-

This is the second acquisition in the private equity firm’s newly established technology vertical.

July 7 -

The company is looking to sell 20 million shares, with a 3 million underwriters' option, at between $16 and $18 per share.

July 6 -

The financial services company will incentivize existing card members with statement credit for taking out or refinancing a home loan with either lender.

July 1 -

Lending startup Tomo Networks will eschew refinances to focus exclusively on purchases.

June 30 -

The financial services company will use its new capital to invest in artificial intelligence and machine learning to cut transaction times, as well as build its own servicing platform.

June 23 -

The company plans on trading on the New York Stock Exchange under the ticker symbol BLND

June 21 -

While usage of this process in mortgage closings picked up steam last year, only 34 states have permanent laws in place and two do not permit it at all.

June 21 -

Consumer-permissioned access to bank or payroll information could be used to evaluate borrowers who still need relief after payment suspensions for pandemic-related hardships end.

June 16 -

There are plans to incorporate the code into the Encompass eClose product, which will allow for secure storage of digital mortgages and notes.

June 11 -

The digital title insurance, closing, escrow, and recording services provider has now raised a total of $110 million in funding.

June 2 -

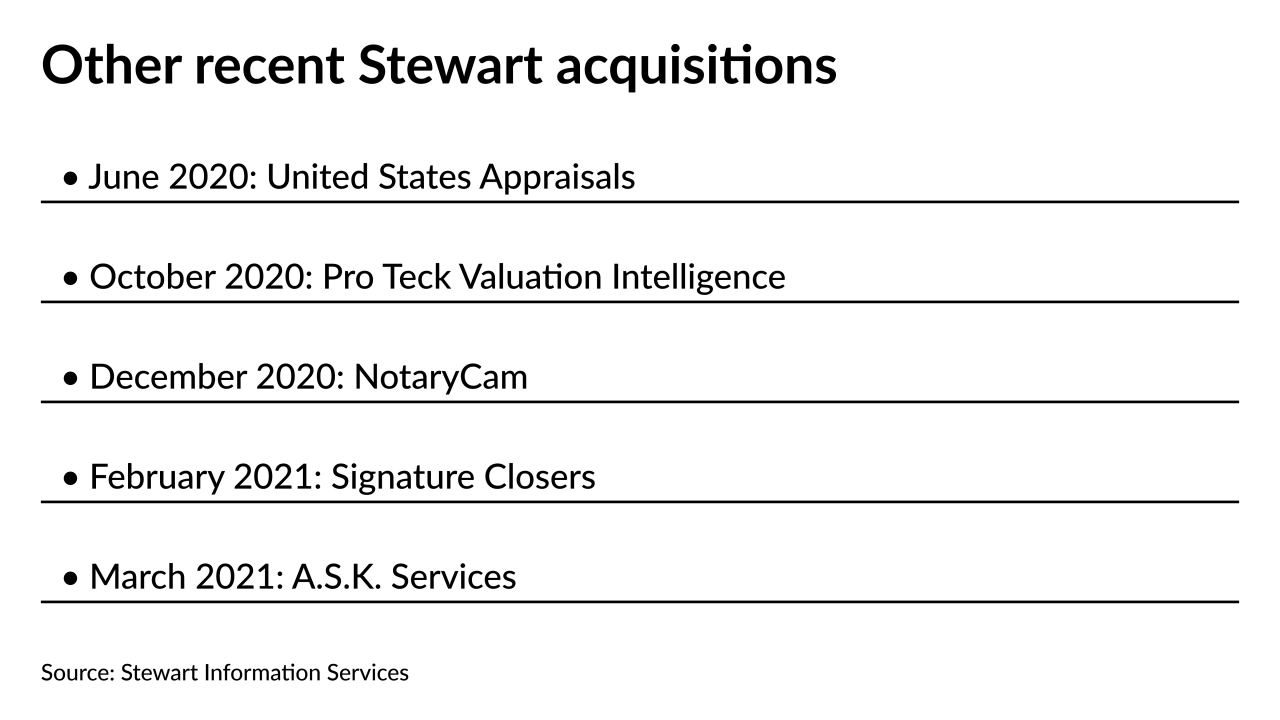

This is the multi-hyphenate company’s sixth deal since the start of 2020 — a series of acquisitions in a variety of sectors within the industry, ranging from analytics to artificial intelligence.

May 28 -

Rather than completing another equity raise, the five-year-old mortgage technology company went looking for a partner.

May 27 -

The cloud-based mortgage closing platform’s Series D round earned $150 million for the company.

May 25 -

The deal adds to the burgeoning technology stack at the Houston-based title underwriter, which added NotaryCam in December.

May 25 -

While COVID-19 pushed digitization to the forefront of lending, a majority of borrowers still want some degree of human interaction, according to a survey by ICE Mortgage Technology.

May 13 -

The move formalizes the use of the Rocket Mortgage moniker, which has been a major part of the company’s branding since 2016.

May 12 -

The incident points to a risk mortgage companies should be aware of as they shift to digital servicing strategies.

April 26 -

The lender will expand certain mortgage products, like its HomeRun program, which requires lower down payments and removes mortgage-insurance requirements for lower-income borrowers.

April 26 -

The mortgage real estate investment trust has been a first-mover regarding innovations in the private securitized market, and others tend to follow its lead.

April 19 -

In the nonstop deluge of loan volume, last year’ highest producing loan officers leaned on tech — though sometimes reluctantly — to adapt in the digital marketplace.

April 14