Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Servicers struggled to bring back their borrowers as the overall retention rate crept down to a nadir in the fourth quarter, according to Black Knight.

March 8 -

After the coronavirus spurred a great migration in search of literal greener pastures, homebuyers are returning to cities with the end of the pandemic in sight, according to Redfin.

March 5 -

The agency will allow an additional three months of forbearance for multifamily property loans backed by Fannie Mae and Freddie Mac, as long as tenant protections are offered.

March 4 -

With the latest growth, interest rates spiked 37 basis points since the calendar flipped to 2021 alongside rising Treasury bond yields.

March 4 -

From gamifying work to taking the "hell" out of hell weeks, creativity in worker recognition is gaining steam among the firms listed in the Best Mortgage Companies to Work For ranking.

March 4 -

The servicer owned by Mr. Cooper agreed to pay a penalty for allegedly failing to provide its clients with clear information on foreclosure and defaults.

March 3 -

With the pandemic’s radical disruption of the housing market, values grew at the highest rate in eight years, according to CoreLogic.

March 2 -

National Mortgage News presents the third annual Best Mortgage Companies to Work For — a survey and awards program dedicated to identifying and recognizing the industry's best employers and providing organizations with valuable employee feedback.

March 1 -

The number of home listings collapsed to the lowest level on record, leaving “nearly all of the shelves empty,” Glenn Kelman said in the company’s latest home sales report.

February 26 -

While foreclosure moratoria keep the overall numbers down, zombie foreclosure rates jumped in the majority of states, according to Attom Data Solutions.

February 25 -

With extreme winter weather about to give way to ballooning insurance and mortgage forbearance claims in Texas, servicers will need to get through their pipelines with urgency while weeding out fraud.

February 25 -

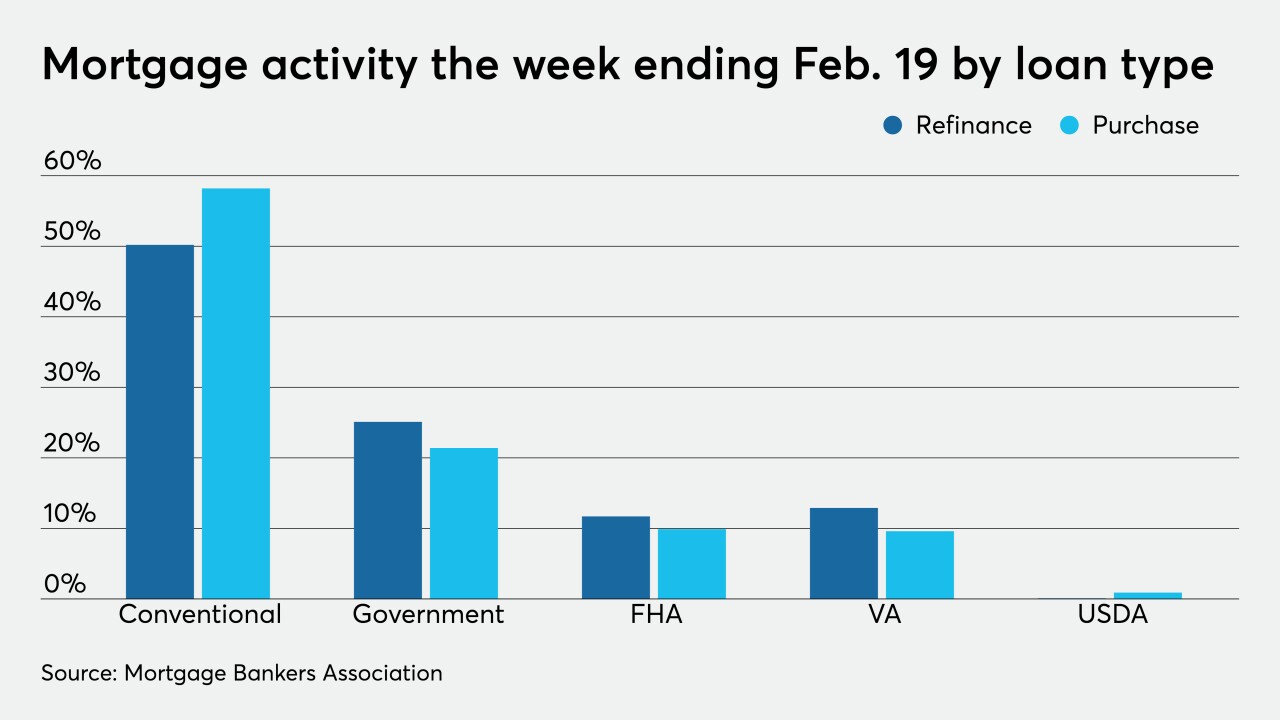

Severe winter weather and another hike in mortgage rates stifled loan volume for the week, according to the Mortgage Bankers Association.

February 24 -

As its mortgage origination volume delivered another quarter of strong earnings, Mr. Cooper’s banking on its "enormous backlog" of REO orders to generate further profitability once the foreclosure moratorium is lifted.

February 23 -

Independent mortgage banker recovery drove the weekly decrease in forbearance share, according to the Mortgage Bankers Association.

February 22 -

Moratorium extensions helped drive a weekly increase in forbearances, according to Black Knight.

February 19 -

With the most recent stimulus aiding economic recovery, mortgage lending’s feeding frenzy could be coming to an end.

February 18 -

The acquisition of the mortgage fintech aligns with growing customer expectations surrounding a fully digital homebuying experience.

February 18 -

While sales shot up from the same time last year, inventory reached its lowest level since Remax started its National Housing Report in 2007.

February 17 -

While the Mortgage Bankers Association hailed the move, some experts say it could negatively impact housing inventory.

February 16 -

While its net income declined annually for the second consecutive year, CEO Hugh Frater touted Fannie Mae’s resiliency in a record year for providing mortgage liquidity.

February 12