-

The city's decision to drop a lawsuit alleging predatory ending by Wells Fargo, JPMorgan Chase, Bank of America and Citigroup highlights the challenges municipalities face in taking on deep-pocketed financial institutions.

February 4 -

In letters to Freddie Mac and Fannie Mae, six Democrats asked how the mortgage giants are factoring extreme weather into their risk modeling.

February 4 -

With policymakers focused on ending Fannie Mae and Freddie Mac’s conservatorship, their regulator is reorganizing key units and adding staff to position itself for the long term.

February 4 -

Now that the Consumer Financial Protection Bureau says it will scrap an unpopular standard for so-called qualified mortgages, the big question is what will take its place.

February 3 -

The regulator said the investment bank and financial services company will help in the process of strengthening Fannie Mae and Freddie Mac’s capital standing for their eventual exit from conservatorship.

February 3 -

After maintaining a $250,000 exemption threshold for real estate appraisals for nearly 20 years, the National Credit Union Administration is set to raise that limit to $400,000.

January 31 -

The agency has named Thomas G. Ward as the bureau's assistant director for enforcement. House Democrats have questioned Ward's role as a political appointee in the Trump administration.

January 30 -

A high-profile proposal to address California's housing crisis by compelling cities to build more homes failed to pass the Senate on Wednesday, but lawmakers left the bill's author one more chance to pass the measure.

January 30 -

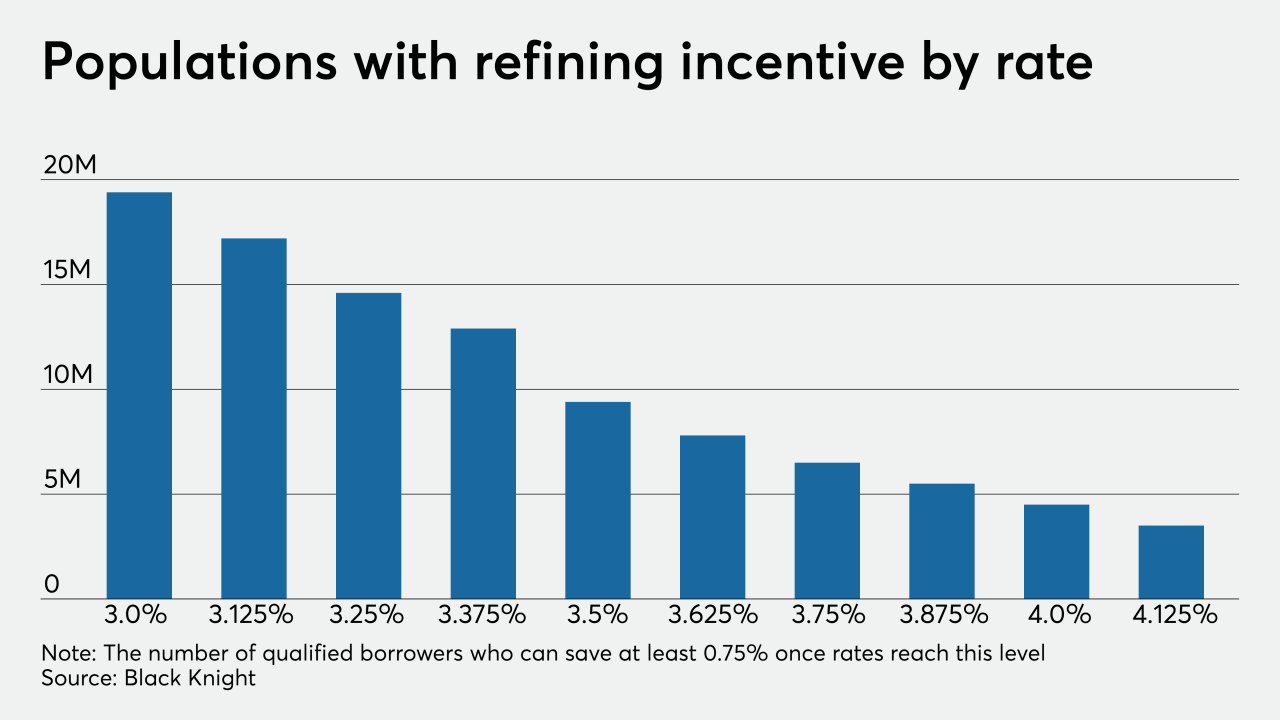

After being range-bound for several weeks, mortgage rates are fluctuating enough to spur significant changes in refi incentive, according to Black Knight.

January 29 -

Conundrum for lenders: How to overcome top producers' tendency to stay put?

January 29