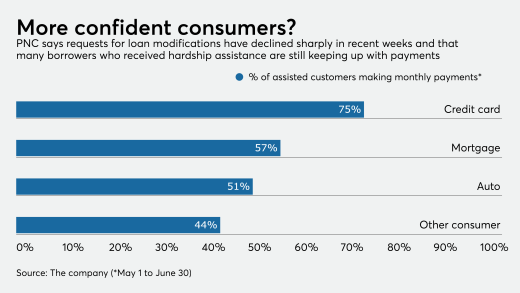

The Pittsburgh bank says fewer borrowers are asking for help and that many borrowers who received assistance are making payments again. But with the coronavirus pandemic still raging in much of the country, CEO William Demchak and other bankers are tempering their optimism.

-

The coronavirus relief law allows forbearance plans for up to a year on federally backed mortgages, but House Democrats say homeowners have had difficulty getting relief.

July 16 -

The surge of COVID-19 cases in much of the nation put a hold on reopening the economy, adding risk to the housing market, First American said.

July 16 -

After two months of declines in the coronavirus pandemic, the Boise, Idaho, area housing market rebounded in June with a 3.4% increase in homes sold compared with June 2019.

July 16 -

The Pittsburgh bank says fewer borrowers are asking for help and that many borrowers who received assistance are making payments again. But with the coronavirus pandemic still raging in much of the country, CEO William Demchak and other bankers are tempering their optimism.

July 15 -

The Minneapolis company said 75% transactions have been handled online since the pandemic hit.

July 15 -

The rise in late and suspended payments following the coronavirus outbreak in the United States may have helped the FHA realize it's high time to improve the process.

July 14 -

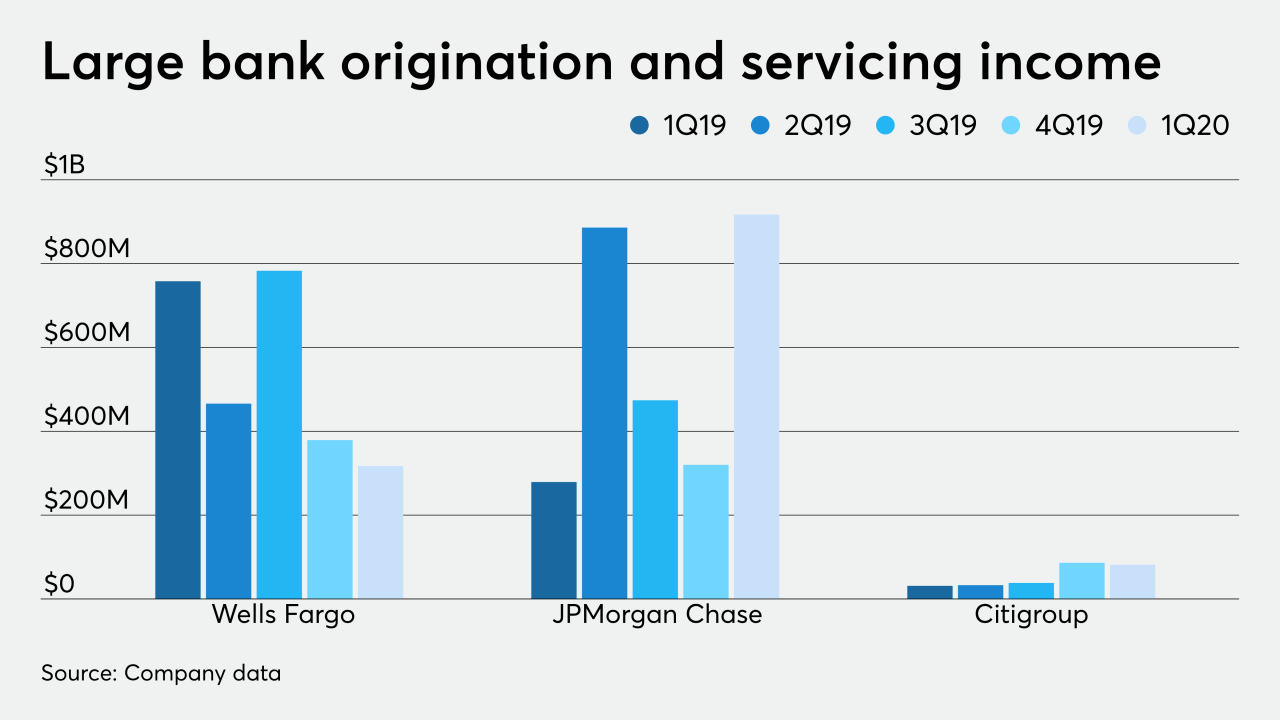

The banks logged strong year-over-year growth in gain-on-sale margins for mortgage loans.

July 14 -

Down payment assistance programs remain an important tool for increasing minority homeownership, but especially more so because of the pandemic.

July 14 Mountain Lake Consulting

Mountain Lake Consulting -

The share of Dallas-Fort Worth area homeowners who are behind on their mortgage payments is spiking with the pandemic.

July 14 -

The number of loans going into coronavirus-related forbearance fell for the fourth consecutive week, as the growth rate plummeted 21 basis points between June 29 and July 5, according to the Mortgage Bankers Association.

July 13