and fintechs.

-

The appointment of the mortgage veteran comes as the lender undergoes marketing and branding pivots, including its recent name change from Nexa Mortgage.

-

The reduction in force affects under 1% of Rocket's team, with the decision to streamline operations made following identifying overlapping roles post-merger.

-

Other studies have found fewer credit pulls could be viable, but this shows millions more would be adversely impacted than in a bi-merge.

-

A judge agreed to expand her temporary restraining order to add more federal worker unions after their lawyers said there's an "urgent" need to prevent layoffs.

-

Overall, new 60-day-plus delinquencies totaled $2 billion, up from $1.69 billion in August, while maturity defaults accounted for half, or 51% ($1.05 billion) of new delinquencies.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

The Consumer Financial Protection Bureau can determine nearly anything to be an unfair, deceptive or abusive act or practice, and it's more likely to do so when lenders try to take advantage of regulatory loopholes.

-

Starting in 2010, regulators warned banks about the risks associated with rising interest rates. The problem has turned out to be just the opposite: persistently low rates.

-

Over the next 40 years, the rate of homeownership is likely to continue to decline further as changes in demographic trends, increased regulation and stagnant incomes make that dream harder to achieve.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland