-

A continuous servicing-to-originations loop keeps and grows customer relationships while increasing MSR values and lowering origination cost. But as with all things mortgage, executing on this is harder than it looks, writes Sagent's CEO and President

November 29 Sagent Lending Technologies

Sagent Lending Technologies -

CEO Thomas Cangemi is pushing to modernize a bank that for decades was focused largely on multifamily lending. The company has already agreed to buy the mortgage lender Flagstar Bancorp and its partnership with Figure Technologies, a blockchain-focused fintech, has the potential to make that acquisition more productive.

August 18 -

New York Community Bancorp says it will invest in Figure Technologies, which has developed an open source distributed ledger. The bank plans to use the technology to cut costs in mortgages and payments and promote financial inclusion.

August 16 -

The two-pronged agreement also will add Figure's mortgage servicing rights onto Sagent's platform.

August 11 -

The mortgage real estate investment trust has been a first-mover regarding innovations in the private securitized market, and others tend to follow its lead.

April 19 -

Bee Mortgage App will use blockchain and automation provided by Elphi to create "a COVID tool for real estate agents" to get fully digital mortgage approval in under three minutes.

November 25 -

The former SoFi chief’s latest startup, Figure, has created what it says is a transparent marketplace for buying and selling assets. Some banks have embraced the technology, but other blockchain projects have stalled because lenders don't want rivals to see their data.

August 25 -

Figure Technologies appears to be one of the few companies to find a viable use case for blockchain in the financial industry — cutting down the costs associated with loan origination.

December 13 -

The SoFi co-founder said Figure Technologies is working with national banks to employ its distributed ledger tech for loan originations.

December 13 -

Provenance Blockchain, recently spun off from Mike Cagney's Figure Technologies, says it can help lenders trim 70% of mortgage settlement expenses through speedier processing and paperwork reduction.

April 26 -

The Money Source has filed three provisional patent applications as part of its efforts to develop new innovations in mortgage servicing, including the use of blockchain technology.

February 27 -

Figure, the startup headed by Mike Cagney, uses blockchain technology to provide home equity loans in as little as five days. It intends to use the newly raised funds to offer other services, including wealth management.

February 27 -

Mike Cagney’s current venture, Figure Technologies, is offering consumers the ability to apply online for home equity loans and get funding in as little as five days.

October 10 -

Startup Block66 is using blockchain to create a mortgage audit trail for fraud prevention purposes and also plans to enable trading of securities lenders can use to increase their liquidity.

June 22 -

Mike Cagney, who built SoFi into America's biggest student loan refinancer before quitting amid allegations of sexual harassment at the fintech firm, is preparing for his second act: a startup offering home-equity loans.

April 30 -

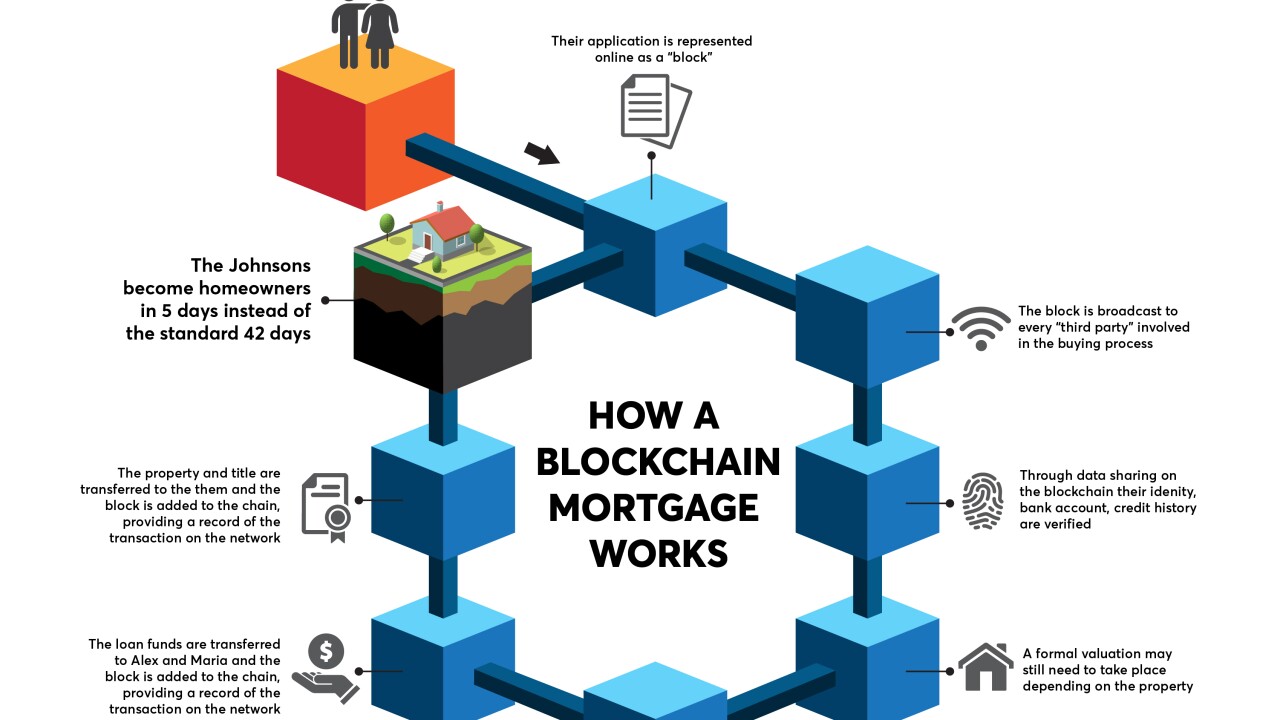

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

Ranieri Solutions, a fintech investment firm in the mortgage space, has partnered with blockchain and smart contract company Symbiont to explore opportunities to implement blockchain technology in the mortgage industry.

April 6 -

Governments are studying ways blockchain can safeguard property records and simplify how they get tracked.

March 26 Hodgson Russ

Hodgson Russ -

From origination to payoff, blockchain technology makes data more reliable and secure to enhance and improve mortgage lending.

February 23 Fiserv

Fiserv