Elina Tarkazikis is a reporter for National Mortgage News. She is a graduate of Ramapo College of New Jersey, where she was the founding editor in chief of the school's chapter of HerCampus.com and a staff writer for its student-run publication, The Ramapo News. She has previously worked for The County Seat in Hackensack and Elvis Duran and the Morning Show, iHeartMedia's nationally syndicated radio program. Elina is also a licensed real estate agent in New Jersey, adores pets and speaks three languages.

-

Here's a look at the 12 housing markets where mortgage lenders have to compete the most for borrowers' business.

June 21 -

Walker & Dunlop has been approved as a seller and servicer under Freddie Mac's Affordable Single-Family Rental pilot program, allowing the company to focus on middle markets.

June 20 -

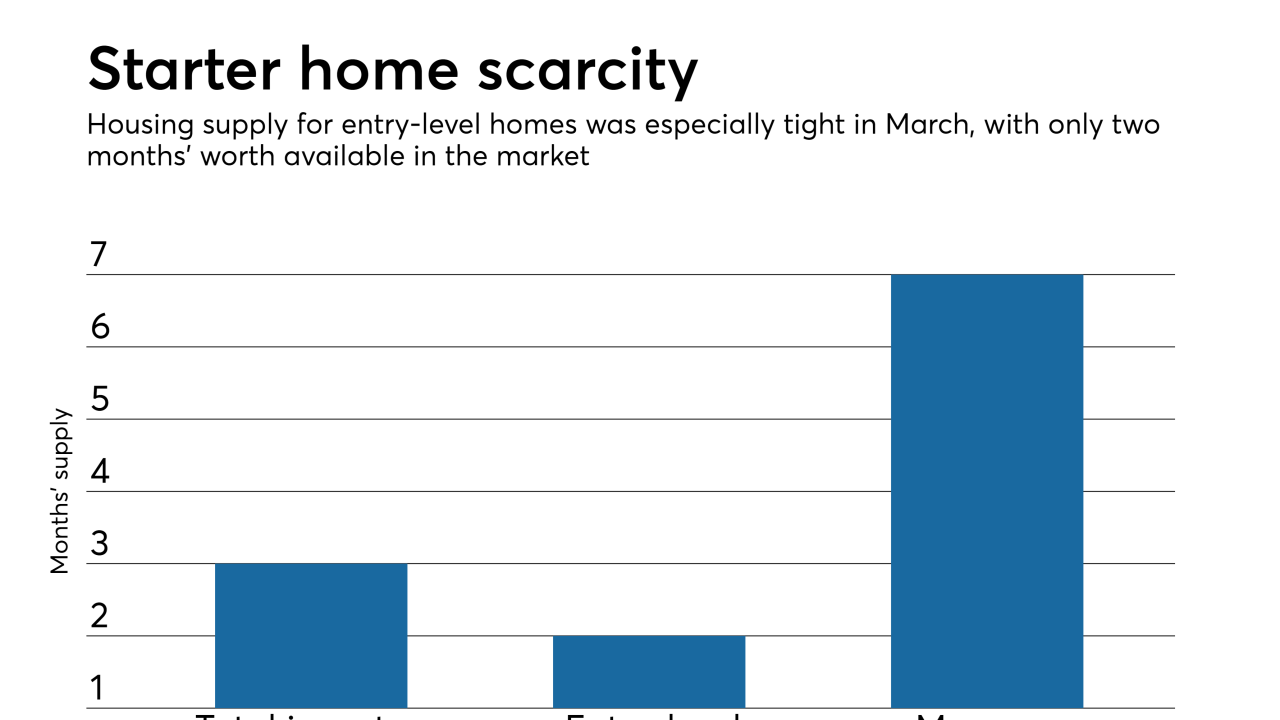

Resale inventory is at its lowest level in 18 years and new construction supply continues being outpaced by high demand, according to CoreLogic.

June 19 -

While rising mortgage rates are top of mind for the industry after last week's increase in the federal funds rate, the housing market should be more concerned about limited home inventory, according to First American Financial Corp.

June 18 -

Regulation imposed by all levels of government accounts for 32% of multifamily development costs, according to the National Association of Home Builders and the National Multifamily Housing Council.

