Consumer banking

Consumer banking

-

With its sale to Blue Ridge Bankshares set to close within months, FVC Bankcorp is moving to diversify by taking a 29% stake in Atlantic Coast Mortgage.

September 1 -

The Office of the Comptroller of the Currency is seeking nearly $19 million from David Julian, Claudia Russ Anderson and Paul McLinko. The trial before an administrative judge is scheduled to begin in South Dakota on Sept. 13.

September 1 -

CEO Thomas Cangemi is pushing to modernize a bank that for decades was focused largely on multifamily lending. The company has already agreed to buy the mortgage lender Flagstar Bancorp and its partnership with Figure Technologies, a blockchain-focused fintech, has the potential to make that acquisition more productive.

August 18 -

The bank saw a modest increase in net income from the first quarter, as lawsuit settlements tied to the company’s discontinued home lending business and fees regarding an anti-money laundering and securities class action suit continue to limit growth.

August 2 -

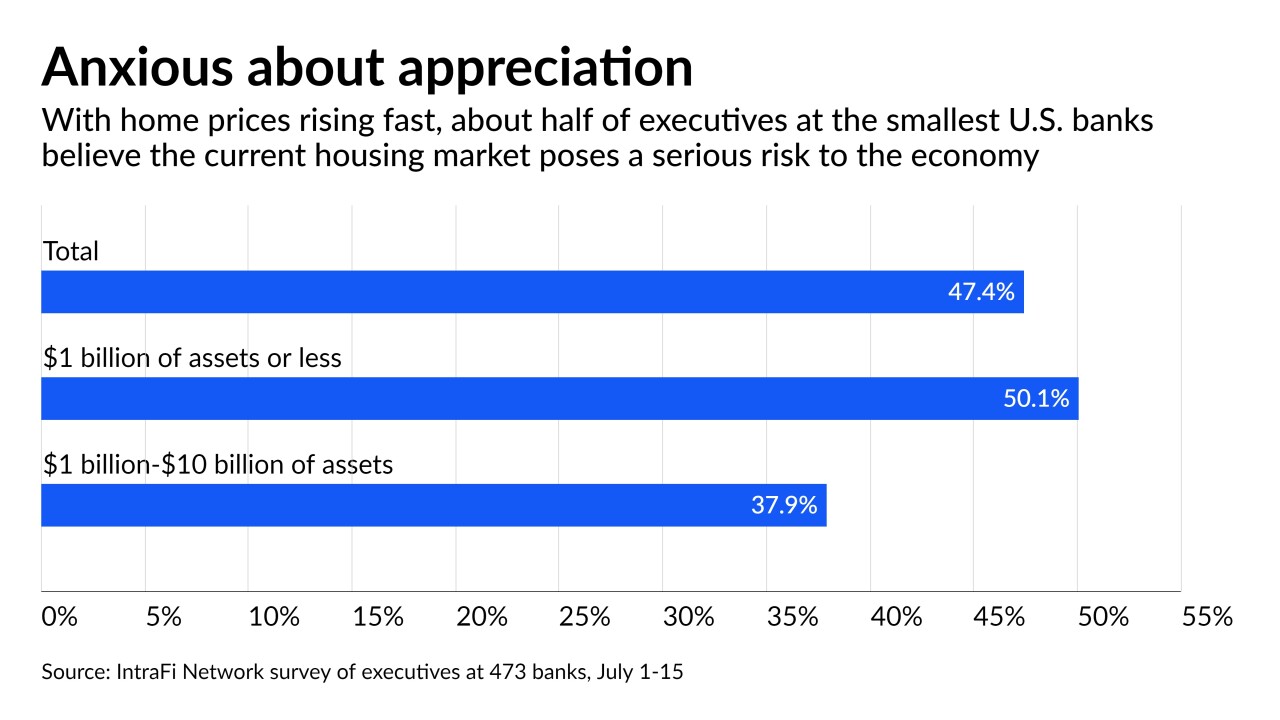

The very smallest banks, whose numbers shrank during the financial crisis, were most likely to express concern that the housing market will imperil the broader economy.

July 27 -

The Office of the Comptroller of the Currency confirmed it will rescind an unpopular rule overhauling the Community Reinvestment Act and joined other agencies in calling for a renewed interagency effort.

July 20 -

Even as lockdowns ease, the trend toward remote work poses challenges for building owners and the banks that lend to them.

June 30 -

The lender's founder and CEO says the acquisition of Roscoe State Bank will give it new products and referral sources.

June 14 -

Mortgage lenders should develop a comprehensive program to identify potential risks of noncompliance with consumer protection rules and take corrective actions before the Biden-era Consumer Financial Protection Bureau comes calling.

June 11 -

Less than two years after shutting down its biggest business amid fraud allegations, the Michigan company has sold branches, settled a shareholder lawsuit and returned to profitability under turnaround specialist Thomas O’Brien.

May 7 -

The Dallas company will pay nearly $54 million for a 49% stake in a lender that operates in 10 states.

April 28 -

One year after its internal merger, the fintech and fulfillment services provider’s COO Debora Aydelotte discusses the company’s support for community banks and its placement in the ranking of Best Fintechs to Work For.

April 6 -

Bradley Riss is chief commercial officer at Checkout.com, a firm that acts as a payment gateway, acquirer and processor through a single channel, covering cards, passthrough wallets, stored value wallets and alternative payment options such as point of sale credit. It charges a fee based on processing and card payment costs rather than the percentage+ model that most payment API companies charge. The model is designed to make the service customized to different merchants and serve as a base to offer other merchant products.

March 26 -

Complaints to the Consumer Financial Protection Bureau jumped 54% to 542,300 in 2020. Concerns about credit reports have long outnumbered those in other categories and jumped significantly as a share of the total from 2019.

March 24 -

Like the fintechs SoFi and LendingClub, DLP Real Estate Capital is acquiring a community bank largely to lower the cost of funding loans.

March 18 -

The American Fintech Council and the Financial Technology Association say they’ll promote responsible innovation, fair access to financial services and more. Their dozens of members include some of the biggest names in fintech.

March 17 -

-

Home loans accounted for the bulk of the industry’s lending gains in 2020, but inventory shortages in some markets and an uneven economic recovery may dim prospects this year.

February 9 -

First Foundation is relocating its corporate headquarters to Dallas, where the tax burden is lighter and it sees more opportunity to beef up lending, add wealth management clients and pursue acquisitions of community banks.

February 5 -

Community banks say Vizaline’s software, which converts property descriptions into images, helps them catch errors before they close real estate loans without resorting to expensive land surveys. But traditional surveyors say the results are of questionable value.

February 3