The provider of actuarial-related services is bringing a company that provides mortgage servicing rights analytics and risk management into the fold.

The Homeowners Privacy Protection Act will go into effect next March 5, after a years' long effort by the mortgage industry to bar the marketing tactic.

The Federal Housing Finance Agency found the practice aimed at selling more real-estate owned homes to occupants had downsides, according to a recent order.

The Mortgage Bankers Association is examining the data to see if the high ratio warrants a new push for a premium cut but said rising arrears call for caution.

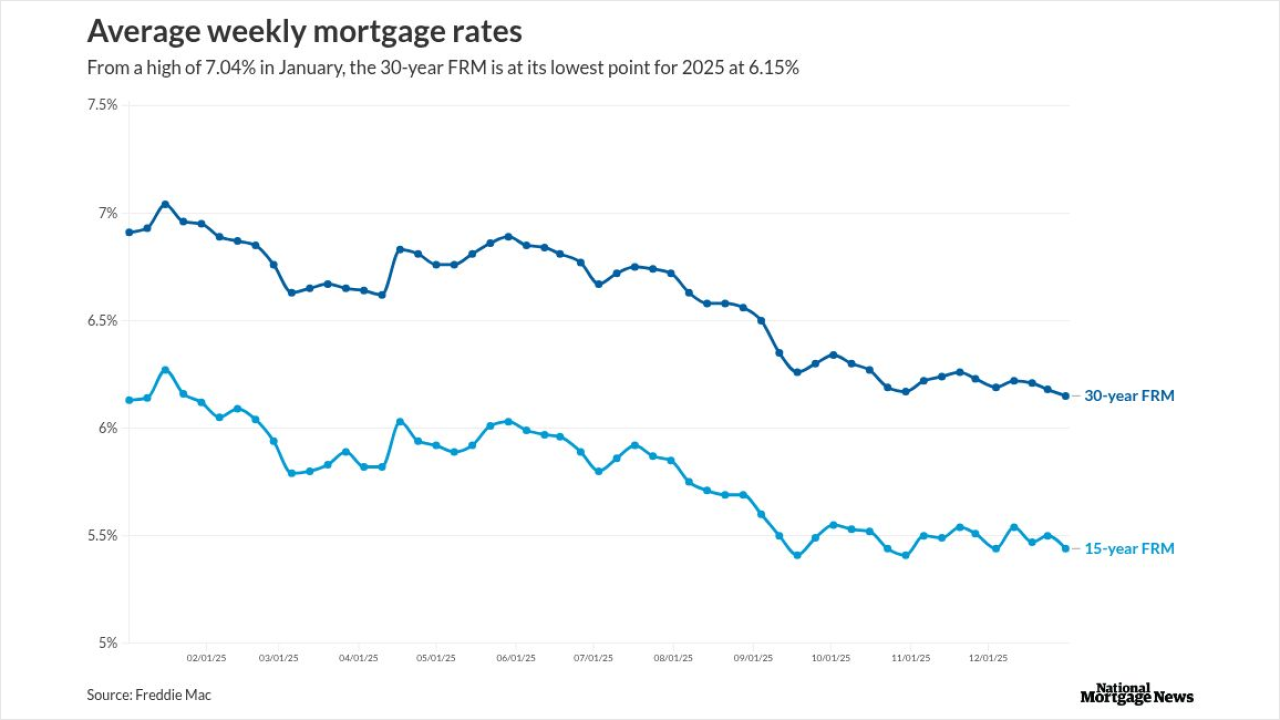

After piercing the 7% ceiling in January, the 30-year fixed trended lower the rest of the year, dropping 89 basis points from peak to trough, Freddie Mac found.

-

Confidence among US homebuilders edged up in December as builders continued to deploy sales incentives to motivate buyers.

-

Fannie Mae and Freddie Mac have added billions of dollars of mortgage-backed securities and home loans to their balance sheets in recent months, fueling speculation that they're trying to push down lending rates and boost their profitability ahead of a potential public offering.

-

After home equity surged in 2023, average gains slowed last year before falling into negative territory over the past 12 months, Cotality said.

-

For 2026, the mortgage industry operating environment will improve, while nonbank financial metrics should be within Fitch's rating criteria sensitivities.

-

Rohit Chopra is named senior advisor to the Democratic Attorneys General Association's working group on consumer protection and affordability; Flagstar Bank adds additional wealth-planning capabilities to its private banking division; Chime promotes three members of its executive leadership team; and more in this week's banking news roundup.

-

The executive order described state legislation on artificial intelligence as a cumbersome patchwork, and pledged to develop a national framework.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

In an open letter, industry veteran Thomas Vartanian outlines the steps the administration can take to encourage innovation, better detect cyber threats and modernize regulation.

-

To truly manage risk, banks must invest in more sophisticated modeling, reporting and analytics to track market movements and ultimately maximize profitability, Vice Capital Markets’ Christopher Bennett says.

-

When new lending volumes start to recede, even with the FOMC’s actions, the shoals of credit and operational risk lurking just beneath the surface will emerge, columnist and analyst Chris Whalen says.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

- Partner Insights from Cloudvirga

- Partner Insights from FormFree

- Partner Insights from FormFree

- Partner Insights from Tavant Technologies