Elina Tarkazikis is a reporter for National Mortgage News. She is a graduate of Ramapo College of New Jersey, where she was the founding editor in chief of the school's chapter of HerCampus.com and a staff writer for its student-run publication, The Ramapo News. She has previously worked for The County Seat in Hackensack and Elvis Duran and the Morning Show, iHeartMedia's nationally syndicated radio program. Elina is also a licensed real estate agent in New Jersey, adores pets and speaks three languages.

-

Goldman Sachs is getting closer to hitting its $1.8 billion consumer relief obligation as outlined in mortgage settlement agreements between the U.S. Department of Justice and three states.

November 2 -

Fannie Mae and Freddie Mac transferred a substantial amount of credit risk to the private sector through both single-family and multifamily market transactions in the first half of the year, with activity expected to rise in 2019, according to the Federal Housing Finance Agency.

November 1 -

Mutual of Omaha Bank company Synergy One Lending is preparing to acquire certain assets of BBMC Mortgage, a national mortgage company and division of Bridgeview Bank, which will expand its Midwest footprint and improve its strategic direction.

November 1 -

Mortgage borrower credit scores hit their low points more than five months after making a home purchase, but lender reporting cycles also cause these results to vary, according to LendingTree.

October 31 -

Housing policies are helping the number of vacant foreclosure homes drop, which could also mean homebuyers have been taking advantage of these properties as inventory continues to be constrained, according to Attom Data Solutions.

October 30 -

QRL Financial Services, the mortgage outsourcing division of First Federal Bank of Florida, is the latest investor to seek out better secondary market execution by purchasing electronic notes from correspondents.

October 29 -

Protecting consumers from intrusive cold calls and fax-spamming is having adverse effects on the mortgage industry as the Federal Communications Commission fails to reasonably interpret language under the Telephone Consumer Protection Act, according to the Mortgage Bankers Association.

October 25 -

The Money Source is the latest mortgage company partnering with Ellie Mae to streamline workflows between lenders and correspondent investors through Encompass Investor Connect.

October 25 -

Mortgage technology company SharperLending is tapping mobile devices to offer a quicker and more efficient loan process for lenders in instances that don’t require full appraisals.

October 23 -

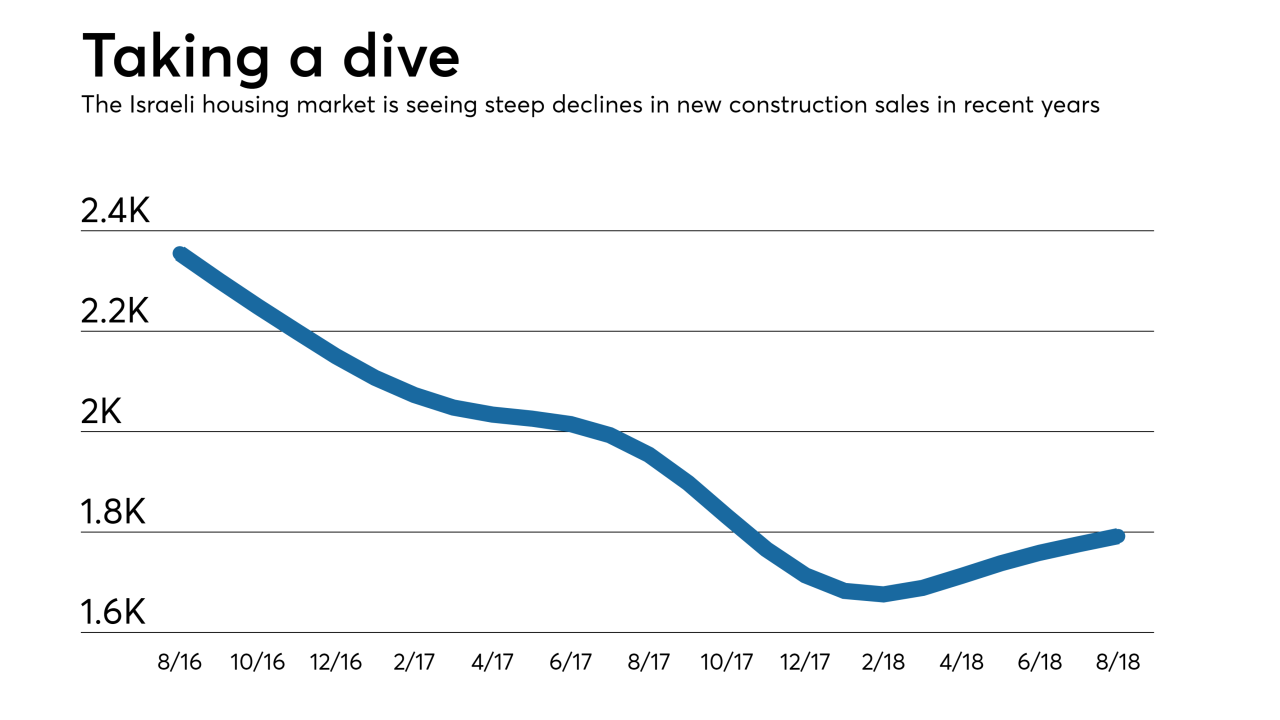

The Department of Housing and Urban Development and the Israeli Ministry of Finance are joining forces through a memorandum of cooperation to explore and share approaches on housing and mortgage finance issues plaguing their nations.

October 22 -

Ellie Mae is tackling home equity lines of credit loans with its latest Encompass Digital Mortgage Solution update as signs point to a surge in home equity borrowing.

October 22 -

A surge in home equity borrowing may be around the corner as household equity levels surpassed their previous housing bubble peak, according to a TransUnion study.

October 19 -

Property values have grown enough for households to establish equity and make a profit, but homeowners continue staying put, causing sales to underperform their potential.

October 18 -

First American Mortgage Solutions is stepping up its digital mortgage game by offering electronic closing capabilities.

October 16 -

Wells Fargo Home Lending is tapping eOriginal to launch an electronic note program, marking a step forward for the mortgage industry's push toward a more digital process.

October 15 -

The share of homes for sale listed with a price cut hit its highest level since 2014, but the reductions themselves are shrinking, according to Trulia.

October 12 -

Hurricane Michael is putting mortgage transactions with a combined value of over $400 million in jeopardy, according to ClosingCorp estimates.

October 11 -

Millennials are targeting homeownership within the next few years, but many are buying into certain house-purchasing myths, according to Bank of America.

October 10 -

The mortgage delinquency rate fell to a 12-year low, with declines expected to continue as the unemployment rate stays down, according to CoreLogic.

October 9 -

Property values for homes that were foreclosed on during the Great Recession are outpacing the nation's average house price appreciation, according to Zillow.

October 5