Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

For the first time since June 7, the number of loans going into coronavirus-related forbearance didn't decrease from the week before, according to the Mortgage Bankers Association.

August 31 -

The refinance boom kept mortgage loan application defect risk flat, with record-low levels in July, but fraud risk for purchases climbed again, according to First American Financial.

August 31 -

The DocVerify deal adds to Black Knight's goal of providing tools for each step in the home-buying and mortgage processes.

August 28 -

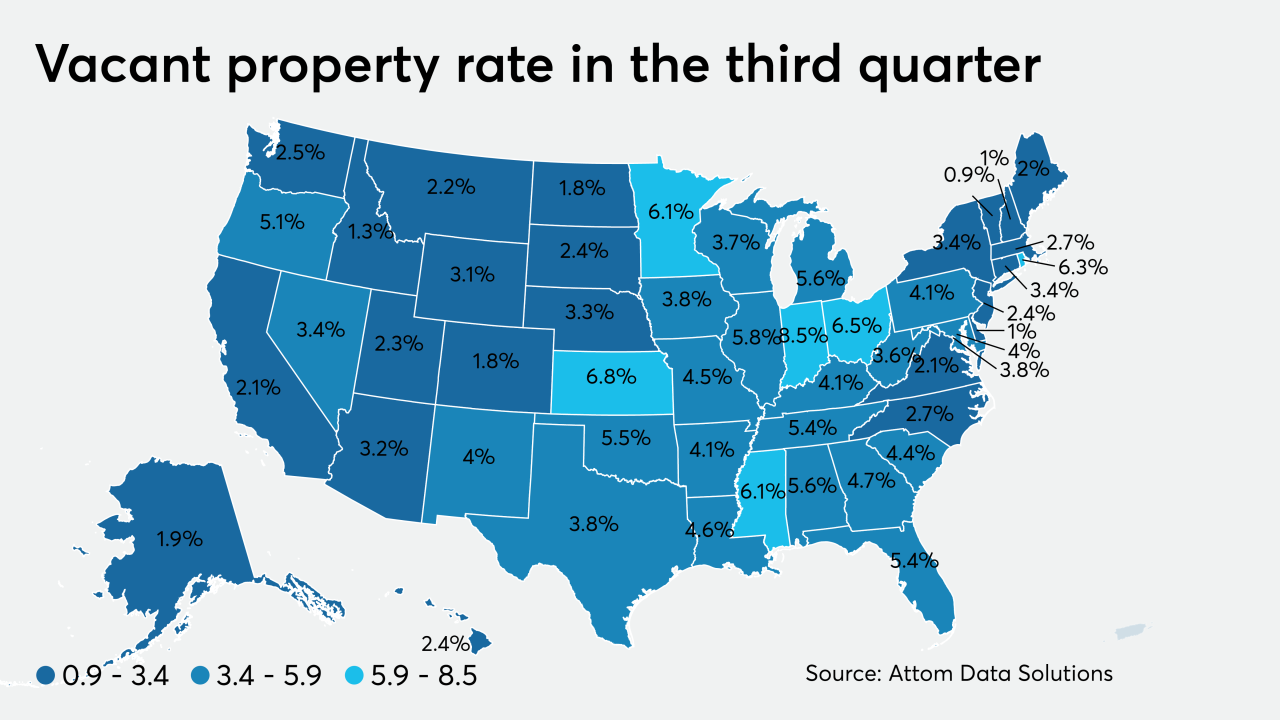

While the overall amount of foreclosures continued to decline due to the coronavirus moratorium, the share of zombie properties grew during the third quarter, according to Attom Data Solutions.

August 27 -

With mortgage rates and housing inventory both at all-time lows, the majority of consumers would overshoot their budgets for the right home without accounting for future costs, according to LendingTree.

August 26 -

If it makes landfall as a Category 3 storm as was initially projected, damage from Hurricane Laura's surge could potentially devastate 432,810 residential properties in Texas and Louisiana, according to CoreLogic.

August 25 -

The housing market reaped the rewards of new construction increasing before the coronavirus took effect, netting a boost in July sales, according to Redfin.

August 25 -

The number of loans going into coronavirus-related forbearance decreased for the tenth straight week, but to a lesser degree than in previous weeks, according to the Mortgage Bankers Association.

August 24 -

As swelling demand constricts inventory to record-low levels, home price growth cuts into the purchasing power afforded by plunging interest rates, according to First American.

August 24 -

As interest rates tumbled throughout July, prepayments climbed to the highest monthly rate since 2004, but 90-days-or-more delinquencies were on the rise from June, according to Black Knight.

August 21 -

Positive payment behaviors in conjunction with CARES Act measures kept mortgage delinquencies from rising, but the number of borrowers facing hardship grew exponentially from last year, according to TransUnion.

August 20 -

With mortgage rates tumbling near 3% in the second quarter, refinance originations spiked 400% in some housing markets, pushing overall volume to its highest point since 2009, according to Attom Data Solutions.

August 20 -

Fannie Mae's new chief administrative officer position focuses on diversity, inclusion and affordable housing.

August 19 -

Freedom Mortgage's acquisition of RoundPoint Mortgage Servicing gives it a MSR portfolio of over $300 billion.

August 18 -

The number of loans going into coronavirus-related forbearance decreased for the ninth consecutive week, according to the Mortgage Bankers Association.

August 17 -

As inventory dropped to an all-time low in July, borrowers hunted for houses further and further from city centers, causing price spikes in rural markets, according to Redfin.

August 17 -

As more borrowers exit their plans, fewer than 4 million loans sit in forbearance, according to Black Knight.

August 14 -

With the moratorium still in place, mortgage foreclosure activity fell 83% in July compared to the year before and 4% from June, according to Attom Data Solutions.

August 13 -

A former home mortgage consultant with the company alleges she was subjected to a lower compensation structure, awards and benefits compared to her male counterparts.

August 12 -

Refinance volume led the spike in mortgage applications for the week ending Aug. 7 as interest rates continued tumbling.

August 12