-

The tricky part: raising awareness without appearing to take advantage of borrowers at a time when agencies like the SBA are out of commission.

January 11 -

The American Bankers Association has called for an end to the government shutdown, saying it has prevented customers from securing loans and threatens even more damage.

January 11 -

Consumer lending should also be a bright spot, while mortgage lending could be suppressed by rising rates and tight housing supplies.

January 9 -

The banking industry has long been critical of the government-sponsored enterprise, but the system could provide valuable banking services to large swaths of the country currently lacking access to them.

January 7 Duke Financial Economics Center

Duke Financial Economics Center -

Freddie Mac issued its first non-low-income housing tax credit forward commitment, providing financing for an affordable housing development in Minnesota.

December 28 -

Richard Harra was also fined $300,000 for painting a false picture of the bank’s financial health at the height of the financial crisis.

December 18 -

An agency report said servicing portfolios have shrunk by nearly half in 10 years as much of the mortgage market has shifted to nonbanks.

December 12 -

The performance of loans included in commercial mortgage-backed securities improved for the fifth consecutive quarter, with delinquencies down 179 basis points over the time frame, according to the Mortgage Bankers Association.

December 4 -

Social Finance, the lending and refinancing startup valued at more than $4 billion, is cutting about 7% of its staff, according to a person familiar with the matter.

December 3 -

Minorities are still charged more for mortgages when all other applicable credit factors are equal — both in person and online, according to a new study by the University of California, Berkeley.

November 26 -

The move allows the New York multifamily lender to make more loans without having to raise capital.

November 15 -

Online personal lending pioneer Prosper is developing a home equity line of credit product that it will offer in partnership with banks. The embrace of traditional depositories marks a departure from fintech lenders that typically seek to disrupt and displace legacy institutions.

November 14 -

Amazon has yet to announce the winning city for its second headquarters, but investors in JBG Smith Properties seem pretty convinced that northern Virginia is going to take the cake.

November 5 -

A low-rated segment of an index that most closely tracks the performance of U.S. mall mortgage loans saw its biggest decline in more than a year in October.

November 5 -

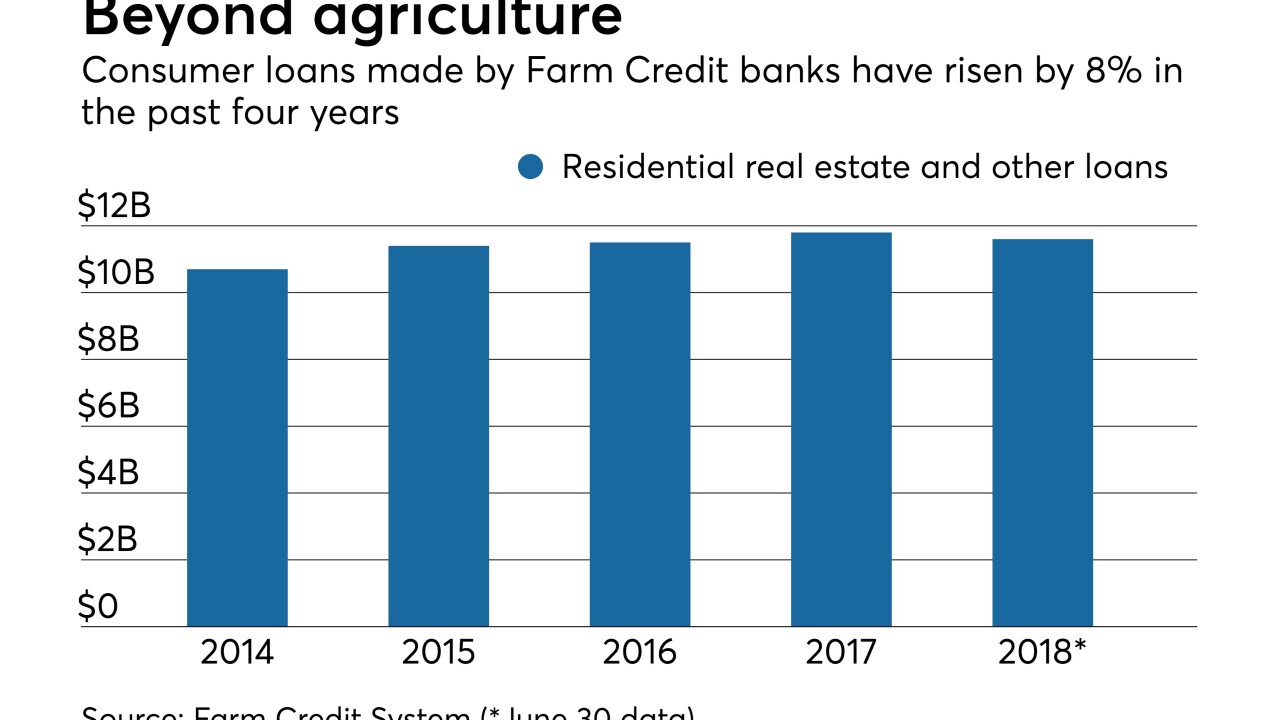

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31 -

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23 -

New York developer Silverstein Properties Inc. built a $4 billion pipeline of real estate deals just weeks after starting. None of the money was for buildings it will own.

October 19 -

The Providence, R.I., company reported a 27% gain in profits thanks partly to a boost in fee income from its purchase of Franklin American Mortgage in August.

October 19 -

The Portland, Ore, company also benefited from lower expenses and an improved efficiency ratio.

October 18 -

Proposition 10 would give local jurisdictions a freer hand to restrict rents, but critics say that would lead to property devaluations. Some see an effect regardless of whether the measure passes.

October 10