The mortgage industry's digital transformation is revolutionizing the home buying experience and upending the status quo for lenders and servicers. The Digital Mortgage Conference is the premiere event exclusively dedicated to these developments, bringing over 1,500 professionals to Las Vegas on Sept. 17-18 for keynote speakers, panels and the main attraction: live product demos showcasing the latest mortgage innovations.

-

Continuing to retreat from Biden-era rules, the Consumer Financial Protection Bureau and Department of Justice withdrew a 2023 advisory opinion that had cautioned about denying credit to immigrants.

January 12 -

A new move that would open up more use of certain dedicated savings accounts for home purchase purposes is under consideration, according to Politico.

January 12 -

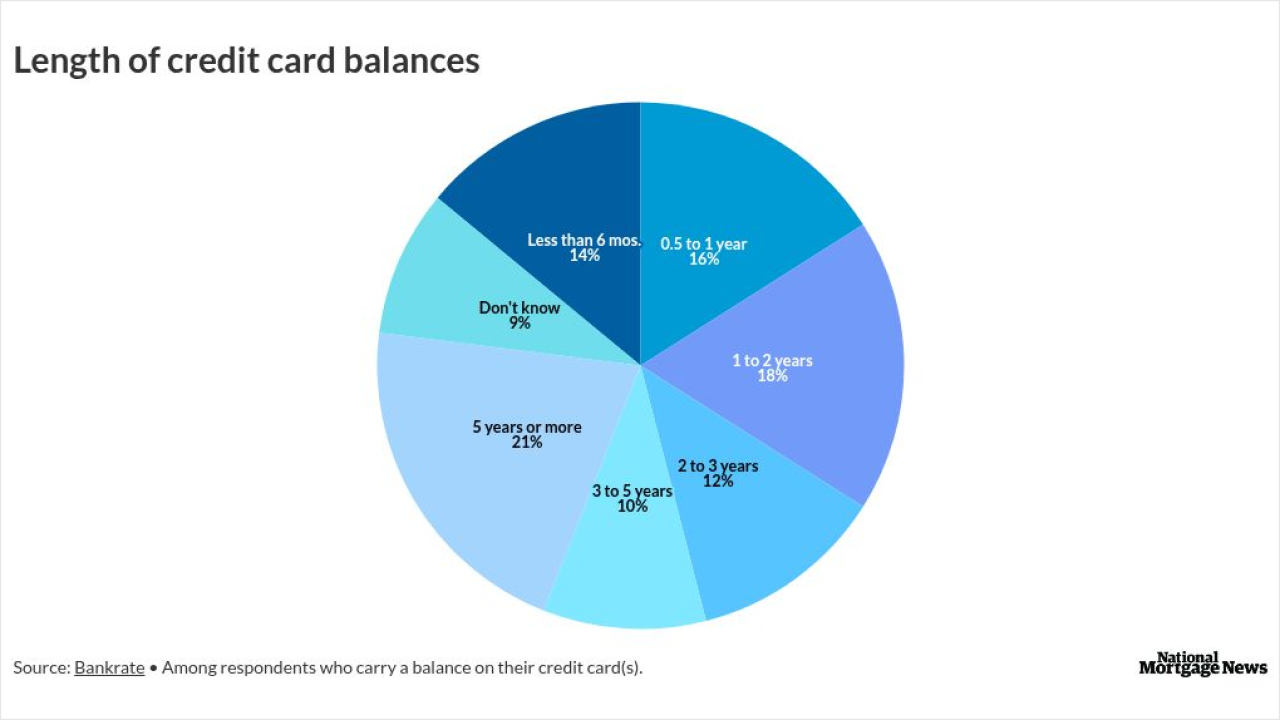

Nearly half of all credit card users carry a balance, according to Academy Bank. Higher non-mortgage debt levels can affect home loan underwriting.

January 12 -

-

The survey, taken before Pres. Trump's $200 billion MBS buy demand, finds panelists worried over inflation, but also see employment as the larger downside risk.

January 12 -

Jason Flanders serves as president of professional talent solutions at

Randstad USA , leading operations and strategic initiatives to expand Randstad's footprint, optimize service delivery, and align talent solutions with the market's shifting demands. As an alumnus of Clemson University, he is a noted speaker and commentator on key issues related to finance and accounting, employment trends as well as extensive thought leadership topics related to the broader labor market. He presents on the national and chapter level with leading professional associations, including Financial Executives International, CFO Leadership Council, Institute of Management Accountants, and the FP&A Board.January 12 -

But a senior administration official said the DOJ, not Pulte, is behind the subpoena that relates to Powell's congressional testimony about Fed building renovations.

January 12 -

Federal Reserve Chair Jerome Powell said the central bank has been served grand jury subpoenas and been threatened with criminal indictment, moves he called "pretexts" to influence interest rates through "political pressure or intimidation."

January 11 -

Trump's proposed $200B MBS purchase briefly tightened mortgage spreads, but analysts question the long-term impact on mortgage rates and GSE balance sheets.

January 9 -

Home prices are now something Americans can wager on. Polymarket partnered with Parcl to offer prediction markets tied to housing price indices.

January 9