Since the end of July, UWM's common stock price gained 55%, but an improved mortgage origination outlook was already accounted for, said Jeffrey Adelson.

The top five lenders have an average retail mortgage origination volume of more than $6 billion, as of the end of the fourth quarter of 2024.

KBRA recently assigned low-end investment grade designations to Freedom Mortgage and Pennymac transactions that involve interests in Ginnie Mae mortgage servicing rights.

The multi-year, $100 million agreement will allow users to take financial actions without leaving the ChatGPT app.

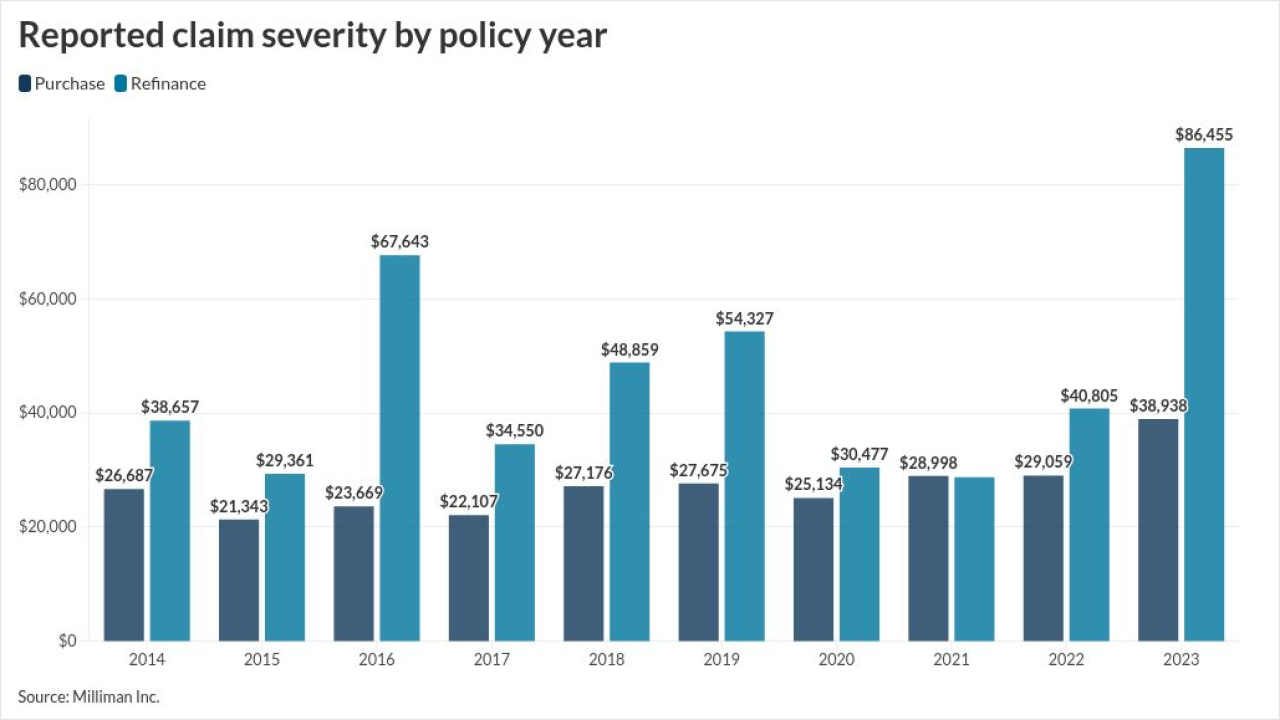

The average loss from the two categories is almost seven times higher than the mean amount for all other types, according to research from ALTA and Milliman.

-

Noninterest income at the Minneapolis-based company jumped more than 10% during the third quarter, while asset quality improved and expenses held steady. "Our focus is very much on organic growth," said CEO Gunjan Kedia.

-

Observers believe the government shutdown and lack of data is keeping mortgage rates in the same narrow range, as investors have issues reading the tea leaves.

-

The Detroit-based mortgage bank's announcement trailed competitors' by over two weeks, but is taking a more aggressive risk-reward stance on the limit.

-

Components of the index all rose, including the highest reading for sales expectations in the next six months since the start of the year.

-

Despite the decrease, average profit margins approached 50%, as the lock-in effect continues to stymie inventory growth and keep home values elevated.

-

The next chair is likely to be named to a 14-year Fed governor term which opens up in early 2026.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Teardowns in which builders or private individuals purchase an aging, outmoded house, then demolish it and replace it with a modern home that will suit today's homeowners are currently on a tear.

-

A lawsuit brought by the City of Miami has the potential to determine the reach of legal actions brought against lenders under the Fair Housing Act.

-

Regulators sought to limit improper contact between lenders and appraisers, but policies of the two mortgage giants encourage the kind of practices that contributed to the housing crisis.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland