Antonio White says he wants to use his experience in Washington and finance to help individuals who want to build wealth and connections in their communities.

Fannie Mae didn't change its estimate for total originations this year.

A second bill formally making it a felony only passed one house of the state legislature.

The Arkansas-based company spent nearly four years on the M&A sidelines, grappling with asset quality issues and litigation tied to its 2022 acquisition of Texas-based Happy State Bank. Now it's signed a letter of intent to buy an unnamed bank.

The company cited efforts to improve profitability behind its decision, with Popular joining a line of other banks in ending mortgage operations in 2025.

-

As President Trump calls for scrapping quarterly earnings reports and switching to a six-month schedule, industry observers wonder whether the time saved would be worth the potential loss of transparency.

-

-

-

-

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

To take advantage of changing customer demographics and preferences, lenders must capitalize on digital technology. At the same time, digital technology should work in conjunction with, not as a replacement for, the loan officer.

-

Leading economic indicators are favorable for a continued improvement in both the economy as a whole and the housing industry, and many midtier lenders will find their companies operating at a disadvantage when compared to larger firms that are approved to sell their production directly to the industry's largest investors.

-

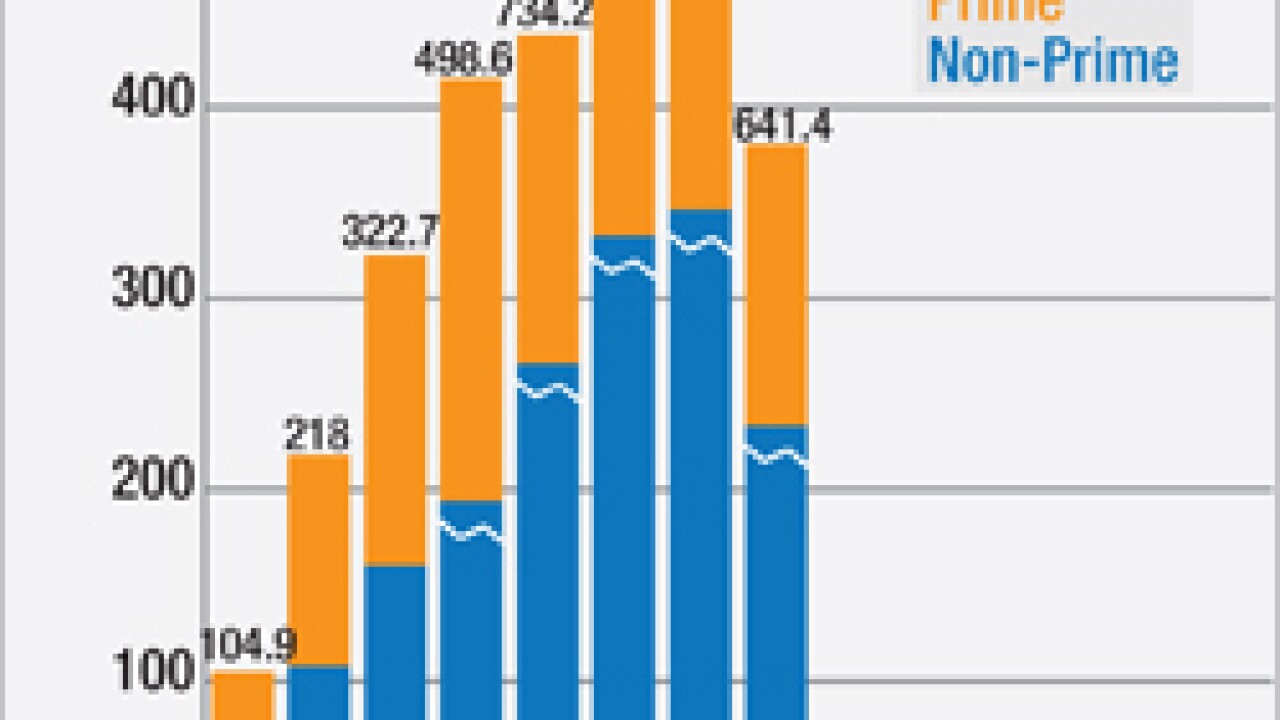

Amid a growing investor appetite for risk, efforts to standardize private-label securities are key to helping ensure the market's healthy return.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland