-

But for the first time in a month, fewer consumers refinanced into a government-guaranteed mortgage.

October 28 -

A booming housing market contrasts with a slow-to-improve job market, making for lopsided improvement in the number of troubled mortgages, according to numbers from the Mortgage Bankers Association.

October 26 -

As of the end of July, there were more than 1 million past-due mortgages not in forbearance plans, and the majority likely would have qualified for forbearance under the CARES Act.

October 22 -

HUD Deputy Secretary Brian Montgomery questioned "whether we could ever totally accept desktop-only appraisals" at the Mortgage Bankers Association conference this week.

October 21 -

Mortgage applications decreased 0.6% from one week earlier, although a slight drop in purchase volume belied the fact that consumers are taking advantage of the current rate environment, according to the Mortgage Bankers Association.

October 21 -

The overall forbearance rate was under 6% for the first time since April as another large swath of loans fell out of CARES Act coverage, according to the Mortgage Bankers Association.

October 19 -

A surge of mortgage originations allowed Ginnie Mae to surpass its high watermark for mortgage-backed security issuance by nearly 33%.

October 14 -

Mortgage applications decreased 0.7% from one week earlier, but lending activity should continue strong for the remainder of the year as rates stay low, according to the Mortgage Bankers Association.

October 14 -

The government-sponsored enterprises set a Sept. 30 deadline for sellers to accept applications for Libor adjustable-rate mortgages.

October 8 -

Millennials continue to lock in the lowest average mortgage rates on record, keeping lenders busy and the housing market churning, according to Ellie Mae.

October 7 -

The up-and-down pattern for mortgage application activity continued, as volume rose 4.6% from one week earlier led by refinancings, according to the Mortgage Bankers Association.

October 7 -

GSE mortgages in forbearance fell for the 17th straight week, spearheading the overall downtrend, according to the Mortgage Bankers Association.

October 5 -

But most borrowers who have exited forbearance plans are back on track when it comes to paying, and the incidence of loss mitigation plans is high among those who aren't.

October 5 -

Over 3.6 million borrowers sit in coronavirus-related forbearance with portfolio and private-label securitized loans driving the week's increase, according to Black Knight.

October 2 -

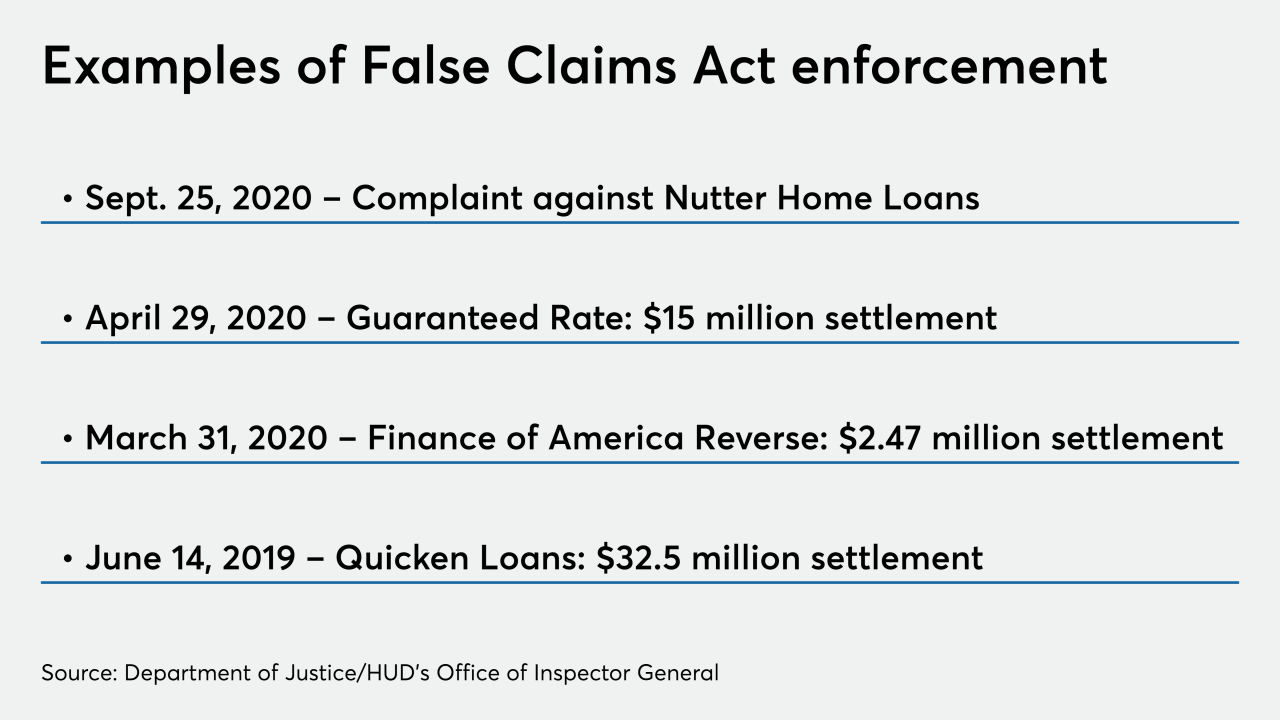

The accusations against Nutter Home Loans, like an earlier settlement with the Department of Housing and Urban Development, center on concerns related to FHA-insured reverse mortgages. The company "strongly disputes" them.

September 30 -

Mortgage applications decreased 4.8% from one week earlier, as refinance activity was down even as average rates fell to a new record low, according to the Mortgage Bankers Association.

September 30 -

Approximately 75% of the quarter-to-quarter growth came from multifamily mortgage originations.

September 29 -

The net share of mortgages in Ginnie Mae securitizations with suspended payments appears to be stabilizing, but the number of new requests creates doubt about whether it will subside.

September 29 -

The agency’s report on mortgage data submitted by lenders identified persistent disparities between white borrowers and minorities in denial rates and pricing. Some observers say the bureau should have been more explicit as the nation wrestles with systemic racism.

September 24 -

Twelve people were charged in a scheme regarding the creation of 100 fraudulent mortgages in Georgia, according to the HUD inspector general.

September 24