Elina Tarkazikis is a reporter for National Mortgage News. She is a graduate of Ramapo College of New Jersey, where she was the founding editor in chief of the school's chapter of HerCampus.com and a staff writer for its student-run publication, The Ramapo News. She has previously worked for The County Seat in Hackensack and Elvis Duran and the Morning Show, iHeartMedia's nationally syndicated radio program. Elina is also a licensed real estate agent in New Jersey, adores pets and speaks three languages.

-

Fiserv Lending Solutions' rebrand to Sagent Lending Technologies reflects the company's focus on a more efficient process for mortgage and consumer lenders.

September 20 -

Homebuyers are seeking financing options first before even looking for a house, according to loanDepot.

September 12 -

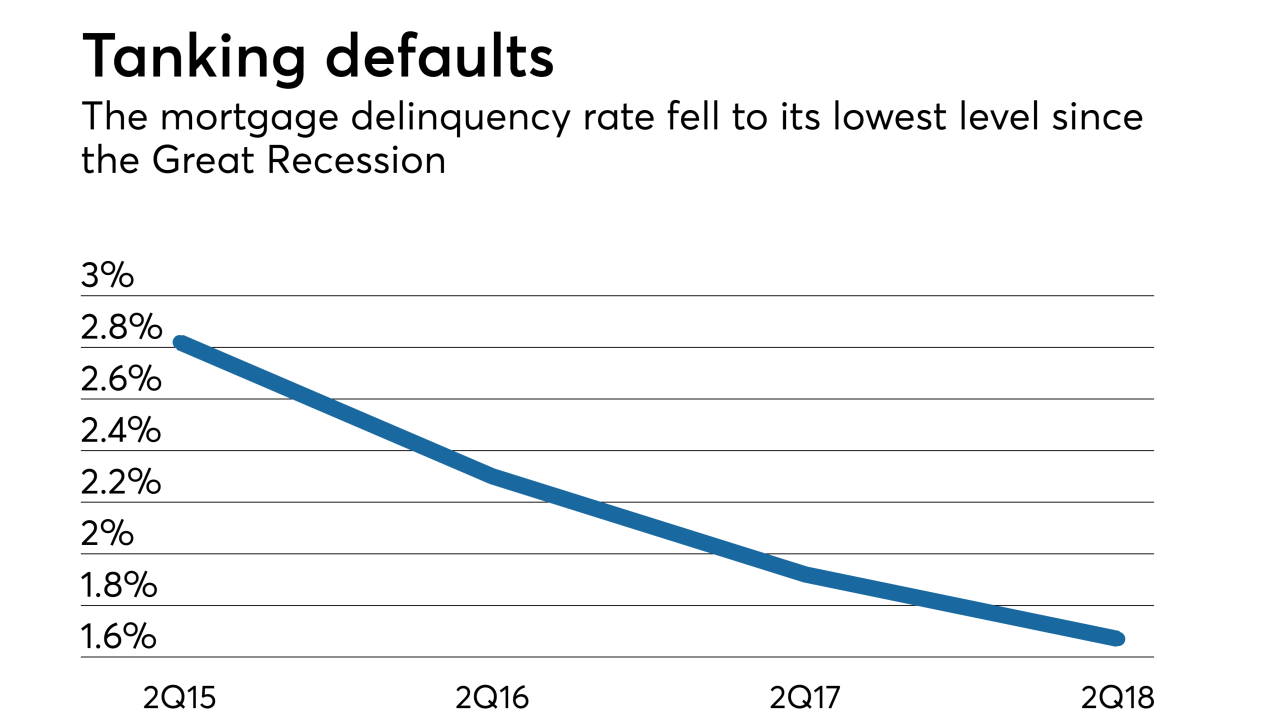

The serious mortgage delinquency rate sank to its lowest June reading in 11 years, though recent natural disasters pose risk to loan performance in affected areas, according to CoreLogic.

September 11 -

Early adopters took digital mortgages from concept to reality. What will it take for everyone else to catch up?

September 10 -

Lennar Corp. closed its first fully electronic digital mortgage with a remote notary, just a few months after the homebuilder made an equity investment in digital mortgage vendor Notarize.

