-

New Penn Financial has launched a condo loan program that features more flexible property restrictions than what's allowed under Fannie Mae and Freddie Mac guidelines.

September 13 -

The Federal Housing Finance Agency issued a proposal Wednesday that would require mortgage giants Fannie Mae and Freddie Mac to align their policies on cash flows for current mortgage-backed securities, and eventually for a uniform security when it is implemented next year.

September 12 -

Housing finance reform is still likely years away, but a growing chorus of lawmakers say the government guarantor has the ability to clear the path to a final plan.

September 11 -

Fund manager Varde Partners wants to grow its partnerships with lenders and servicers interested in selling off their excess mortgage servicing rights.

September 11 -

Early adopters took digital mortgages from concept to reality. What will it take for everyone else to catch up?

September 10 -

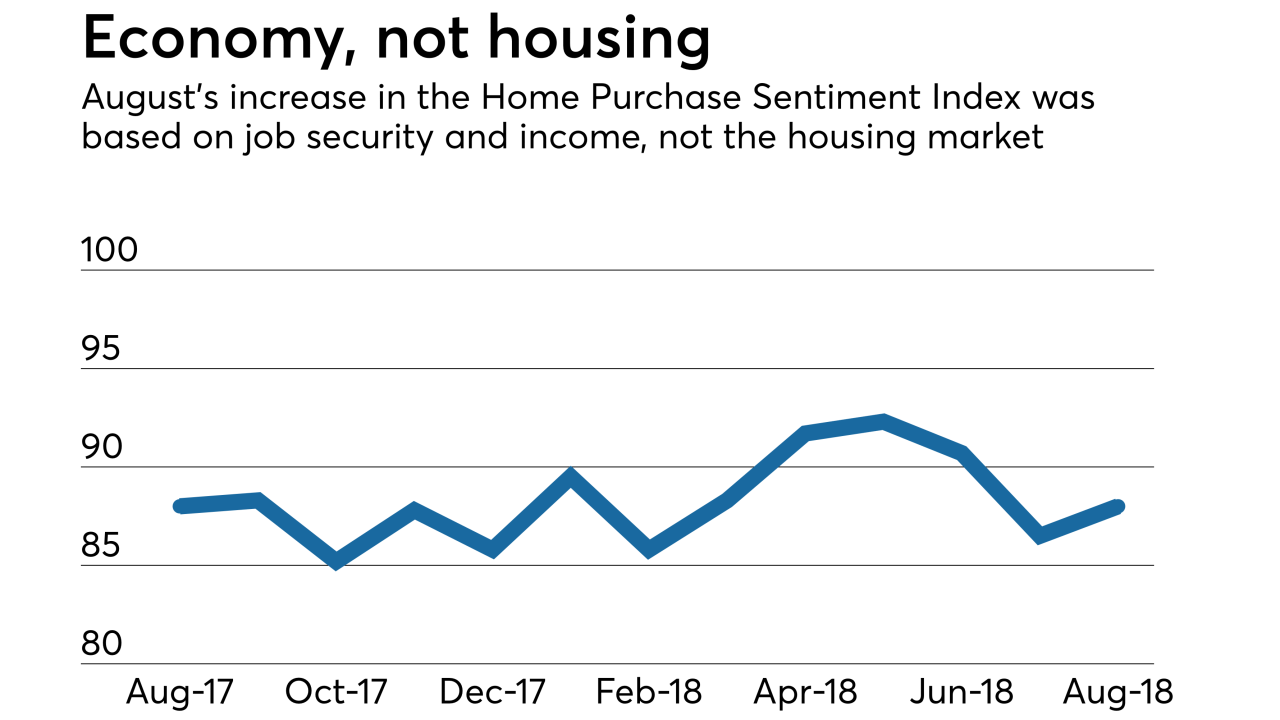

Consumer confidence about the U.S. economy is not correlating with their views on the current state of the housing market, Fannie Mae said.

September 7 -

The GSE recently transferred $166 million portion of risk on $11.1 billion of loans via contracts with seven reinsurers and insurers; it plans to come to market two or three time a year going forward.

September 6 -

The proposal by Reps. Jeb Hensarling and John Delaney is a sign that a bipartisan consensus is building on how to move on from Fannie and Freddie.

September 6 -

The departing House Financial Services chair unveiled a bill with Democrat John Delaney to repeal Fannie and Freddie's charters and establish Ginnie Mae as a backstop.

September 6 -

Freddie Mac is promoting Executive Vice President David Brickman to president and will consider him among possible candidates to be the agency's next CEO after Don Layton retires next year.

September 5 -

As the demand for home rentals continues to rise, regulatory burdens could decrease the multifamily housing supply and drive up costs, witnesses said at a congressional hearing.

September 5 -

The Treasury Department and a key housing regulator are preparing to fill a second possible vacancy atop a U.S.-controlled mortgage giant, a move that could strengthen the Trump administration's hand in addressing unfinished business from the 2008 credit crisis.

September 5 -

Delinquencies for loans securing commercial mortgage-backed securities continued to decline, although they are still well above rates for other types of investors, according to the Mortgage Bankers Association.

September 4 -

Maybe political winds or another downturn will spark housing finance reform. But 10 years after the conservatorships began, the companies are still in perpetual limbo.

September 3 -

The sponsor has increased the credit enhancement on the senior support class of notes on offer in order to offset the slightly higher risk to investors.

August 31 -

The Congressional Budget Office has found that restructuring the mortgage market would save the government billions of dollars but may increase the cost of housing.

August 27 -

The agency said the market for larger rental investors may not need additional liquidity from Fannie Mae and Freddie Mac.

August 21 -

Mortgages originated to finance apartments and other income-producing properties managed to generate an overall year-to-year increase in the first half, even though there are declines in some parts of the market.

August 21 -

Top U.S. housing regulator Mel Watt is privately reassuring people close to him that he will keep his post as authorities investigate an employee's claims of sexual harassment. Now, his accuser is heightening the pressure — speaking out publicly for the first time.

August 20 -

MountainView Financial Solutions is brokering a more than $3 billion package of Fannie Mae and government mortgage servicing rights originated primarily through third-party origination channels.

August 17