-

Consumer sentiment for home buying stayed near its record high behind low mortgage rates and a strong job market, though the declining stock markets and COVID-19 concerns may change that soon, according to Fannie Mae.

March 9 -

Capacity constraints among mortgage lenders are leading to wider spreads between mortgages and the 10-year Treasury yield even after it remained below 1% for an extended period this week.

March 5 -

Fannie Mae completed its first two Credit Insurance Risk Transfer transactions of 2020, shifting $1 billion of single-family loan credit risk to insurers and reinsurers.

March 4 -

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.

March 3 -

Fears stemming from the coronavirus have resulted in lower mortgage rates and more business for now, but if the situation deteriorates further, consumers could decide to put off buying a home.

March 2 -

The Federal Housing Finance Agency authorized the government-sponsored enterprises to contribute $502.2 million to two funds that help preserve and build affordable housing.

February 27 -

Fannie Mae and Freddie Mac are expected to retain “limited and tailored government support” after they are released from U.S. control, Treasury Secretary Steven Mnuchin said in a letter to lawmakers.

February 21 -

The metro Atlanta housing market has continued to heat up, with sales jumping and pricing rising modestly since the start of the year.

February 19 -

For the first time since the start of the housing crisis, mortgage origination volume could top $2 trillion for three consecutive years, according to Fannie Mae.

February 18 -

Fannie Mae identified the adoption of hedge accounting and regular issuance of multifamily Connecticut Avenue Securities deals as among strategies it could continue to pursue while navigating regulatory uncertainties and change.

February 13 -

Five MBS pools of predominantly non-QM mortgages have been launched into the market by originators and loan aggregators, according to ratings agency presale reports published since Monday.

February 13 -

Whether a deal involves a minority stake or a whole company carve-out, buyers and sellers should be aware of five issues that may pose transaction risk in the mortgage market.

February 11 Mayer Brown

Mayer Brown -

The administration proposed to end the housing trust funds now financed by Fannie Mae and Freddie Mac, and to subject numerous agencies to the congressional appropriations process, among other things.

February 10 - LIBOR

The government-sponsored enterprises’ plan to cease accepting loans pegged to the London interbank offered rate a year ahead of its scheduled expiration is expected to hasten action in securitized markets.

February 10 -

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

Consumer sentiment about purchasing a home nears its record high as almost half of those surveyed said mortgage rates will stay at the current low levels, according to Fannie Mae.

February 10 -

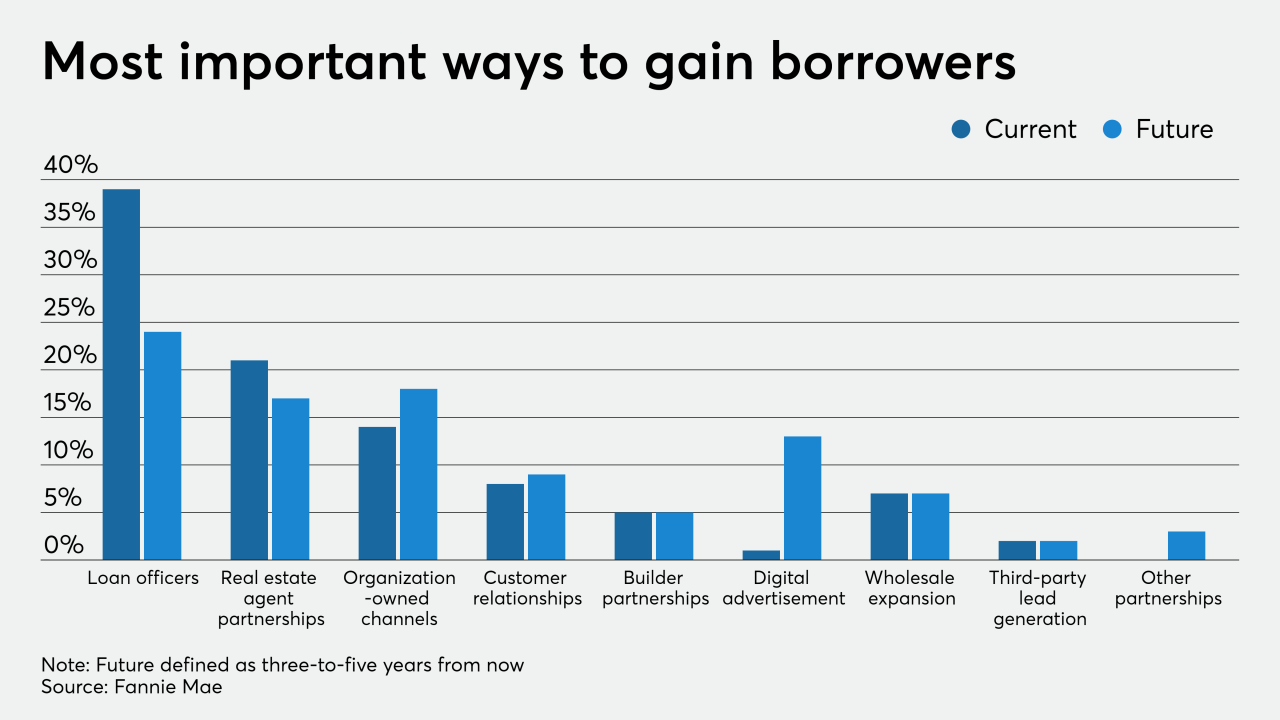

While loan officers will remain mortgage lenders' leading business development tool in the future, those originators believe business will come from a more diversified source pool, a Fannie Mae survey found.

February 7 -

The U.S. mortgage insurance business remained a bright spot for Genworth Financial, as fourth quarter adjusted operating income increased 29% and new insurance written rose nearly 95% over the prior year.

February 5 -

In letters to Freddie Mac and Fannie Mae, six Democrats asked how the mortgage giants are factoring extreme weather into their risk modeling.

February 4 -

With policymakers focused on ending Fannie Mae and Freddie Mac’s conservatorship, their regulator is reorganizing key units and adding staff to position itself for the long term.

February 4