Consumer banking

Consumer banking

-

The San Francisco bank reported a 26% increase in its third-quarter earnings, thanks to robust single-family, multifamily and commercial real estate loan activity in New York, Boston and its home city.

October 13 -

Silvio Tavares, the former chief executive of the Digital Commerce Alliance, will lead the credit-bureau analytics firm.

October 12 -

Banks, credit card issuers and debt collectors all supported the Consumer Financial Protection Bureau’s revised regulations. But they face a steep learning curve in complying with the rules, which take effect Nov. 30.

October 11 -

Housing will still be a priority of the Consumer Financial Protection Bureau, but newly confirmed Director Rohit Chopra is also expected to investigate discrimination in the Paycheck Protection Program and bias in AI-powered lending algorithms.

October 4 -

Rohit Chopra, a liberal consumer watchdog, was approved as the agency’s director nine months after the Biden administration first announced him as the nominee.

September 30 -

Acting Director Sandra Thompson said the Federal Housing Finance Agency is considering changes to the risk-based fees that critics say have disproportionately hurt minority borrowers of low down-payment loans.

September 30 -

At a House Financial Services Committee hearing, lawmakers on both sides of the aisle questioned the widespread practice of screen scraping and agreed that consumers should have a more direct say over how their financial data is handled.

September 21 -

After exiting the business roughly 20 years ago, the San Antonio bank is working with tech consultant Infosys to help it build out a digital consumer lending business that will include home loans.

September 16 -

Elizabeth Warren asked the Federal Reserve this week to force the spinoff of the bank’s nonbanking operations. Wells, which was recently hit with another $250 million fine, countered that it has made significant progress in improving its risk management and addressing misconduct.

September 14 -

Digital technologies are transforming the delivery of financial services and reshaping consumer expectations. At the heart of change is the speed of money movement, which now represents the future — success for those who deliver, challenges for those who don't.

September 13 -

With its sale to Blue Ridge Bankshares set to close within months, FVC Bankcorp is moving to diversify by taking a 29% stake in Atlantic Coast Mortgage.

September 1 -

The Office of the Comptroller of the Currency is seeking nearly $19 million from David Julian, Claudia Russ Anderson and Paul McLinko. The trial before an administrative judge is scheduled to begin in South Dakota on Sept. 13.

September 1 -

CEO Thomas Cangemi is pushing to modernize a bank that for decades was focused largely on multifamily lending. The company has already agreed to buy the mortgage lender Flagstar Bancorp and its partnership with Figure Technologies, a blockchain-focused fintech, has the potential to make that acquisition more productive.

August 18 -

The bank saw a modest increase in net income from the first quarter, as lawsuit settlements tied to the company’s discontinued home lending business and fees regarding an anti-money laundering and securities class action suit continue to limit growth.

August 2 -

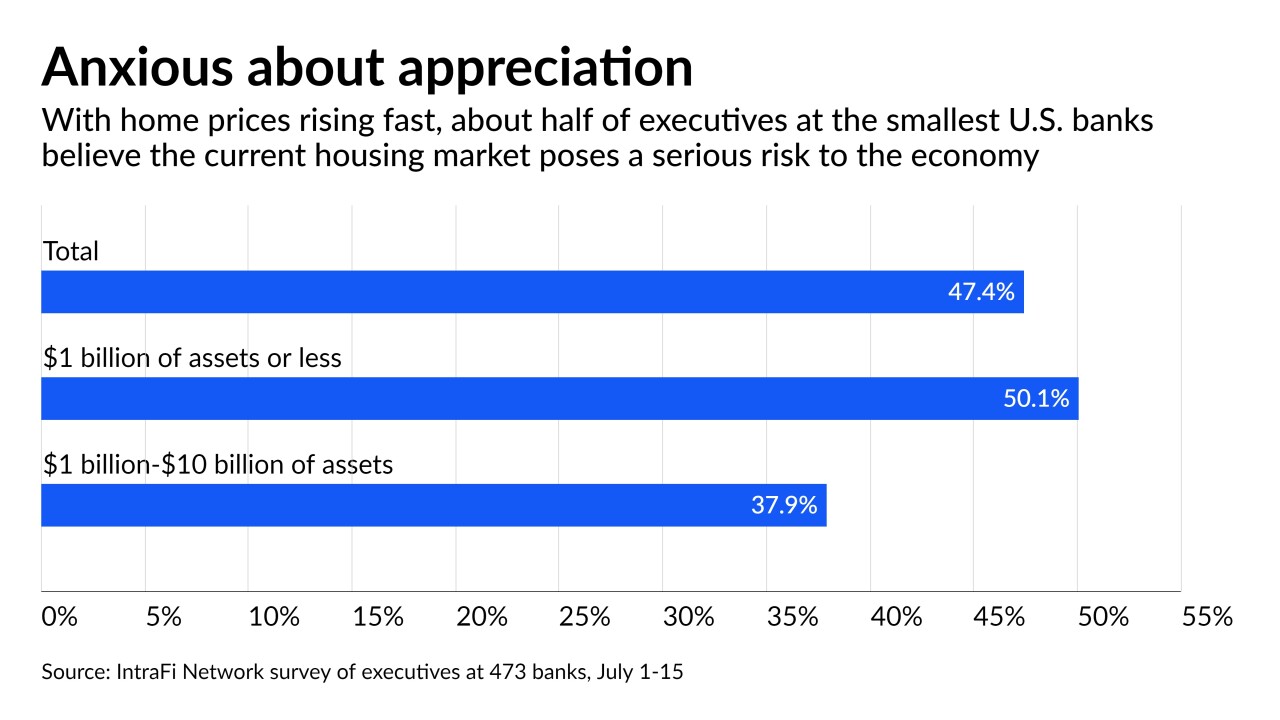

The very smallest banks, whose numbers shrank during the financial crisis, were most likely to express concern that the housing market will imperil the broader economy.

July 27 -

The Office of the Comptroller of the Currency confirmed it will rescind an unpopular rule overhauling the Community Reinvestment Act and joined other agencies in calling for a renewed interagency effort.

July 20 -

Even as lockdowns ease, the trend toward remote work poses challenges for building owners and the banks that lend to them.

June 30 -

The lender's founder and CEO says the acquisition of Roscoe State Bank will give it new products and referral sources.

June 14 -

Mortgage lenders should develop a comprehensive program to identify potential risks of noncompliance with consumer protection rules and take corrective actions before the Biden-era Consumer Financial Protection Bureau comes calling.

June 11 -

Less than two years after shutting down its biggest business amid fraud allegations, the Michigan company has sold branches, settled a shareholder lawsuit and returned to profitability under turnaround specialist Thomas O’Brien.

May 7