-

Applications related to Zillow Offers made up 70% of the mortgage lender's purchase business in the third quarter.

November 3 -

Stronger collateral and less credit enhancement reflect lessening pandemic risk.

November 3 -

After closing its merger with Caliber, the company also hopes to pare down expenses by at least 10%.

November 2 -

The company, which was accused of cutting corners in originations by a former top executive, produced $32 billion in the third quarter and is guiding between $26 billion and $31 billion in the fourth.

November 1 -

When added to other staffing and acquisitions additions since year-end 2019, the mortgage services provider has more than tripled the company’s headcount.

November 1 -

The mortgage giant’s net worth of $42 billion at the end of the quarter was more than double what it was a year earlier. CEO Hugh Frater said that financial strength puts the company on better footing to support affordable housing goals outlined by the Federal Housing Finance Agency.

October 29 -

The move by the agency, which is an arm of the Department of Housing and Urban Development, will help further efforts to give servicers more leeway to modify mortgage terms.

October 29 -

Rocket, already the nation's No. 1 lender, is looking to increase market share

October 29 -

The combined refinance and purchase total was nearly double the average quarterly volume logged before the pandemic, the company said in its third-quarter earnings call.

October 29 -

Benchmark will issue 21 classes of certificates, with 13 entitled to principal and interest payments. Six classes will receive interest only.

October 28 -

Mortgage servicing rights can look more attractive to originators as they become increasingly interested in building their customer base, but some may want to sell due to thinner margins or regulatory uncertainty.

October 28 -

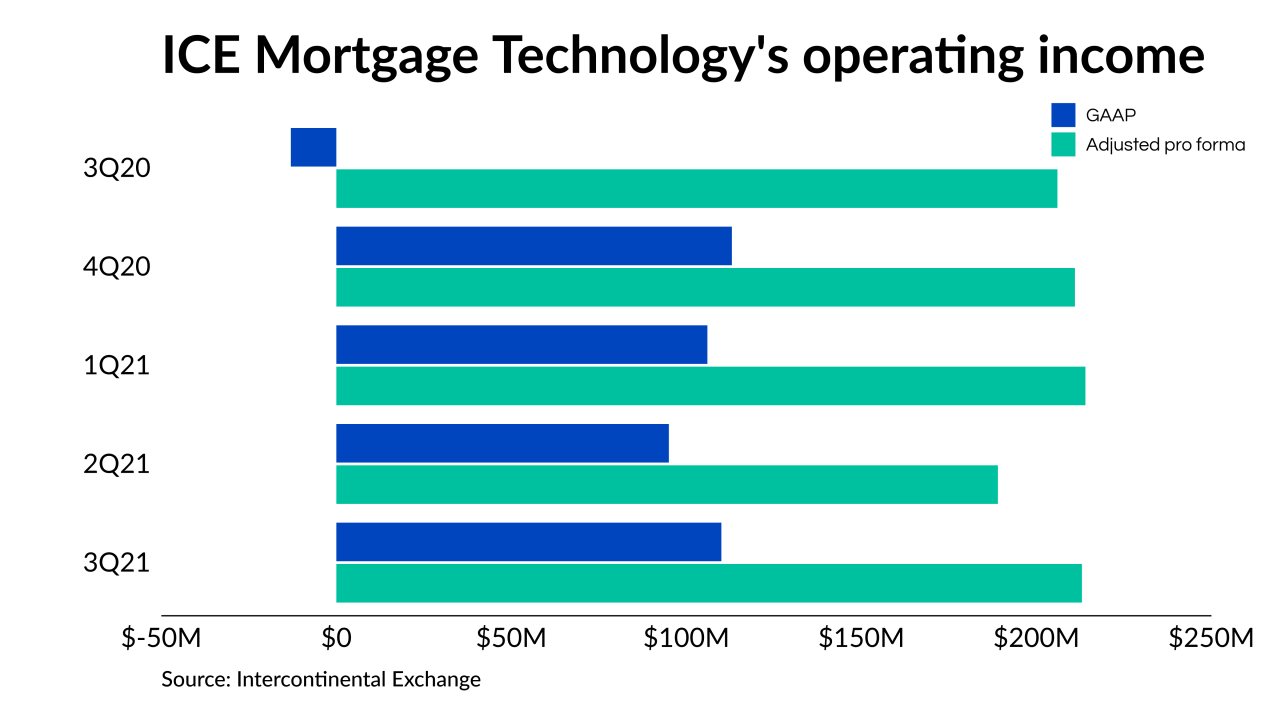

The company is making progress on a focus shift to recurring revenues from transactional activities.

October 28 -

The company sees an opportunity as its competitors have to sell to make up for lost income due to tighter origination margins.

October 28 -

The company also locked a record $4.7 billion in jumbo loans and significantly increased its business purpose lending from a year ago as its revenue mix shifted toward its taxable subsidiary.

October 28 -

The increased complexity of loss mitigation in the wake of the pandemic has increasingly prompted a growing number of mid-sized players to outsource, so constraints on one player could affect others.

October 27 -

The deal for Michigan-based Flagstar Bancorp, announced in April, was originally expected to be completed by the end of the year. The New York bank’s CEO expressed optimism that it will still get regulatory approval.

October 27 -

Maxwell, a startup that operates an online platform catering to mortgage loan officers and smaller lenders, raised $28.5 million in equity funding from investors led by the venture firm Fin VC and Wells Fargo Strategic Capital.

October 26 -

Button Finance intends to use the capital to develop its underwriting platform and increase hiring.

October 25 -

The enormous issuance is backed by a single loan secured by first-priority mortgages on a pool of about 6,148 single-family rental homes, and 299 townhouses.

October 25 -

The Series B investment round for the power buyer comes at a time when all-cash purchases account for almost a quarter of the market.

October 22