-

Having an all-digital process results in lower customer satisfaction for home equity line of credit providers than an all in-person or a mix of methods, a J.D. Power survey found.

March 14 -

Technologies like Siri and Alexa will only make mortgage production more efficient if users communicate with them precisely and securely.

March 13 NTT Data Services

NTT Data Services -

A subsidiary of digital-media company Beta Music Group is linking its origination support technology with Arive's online platform, which connects mortgage brokers to lenders, borrowers and third-party vendors.

March 13 -

Borrowers were more than twice as likely to use a lender they found online in 2018 as they were in 2017, making search engines the mortgage industry's top source of referrals.

March 12 -

A patchwork of state laws makes it tough for lenders to adopt electronic notarization, but they'll need to if they want to make a fully digital mortgage a reality.

March 8 Black Knight

Black Knight -

Assessing the implications of big tech's inevitable next run at the business of mortgage lending.

March 6 -

AI Foundry is aiming to further cut the time it takes to originate a mortgage by adding artificial intelligence tools designed to improve on optical character recognition.

March 5 -

American Mortgage Consultants has acquired title search outsourcer String Real Estate Information Services as part of ongoing efforts to support all the services secondary-market clients need to conduct trades.

March 4 -

Whether through greater investments in technology and talent, or streamlining back-end processes to improve the decision-making process, mortgage servicers are doing more to prioritize borrowers. Here's a look at seven of these borrower-focused initiatives and how they're reshaping mortgage servicing.

March 1 -

The Money Source has filed three provisional patent applications as part of its efforts to develop new innovations in mortgage servicing, including the use of blockchain technology.

February 27 -

Only a fraction of mortgage borrowers return to their servicers to originate or refinance a mortgage loan, and it may be the industry's fault for not exhausting enough effort to keep them around.

February 27 -

Fewer mortgage borrowers are falling behind on their payments, and consumers' broader borrowing habits indicate an increased willingness to turn to nontraditional sources like fintechs for their lending needs, according to TransUnion.

February 22 -

With its latest round of funding, the mortgage fintech company will continue to build its digital platform, with a goal of reducing the complexities and costs of home buying.

February 21 -

The company will shutter the offices it inherited when it bought EverBank in 2017 and focus on lending to existing customers through digital channels. U.S. Bank will assume the leases on about 25 properties.

February 21 -

Through digital validation and intelligent data automation, borrowers will know if their loan would be approved in as little as seven minutes and be able to close in eight days, according to loanDepot.

February 20 -

A digital mortgage startup called Brace is using machine learning to automate loss mitigation and has lined up backing from several venture capital sources, including a fund with high-profile investors like Amazon founder Jeff Bezos.

February 19 -

With a growing market share of home sales and wider breadth of services, Redfin posted significant annual revenue gains.

February 15 -

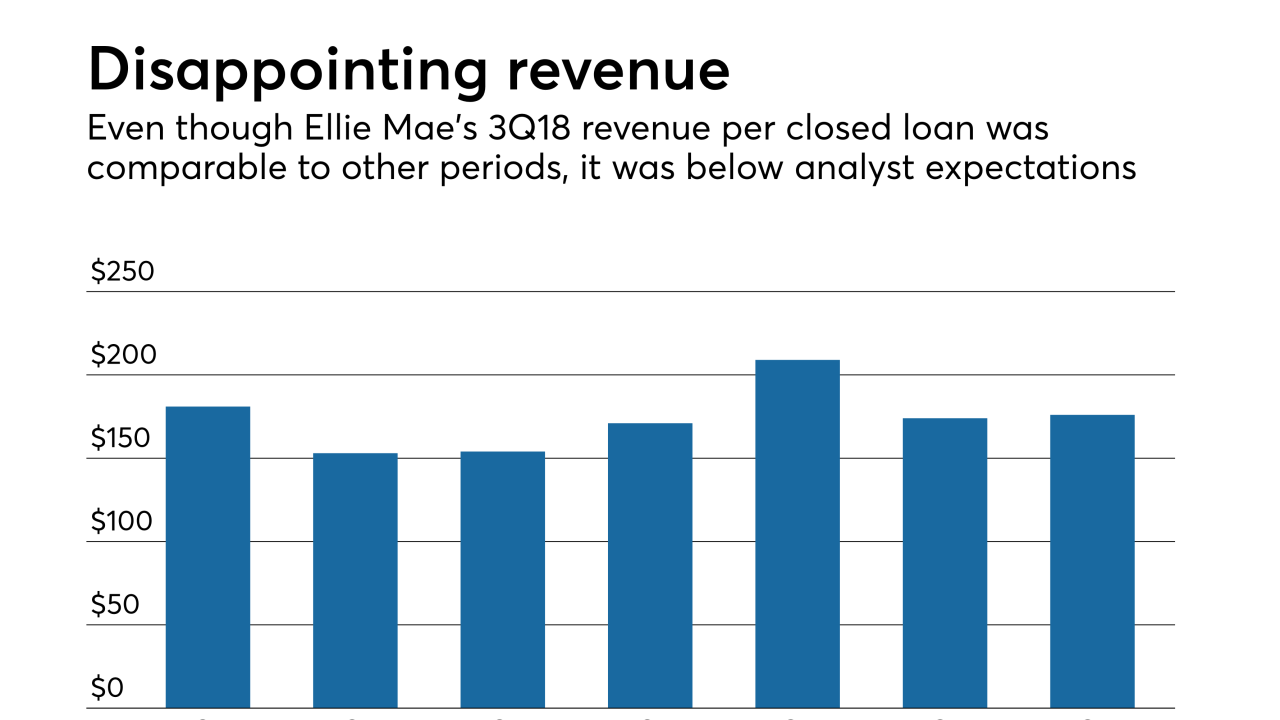

The private equity acquisition of the fintech vendor Ellie Mae will give it some breathing room in a declining originations market because it will have a more patient and strategic investor than its myriad shareholders as a public company.

February 13 -

Black Knight reported lower net earnings, but higher revenue in the fourth quarter compared with the previous year, driven by growth in the company's software segment.

February 13 -

The mortgage loan origination system developer Ellie Mae is going private, agreeing to be acquired by the private equity firm Thoma Bravo in an all-cash transaction valued at $3.7 billion.

February 12