With interest rates and housing inventory both at all-time lows, the majority of consumers would overshoot their budgets for the right home,

While breaking the bank for something exceptional — especially as

"I urge homebuyers to be very cautious about going over budget. Many people underestimate the maintenance costs of owning a home," Tendayi Kapfidze, chief economist at LendingTree, said in the report. "If you are stretched financially and underinvest in maintenance, it can diminish the value of your home."

One of the biggest lessons of the housing crisis was making sure consumers don't stretch themselves too thin. In an interview from December 2018, Freedom Mortgage CEO

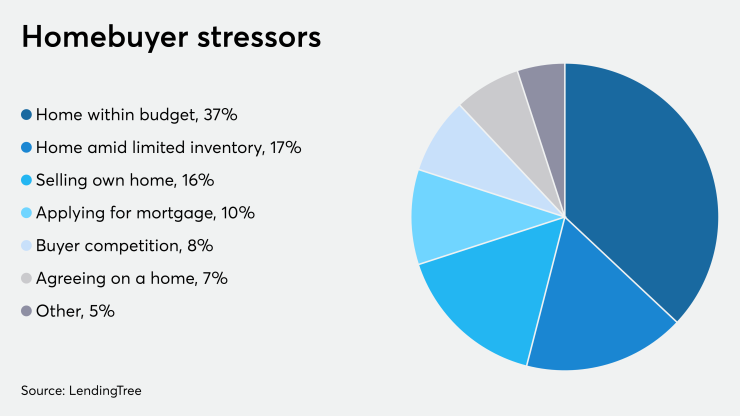

Finding a home within budget currently looms as the largest stressor for consumers, with 37% of potential buyers choosing that as the worst part of the process. Finding a home in their search range because of low supply was the most stressful for 17% and 16% said trying to sell their current home.

Additionally, a 10% share worried most about applying for a mortgage. However, that breaks down to 9% of white buyers compared to 16% of Black and 18% Hispanic buyers — percentages that fall in line with