-

Revisions to the TILA/RESPA integrated disclosure that go into effect this fall drove the changes Ellie Mae made in its latest update to the Encompass loan origination system.

August 6 -

The administration’s recent report on fintech innovation discussed ways to adopt electronic promissory notes — or eNotes — and automated appraisals in federal mortgage programs.

August 6 -

Social media is a main avenue for mortgage lenders to reach the next generation of homebuyers. New American is trying to make their own lenders experts in the space.

August 3 -

An increase in millennials making home purchases is a call to the mortgage industry for a quicker, more efficient digital process.

August 1 -

Loan defect risk rose in only three states and a handful of metropolitan regions in June thanks to the continuing spread of digital mortgage initiatives that improve data quality.

July 31 -

As the mortgage industry continues evolving digitally, MISMO is developing standards for business-to-consumer transactions on mobile devices, according to the Mortgage Bankers Association.

July 25 -

Startup LoanSnap, a company funded in part by Virgin Group founder Richard Branson, has launched artificial intelligence that matches consumers with mortgages based on a complex analysis of their financial situation.

July 20 -

As purchase mortgages continue to dominate overall industry volume, lenders aren't letting the extra work required to close these loans affect their productivity.

July 18 -

Bank of America's residential mortgage origination volume fell short of last year's in its second-quarter earnings despite gains from digital sales and seasonal home buying, and broader consumer lending strength.

July 16 -

Optimal Blue is expanding its reach in the secondary mortgage market by acquiring Resitrader, a whole-loan trading marketplace that has integrations with Fannie Mae and Freddie Mac.

July 10 -

KB Home attributed significant growth in its building and mortgage income to first-time homebuyer activity and new lending technology in its fiscal second quarter.

July 2 -

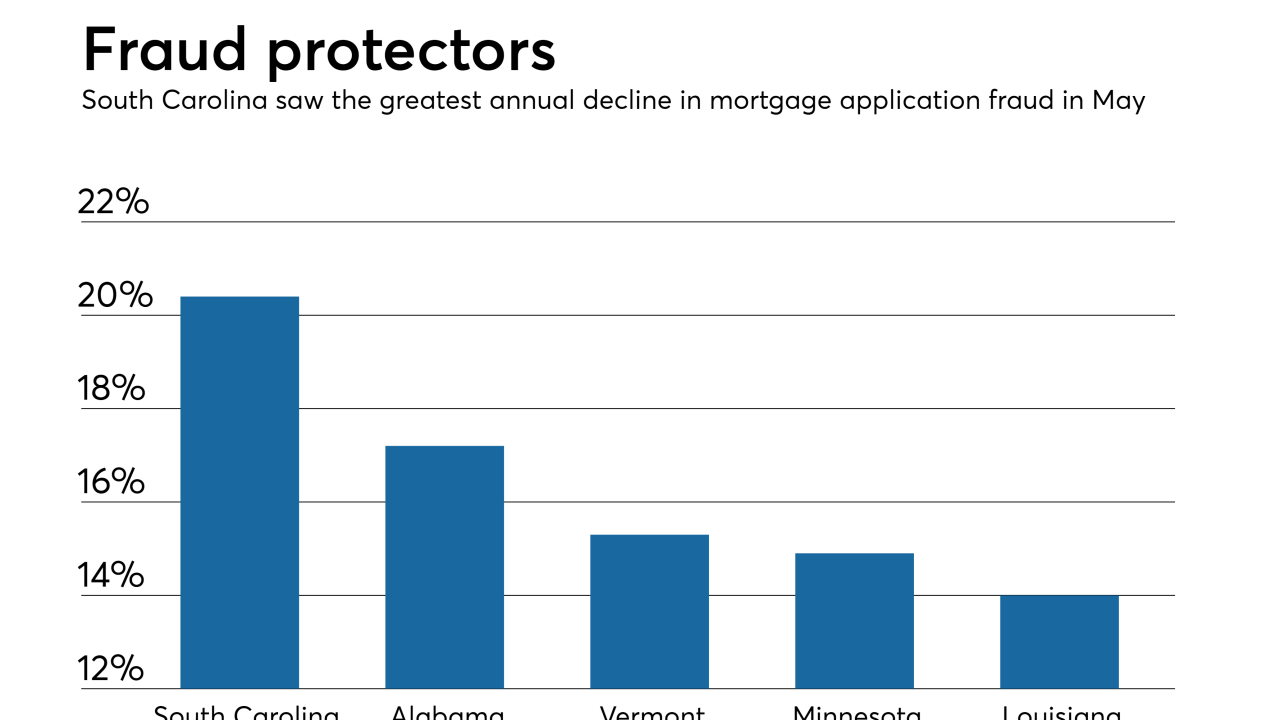

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28 -

While the digital mortgage movement has primarily focused on the originations side of lending, Black Knight's latest release seeks to apply those principles to servicing to help improve borrower retention and engagement.

June 25 -

Ginnie Mae is looking to start a pilot program to securitize digital mortgages as early as 2019, but issuers would not be able to commingle loans using traditional paper files in those deals.

June 20 -

Paycheck information gleaned from bank accounts is emerging as an alternative to verifying a mortgage applicant's income and employment with a 4506-T tax transcript request to the IRS.

June 20 -

With its acquisition of artificial intelligence and machine learning developer HeavyWater, Black Knight is turning to its Artificial Intelligence Virtual Assistant to streamline the mortgage process, with an immediate focus on the originations sector.

June 6 -

Black Knight has acquired HeavyWater, a developer of artificial intelligence and machine learning technology for the mortgage industry, and plans to incorporate the startup's borrower data verification and other automation capabilities into its existing product suite.

June 4 -

Promontory MortgagePath fills management roles for bank relations, technology and outsourced services opportunities.

May 31 -

Fannie Mae is warning mortgage lenders and servicers about possible fraud schemes in Los Angeles County involving "34 apparently fictitious employers being used on loan applications."

May 30 -

To make its technology more relevant to the mortgage industry, Fannie Mae is taking a new approach to developing tools that engages lenders earlier in the process and makes lending more efficient.

May 29 Fannie Mae

Fannie Mae