The builder reported increased revenue from a year ago, with profits near par, as it sets to absorb new acquisitions across different lines of business.

The broader economy added 150,000 positions, a number the bond market initially read as likely to soften rates, but some economists interpreted differently.

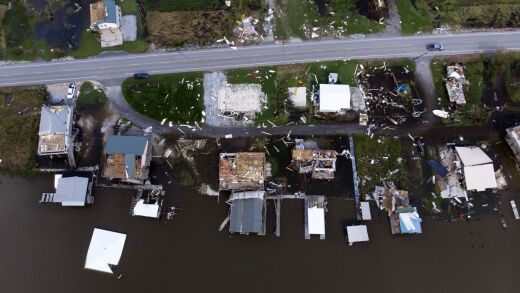

Roughly $8 billion to $12 billion of the residential losses in the Louisiana area could be insured, according to CoreLogic. The storm’s more recent Northeast impact has not yet been calculated.

Fed cut talk fuels hopes of lower mortgage rates. A drop could expose multiple buckets of $200B–$300B in MBS to refi risk, shifting the mortgage market.

Rodney Bolden, Executive Director, is the Head of Industry Engagement and Learning for Morgan

Stanley at Work. In this role, Rodney works with a variety of industry organizations to develop and

present thought leadership research on current trends in workplace financial benefits. Additionally,

Rodney is the host of the award-winning 1 Morgan Stanley at Work Invested at Work Podcast. He is also

the Chairperson for the Employee Benefit Research Institute's Diversity, Equity & Inclusion Council.

-

Details regarding the settlement between the two parties are thin. In the original complaint, Lower was seeking $75,000 in damages from RWM for causing "irreparable harm."

-

A non-bank lender won't ever compete with a bank on price, but can offer flexible underwriting and faster origination times, according to a veteran originator.

-

As part of the acquisition, Hallmark Home Mortgage's CEO Deborah Sturges will join Fairway as the firm's president.

-

The past two Federal Reserve vice chairs for supervision failed to implement the final installment of the Basel III capital framework. Newly installed Vice Chair for Supervision Michelle Bowman is taking a new approach to the thorny question of bank capital.

-

Mortgage applications rose 12.5% from last week, breaking a month-long streak of decline and offering a positive note as summer approaches.

-

Real estate players disclosed losses in 12% of incidents, and the average financial hit was $16,829, according to data from the past decade.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

We're hearing that a possible drop in per-loan profitability is among key concerns as the qualified mortgage rule goes into effect.

-

A study finds consumers are not always understanding what they are being told about financial products.

-

We're hearing that in a post-crisis world, mortgage companies are looking for some new traits in their c-level executive suite.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland