When the pandemic arrived and everything went remote, some in the technologically straggling mortgage industry completely changed

Meanwhile, top producers reached new pinnacles in 2020 as mortgage volume set a record with combined purchase and refinancing

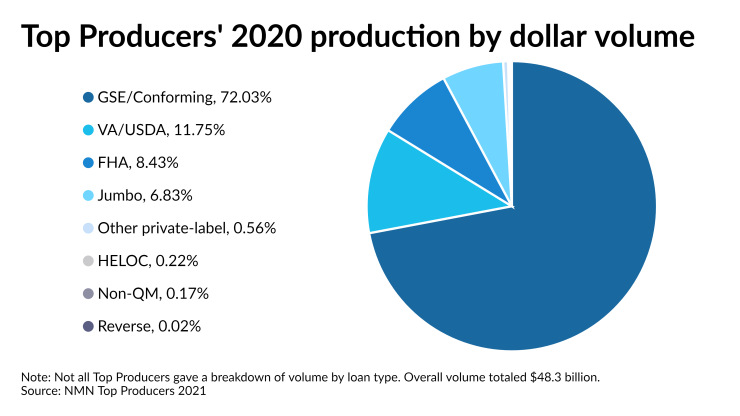

While it translated to a good problem for lenders, it also forced them to figure out which products would best help them keep their heads above water and turn times reasonable.

This year’s crop still relies on manual processes and interpersonal skills, but they adjusted to the pandemic’s sea change — sometimes reluctantly.

John Adams Mortgage in Southfield, Mich.,

“With the volumes this year, the online application process really helped me to get to more customers and the CRM system helped me to get in front of all my past clients quickly and easily,” said Joe Bigelman, branch manager and loan consultant at John Adams. “I didn’t think it was personal enough but proved to be a useful tool and completely acceptable to clients.”

Lenders

Staying organized and maintaining effective communication — both internally and with borrowers — became paramount in a remote world. Zoom grew into a ubiquitous vessel for outreach and co-worker connection while task managing apps saw upticks and lenders fully utilized digital platform functionality.

CIMG Residential Mortgage in Chapel Hill, N.C., adopted web-based board Trello to claim and assign tasks and create a customer contact schedule, according to managing director Robby Oakes.

“The biggest client complaints are with duplicate requests and poor communication, so giving your team one platform to collect information streamlines requests and minimizes stress for the consumer,” Hoeffer said.

Some Top Producers sat ahead of the curve and were well prepared for the shift to working solely online.

“The software Better.com has built allows us to process a higher volume of loans per loan officer than other companies I’ve worked at,” said loan consultant Thomas Vaughan. “One of our biggest advantages is that we were already using these tools before they became necessary and this truly allowed us to leap ahead of the competition.

Meanwhile, others stuck by old programs had revelatory experiences with more updated technology. First Meridian Mortgage in Alexandria, Va., has deployed Act database management for 20 years due to the company’s heavy customization with the product and reluctance to change, according to president Kevin Retcher. However, the pandemic forced them to try new things, like

“Lenders changed for the better with the e-signing of documents,” Retcher said. “I think we got more efficient because of the pandemic and feel those efficiencies have taken root and will continue.”

Of course, many lending shops still have ways to go in modernizing workflows and upgrading their cabinets of digital offerings.

Borrower pre-approvals remain a pain point at

“The status calls, appraisal status, commitment status, constant pre-approvals in this market,” Bonura said. “You’re doing 20, 30, 40 pre-approvals sometimes.”

With borrower activity expected to slow in 2021, it could give those lagging companies a chance to recover and