June 15 -

Though mortgage originations were down overall in the first quarter, home equity lines of credit spiked on higher home prices, according to Attom Data Solutions.

June 14 -

Freddie Mac hit the $1 trillion mark on credit risk sharing for single-family mortgage loans with its second lower LTV deal of the year.

June 13 -

Unemployment lows and increased home equity paved the way for the lowest mortgage delinquency rates seen in 11 years, according to CoreLogic.

June 12 -

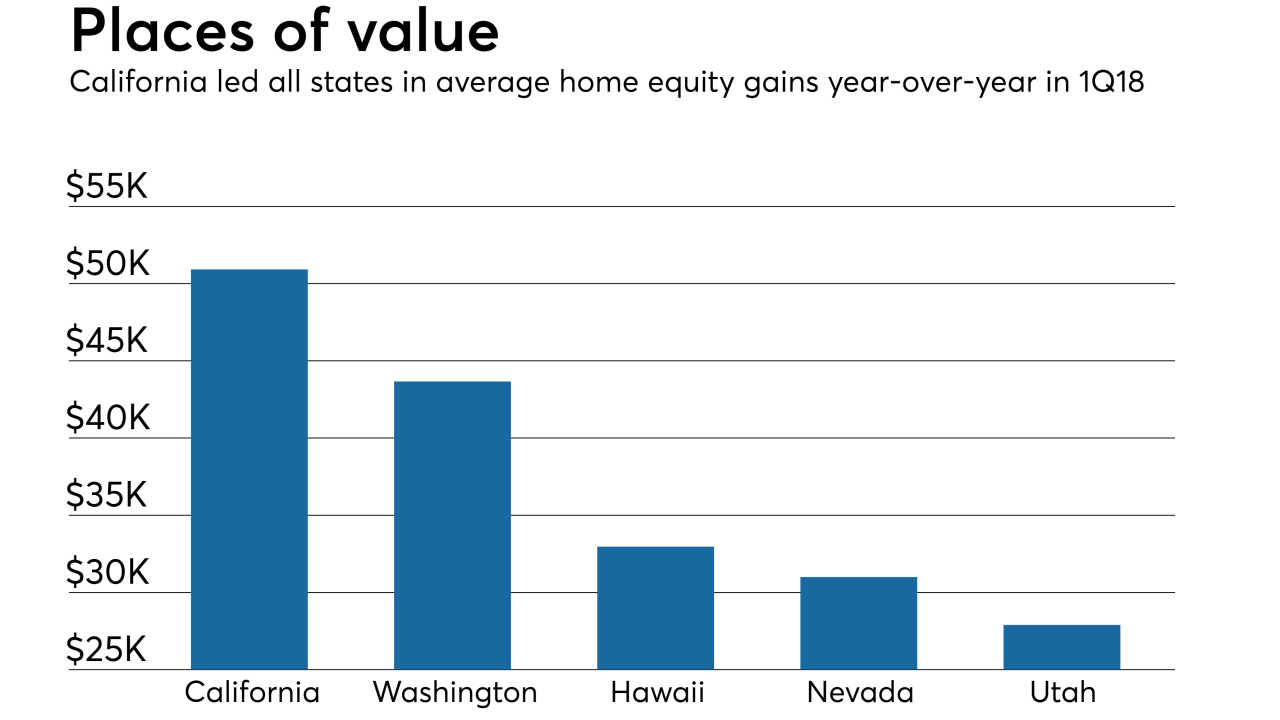

As house values continued growing, homeowners with mortgages saw their equity increase 13.3% year-over-year in the first quarter, a gain of over $1.01 trillion, according to CoreLogic.

June 8 -

Despite gross home flipping profits hitting an all-time high in the first quarter, the average return on investment neared a three-year low, according to Attom Data Solutions.

June 7 -

With its acquisition of artificial intelligence and machine learning developer HeavyWater, Black Knight is turning to its Artificial Intelligence Virtual Assistant to streamline the mortgage process, with an immediate focus on the originations sector.

