Laura Alix is a reporter at American Banker.

-

Call it mutual respect. Bankers from mutually owned British building societies and similarly structured U.S. thrifts recently gathered in New England to address common challenges and share ideas about staying relevant at a time of rapid change in financial services. Here are the takeaways from their meetings.

By Laura AlixMay 18 -

TriStar Bank in Tennessee says a shortage of appraisers is slowing down its commercial real estate lending and raising the cost of appraisals. The claim has outraged appraisers, who argue that the bank is simply trying to avoid paying their fees.

By Laura AlixApril 11 -

China’s threat to impose hefty tariffs on dozens of U.S. imports could weaken demand for soybeans, pork and other agricultural products. Here's what that could mean for farmers, ranchers and the banks that lend to them.

By Laura AlixApril 4 -

A majority of midsize and large banks complain that red tape is mounting and that they are passing on higher regulatory costs to customers and have less flexibility in designing products, according to a new survey by the RMA.

By Laura AlixMarch 28 -

Despite past missteps in the U.S. mortgage business, the bank is giving it another go, bringing servicing in-house and catering to millennials and international clients here, says HSBC’s Raman Muralidharan.

By Laura AlixMarch 12 -

In some states, total mortgages outstanding are at all-time highs, but in others hard hit by the financial crisis they remain well below their 2008 peaks, the New York Fed said Tuesday in its quarterly report on household debt.

By Laura AlixFebruary 13 -

Darryl White sees an opportunity for Bank of Montreal to take more market share in the United States, and he’s betting on investments in mortgage lending, commercial banking and capital markets to get there.

By Laura AlixFebruary 9 -

Net interest income has surged thanks to rising rates, but noninterest income has lagged as trading revenue has weakened, refi demand has softened and fees from deposit service charges have barely budged. Is this the new normal?

By Alan KlineJanuary 24 -

The Oregon company's commercial and consumer lending grew even though fee income declined sharply.

By Laura AlixJanuary 23 -

The Honolulu bank reported strong loan growth in the fourth quarter, but one-time charges related to the new tax law suppressed its profit.

By Laura AlixJanuary 22 -

Rather than pull up stakes and leave two low-income Mississippi towns at the mercy of payday lenders, Regions Bank donated the branches to a local credit union and kicked in another $500,000 for operating costs.

By Laura AlixNovember 7 -

Top banking executives called the Republican tax plan an important first step toward tax reform and economic stimulus, but questions immediately arose about whether trade-offs and complexities in the bill would undercut it.

November 2 -

Home equity lines could double over the next six years. Some banks are actively pursuing the consumer credit opportunity, whereas many still feel stung by the housing crisis, unimpressed by home equity’s comeback so far or fearful of nonbank competition and fraud.

By Laura AlixOctober 30 -

BOK Financial benefited from rising interest rates in the third quarter even as it reported declines in fee income and commercial real estate loan balances.

By Laura AlixOctober 25 -

Hawaii's booming economy contributed to the Honolulu bank's 10% increase in loans and 9% increase in deposits in the third quarter.

By Laura AlixOctober 23 -

Net income for the Oregon regional bank was $61.3 million, a slight decline from the same quarter last year. It earned 28 cents per share and fell short of analysts’ expectations,

By Laura AlixOctober 19 -

The Pittsburgh company benefited from loan growth and higher interest rates, though fee income fell and expense rose in the third quarter.

By Laura AlixOctober 13 -

A change in the formula that banks use to calculate borrowers’ debt-to-income ratios, announced by Fannie Mae in April, appears to be spurring more lending.

By Laura AlixOctober 6 -

At 1.56%, the delinquency rate on consumer loans remains well below historic averages, the American Bankers Association said Thursday.

By Laura AlixOctober 5 -

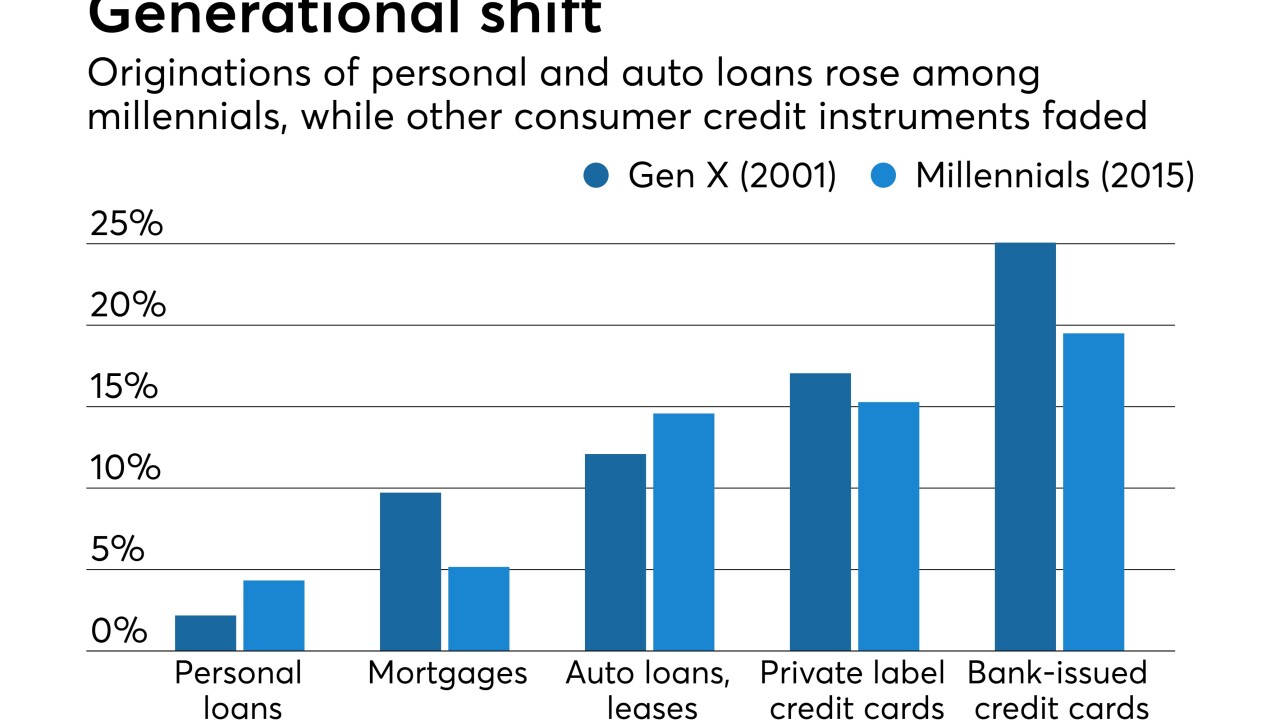

Millennials — many of whom joined credit unions in recent years as the movement's membership expanded — are relying more heavily on personal loans than their Gen X predecessors while paring back on credit cards and mortgages.

By Laura AlixSeptember 11