September 4 -

Private mortgage insurance was the largest source of credit enhancement for new homeowners in the second quarter making a low down payment for the first time ever, according to Genworth Mortgage Insurance.

August 29 -

The vast majority of consumers start the mortgage process with internet research, but when it comes time to initiate contact with a lender, borrowers are nearly as likely to pick up the phone as they are to connect online.

August 29 -

Racial and ethnic discrimination in mortgage lending may be misrepresented by "flawed" denial metrics that suggest a larger gap between the denial rates of racial groups than what actually exists, according to the Urban Institute.

August 27 -

The 30-day delinquency rate dropped to a low not seen in over a decade in July, but foreclosure starts also increased to a three-month high.

August 24 -

Better consumer credit quality helped push the serious mortgage delinquency rate to its lowest level since the Great Recession, but originations remain low due to tighter underwriting standards and eroding homebuyer affordability, according to TransUnion.

August 22 -

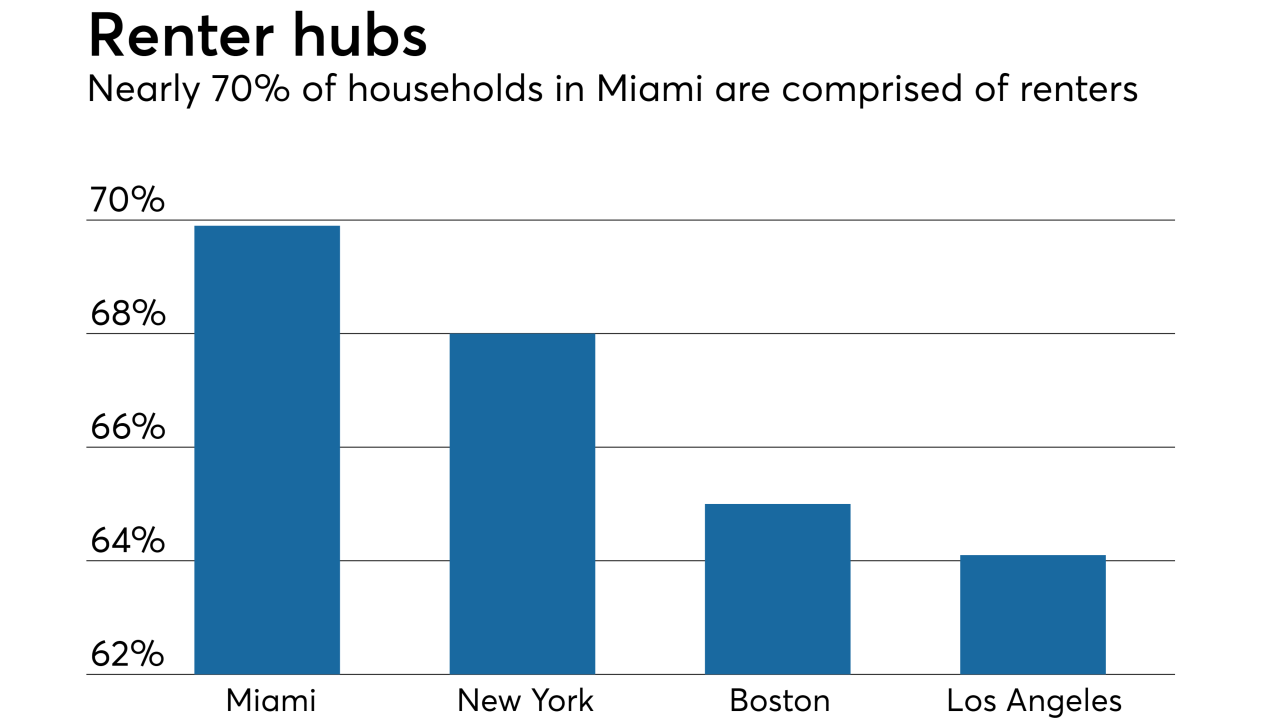

The agency said the market for larger rental investors may not need additional liquidity from Fannie Mae and Freddie Mac.

August 21 -

An improved economy, a healthy labor market and the large population of millennials should have accelerated home sales much higher, but all hope for more transactions this year is not yet lost, according to the NAR.

