-

The move allows the New York multifamily lender to make more loans without having to raise capital.

November 15 -

Online personal lending pioneer Prosper is developing a home equity line of credit product that it will offer in partnership with banks. The embrace of traditional depositories marks a departure from fintech lenders that typically seek to disrupt and displace legacy institutions.

November 14 -

Amazon has yet to announce the winning city for its second headquarters, but investors in JBG Smith Properties seem pretty convinced that northern Virginia is going to take the cake.

November 5 -

A low-rated segment of an index that most closely tracks the performance of U.S. mall mortgage loans saw its biggest decline in more than a year in October.

November 5 -

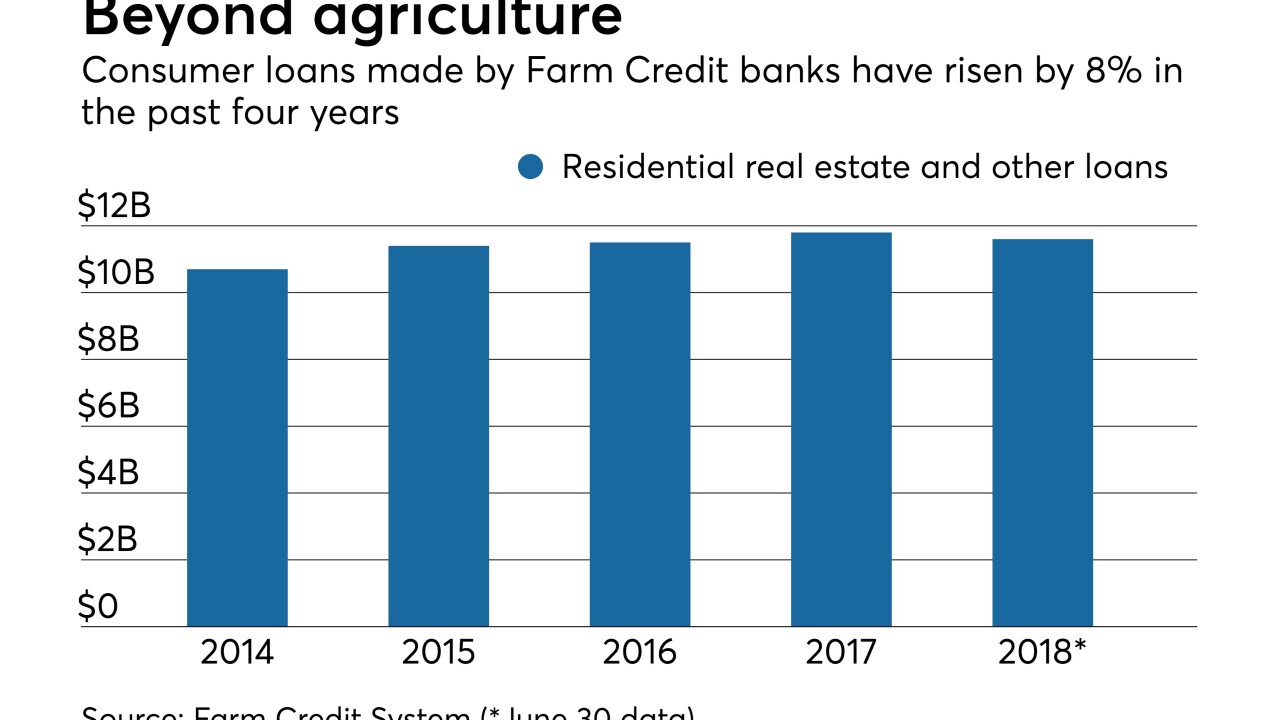

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31 -

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23 -

New York developer Silverstein Properties Inc. built a $4 billion pipeline of real estate deals just weeks after starting. None of the money was for buildings it will own.

October 19 -

The Providence, R.I., company reported a 27% gain in profits thanks partly to a boost in fee income from its purchase of Franklin American Mortgage in August.

October 19 -

The Portland, Ore, company also benefited from lower expenses and an improved efficiency ratio.

October 18 -

Proposition 10 would give local jurisdictions a freer hand to restrict rents, but critics say that would lead to property devaluations. Some see an effect regardless of whether the measure passes.

October 10 -

The House of Representatives passed two bills that would tie appraisal waivers for Small Business Administration loans to bank rules for commercial real estate loans, despite objections from the Appraisal Institute about its members being cut out of transactions.

September 26 -

The changes mandated by the recent regulatory relief law would narrow the definition of "high-volatility commercial real estate" exposures that get a higher risk weight.

September 18 -

A 75-year-old Florida real estate developer was sentenced to six months in prison after admitting he lied to banks to keep money flowing so he wasn't forced to scuttle an oceanfront hotel and condominium in Vero Beach.

August 29 -

The agency said the market for larger rental investors may not need additional liquidity from Fannie Mae and Freddie Mac.

August 21 -

A number of banks have stepped up efforts to lend to residential developers, though they are mindful of missteps made before the financial crisis.

August 20 -

Wells Fargo is considering a sale of commercial real estate broker Eastdil Secured, according to a person briefed on the matter.

July 26 -

The March acquisitions of a warehouse lending portfolio and eight California bank branches helped fuel a 22% increase in net income.

July 24 -

Strong demand for business and multifamily loans, combined with double-digit growth in wealth management revenues, more than offset rising expenses.

July 13 -

Commercial and multifamily mortgage debt outstanding grew $44.3 billion during the first three months of 2018, the largest first-quarter gain since before the Great Recession, according to the Mortgage Bankers Association.

July 2 -

Commercial real estate is their bread and butter, but many banks are scaling back in this vital loan category. Here’s why.

June 29