June 6 -

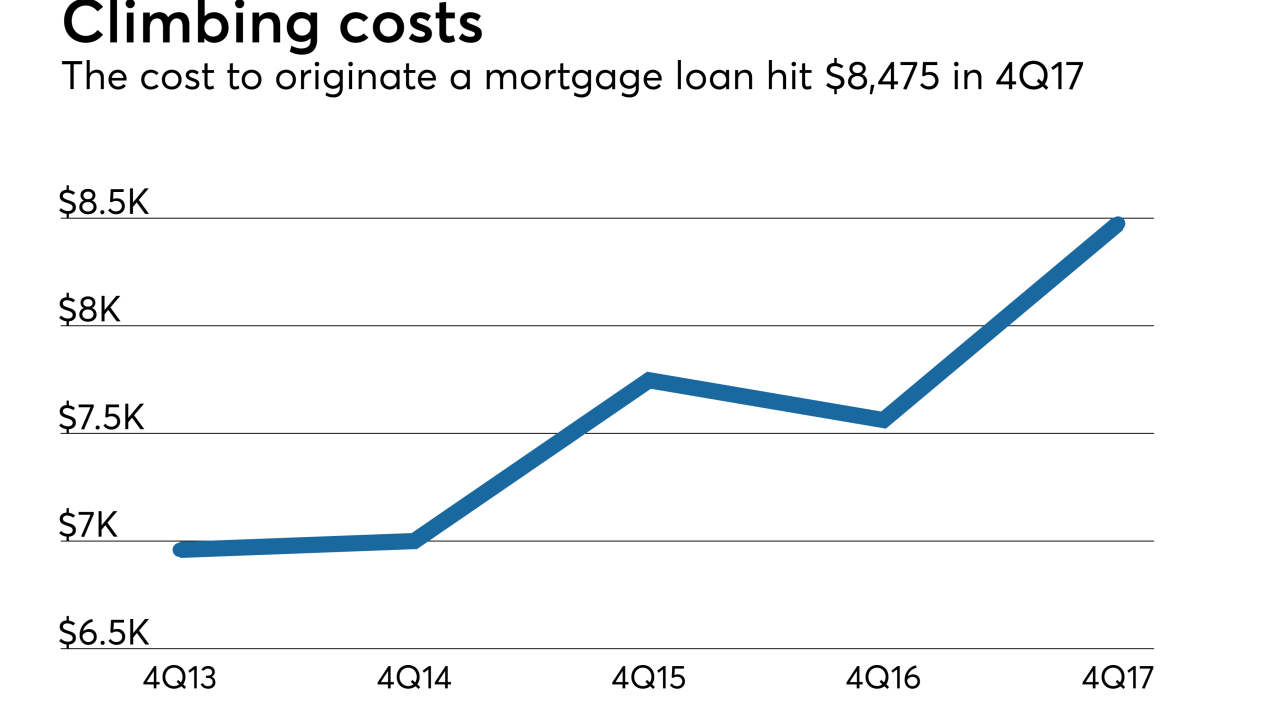

Declining mortgage origination volume and record-high costs drove production income for independent mortgage bankers into negative territory, according to the Mortgage Bankers Association.

June 6 -

Historically, mortgage delinquencies in the month of April have risen 85% of the time, but April 2018 bucked that trend as they fell, according to Black Knight.

June 4 -

While all cities show signs of healthy mortgage competition nationwide, some areas have higher concentrations of lender activity but also face varying degrees of competitiveness based on loan type, according to LendingTree.

June 1 -

Remax Holdings is focused on "what it does best" with its Motto Mortgage business and in facing off against Zillow's new home buying and selling initiative, a company executive said.

May 31 -

While the rate of underwater borrowers continues to decline, many cities still struggle with a deluge of homeowners with so little equity that they have limited incentive or ability to put their homes on the market.

May 30 -

From D.C. to Chicago, here's a look at the 12 cities where homebuyers are getting the best bang for their housing buck.

May 29 -

As mortgage lenders continue seeking ways get more trustworthy consumers into the housing market, a majority of them are utilizing alternative credit as a means of assessing borrower risk, according to Experian.

May 25 -

A new integration between Blend and Ellie Mae seeks to improve the use and accessibility of electronic mortgage documents, the latest in an ongoing industry effort to create a more simplified and consistent borrower experience.

May 24 -

As the mortgage industry moves farther past the housing crisis, access to credit remains tight, especially for first-time homebuyers.

May 23