August 20 -

Credit Karma is diving into the mortgage industry with a plan to acquire digital mortgage startup Approved, a provider of consumer-facing online point of sale technology.

August 17 -

Here's a look at the cities where house hunters and sellers have been the busiest during this summer's home buying season.

August 16 -

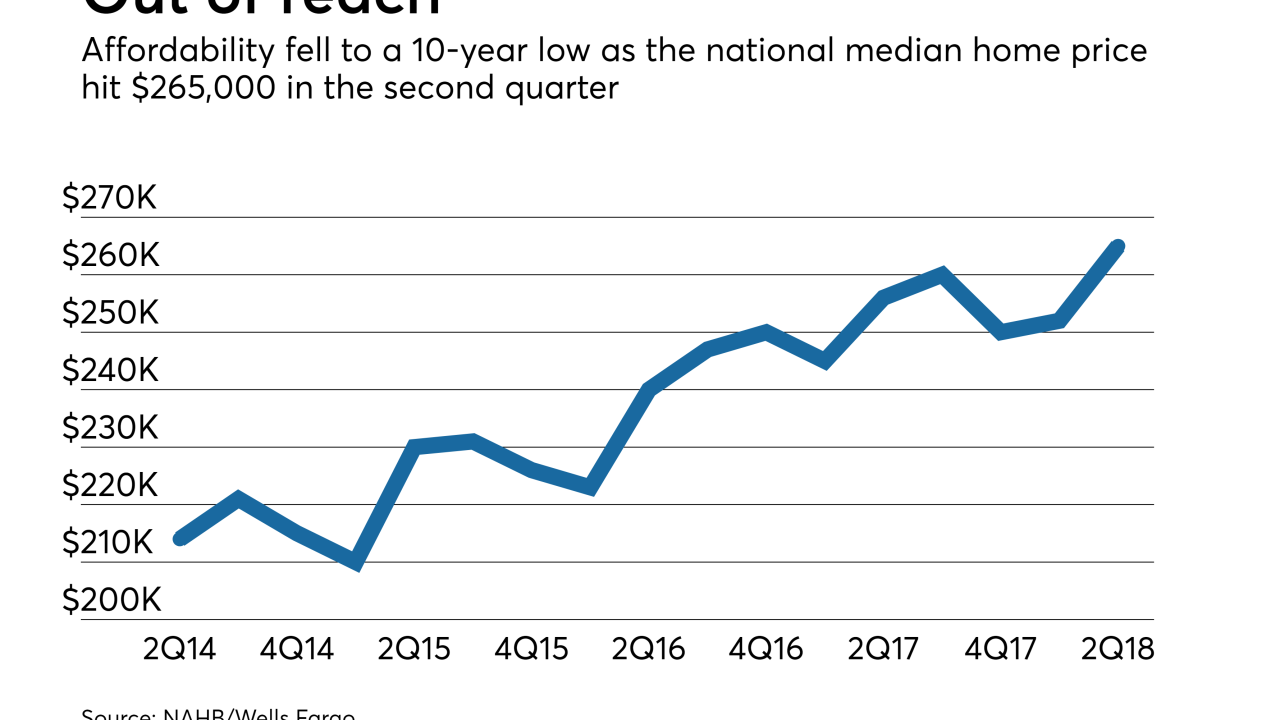

As housing affordability continues eroding on growing property values and mortgage rates, nearly a quarter of millennials believe they need to delay having children to afford a home purchase.

August 15 -

The reliance on nonconventional financing to fund new single-family housing is dropping, with the share accounting for less than a third of the market for the second year in a row.

August 13 -

Housing market conditions pushed affordability to a 10-year low in the second quarter, according to the National Association of Home Builders/Wells Fargo Housing Opportunity Index.

August 10 -

From Denver to Pittsburgh, here's a look at the top 10 housing markets where homeowners are taking advantage of home improvement loans.

August 10 -

The gap between equity-rich homeowners and mortgage borrowers who are seriously underwater narrowed in the second quarter, highlighting the uneven nature of the housing market's recovery since the Great Recession.

August 9 -

Home price appreciation is preventing consumers from entering the housing market, forcing an accelerated number of potential homeowners to rent.

August 8