-

The vendor, SitusAMC Group Holdings, LP, said in a statement Saturday that someone compromised its systems and took client data including "accounting records and legal agreements."

November 23 -

Finance of America is buying Onity's MSRs and loan pipeline in this niche as PHH retains its role as a subservicer and remains involved in buyout securitization.

November 20 -

A combination of factors, including the rise of retail investing and sound assets, propelled ETF formation, with at least four issuances over the past year.

November 19 -

Advances from the Federal Home Loan Banks dipped in the third quarter, but experts do not necessarily see the dip as a sign of ample liquidity in the economy.

November 19 -

The billionaire and legacy government-sponsored enterprise investor says there is a quick interim fix and they should eventually leave conservatorship.

November 18 -

Independent mortgage bankers were in the black for each loan originated during the third quarter, as low rates brought an application surge in September.

November 18 -

The Structured Finance Association is adding its weight to recent support for a Securities and Exchange Commission action that could modernize Reg AB II.

November 18 -

Federal Reserve Gov. Christopher Waller said in a speech Monday that private and public-sector data suggests that the labor market is continuing to weaken, making a 25 basis point rate cut in December a prudent choice.

November 17 -

Quality Control Advisor Plus is an integrated system which brings together previously separate units, cutting months off of Freddie Mac's current QC process.

November 17 -

Policy reviews of GSEs and Basel rules could reshape the MSR market, opening opportunities for banks and altering Fannie, Freddie MBS dynamics.

November 17 -

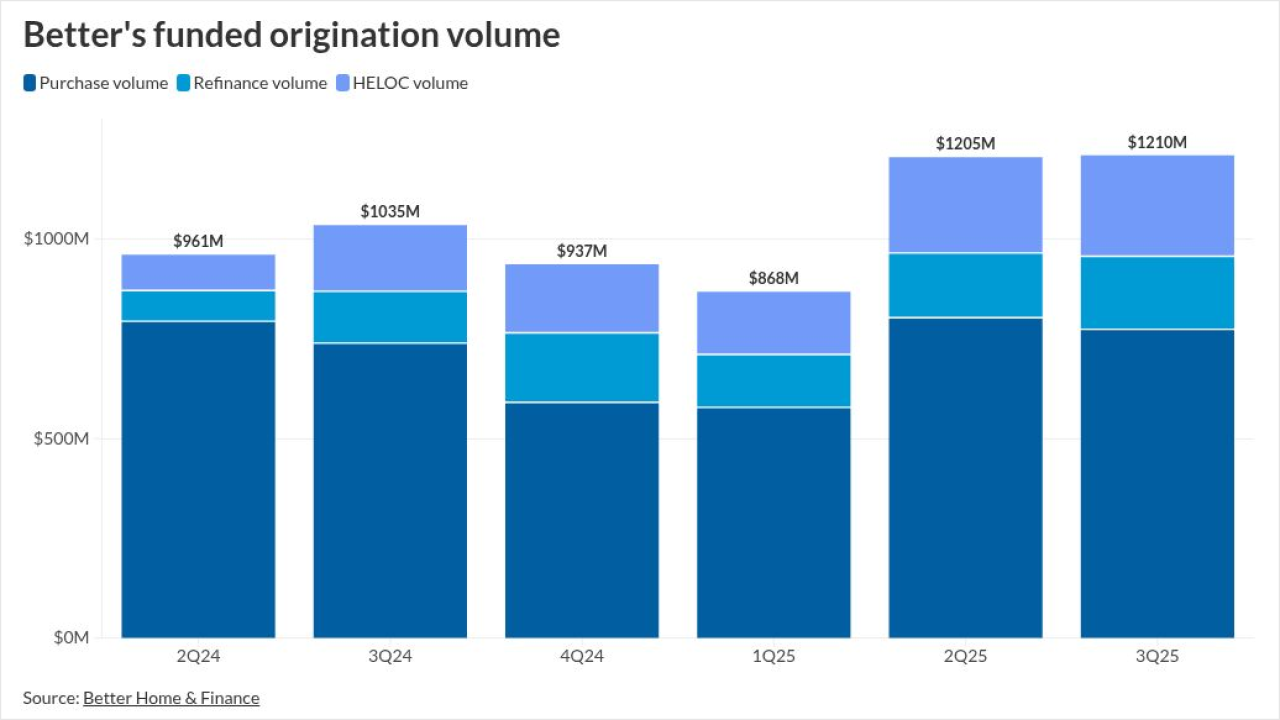

The fintech had over $2 billion in home equity line of credit volume in the third quarter and reported growing production in its crypto and non-QM offerings.

November 14 -

Origination has picked up but has limits, retention rates are improving and stakeholders are seeking a recapture standard, experts at an industry meeting said.

November 13 -

The lender, which crossed the $1 billion origination mark for the second consecutive quarter, is bullish on several new mortgage partnerships.

November 13 -

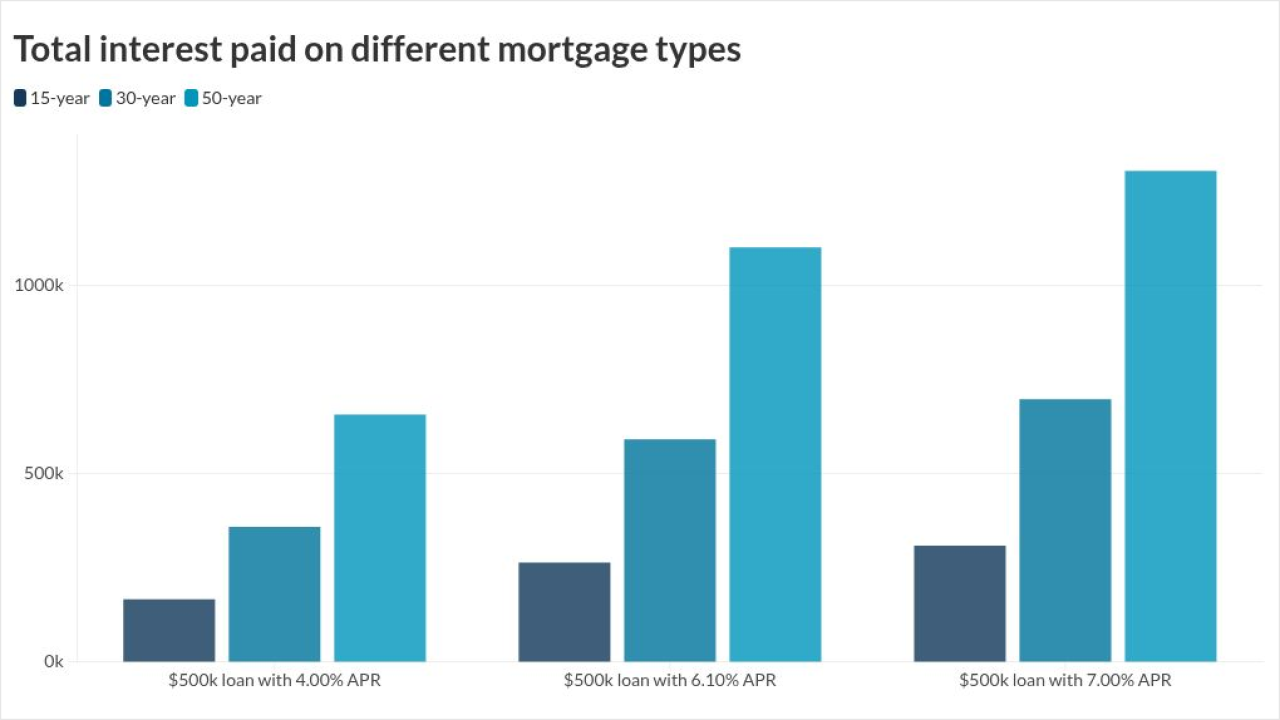

A 50-year mortgage would make borrowers susceptible to higher interest rates, significantly more payable interest and slower equity gains, LendingTree analysis showed.

November 13 -

Fed Gov. Stephan Miran has spent his short tenure at the central bank arguing that disinflation in housing and immigration reforms will tamp down inflation in the near term. But other economists say the timing, degree and context of those effects is very much in question.

November 13 -

SEMT 2025-12's collateral profile is slightly weaker compared with the prior transaction, with a slightly lower weighted average FICO score.

November 12 -

A think tank's analysis of the system that provides banks with financing backed by an implied guarantee arrives amid broader federal efficiency reviews.

November 12 -

Second-lien mortgages make up the collateral pool. Those assets normally have a high expected loss severity, but the borrowers appear to be of prime credit quality.

November 11 -

Third-quarter mortgage earnings revealed swings in profitability, but the real story, according to the Chairman of Whalen Global Advisors, is that hedging MSRs is unnecessary for well-managed lenders.

November 11 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

A 50-year mortgage on a median-priced US home could reduce borrower's monthly repayment, but also double the amount of interest the owner pays over the life of the loan, according to UBS Group AG analysts.

November 11