-

The move suggests the government bond insurer doesn’t expect to see loan performance return to normal levels until next summer.

September 13 -

The technology could help firms that have had less access to automation and generally have conducted trades used to hedge loan pipelines by phone.

September 10 -

While overall volume was down in August, it remained historically strong, particularly in the securitized market for home equity withdrawal loans made to borrowers age 62 and up.

September 9 -

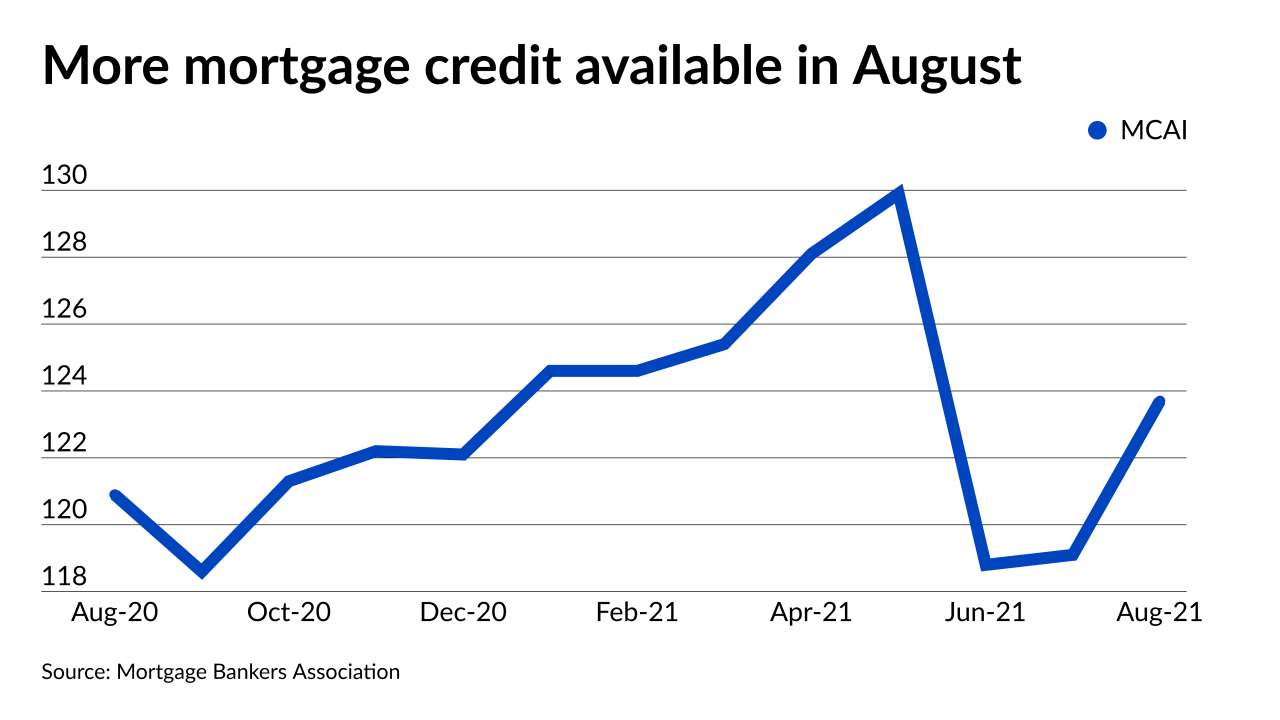

But refinance volume was constrained in recent weeks and many of the new offerings are aimed at low income borrowers, the Mortgage Bankers Association said.

September 9 -

The loan origination system provider, which launched an IPO on July 28, reported that its second quarter revenue and income grew 38% year-over-year.

September 8 -

The Loan Syndications and Trading Association alerts market participants to the challenges of term-SOFR transition before year-end.

September 8 -

The government-sponsored enterprises and their regulator are building on broader efforts by the Biden administration to close racial gaps in homeownership rates.

September 7 -

The government bond insurer allowed lenders to become “eIssuers” a little over a year ago, and the move contributed to a large surge in electronic notes this year.

September 7 -

Some progressive lawmakers argue the Federal Reserve’s deregulatory moves under Jerome Powell should disqualify him for a second term as chair. But the Biden administration could let him keep his job because of monetary policies that helped low-income workers.

September 6 -

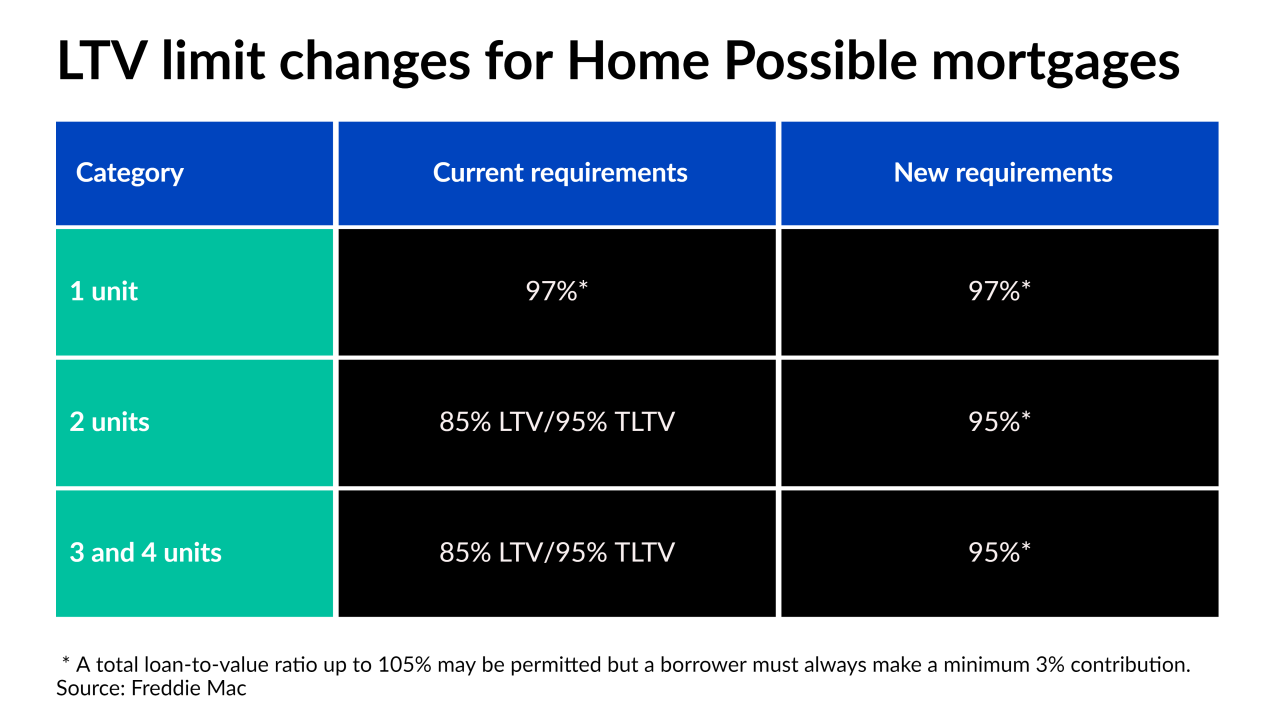

The changes could help one of the Biden administration’s affordable housing goals, which is aimed at making wealth-building through owner-occupied, 2- to 4-unit properties more attainable.

September 3 -

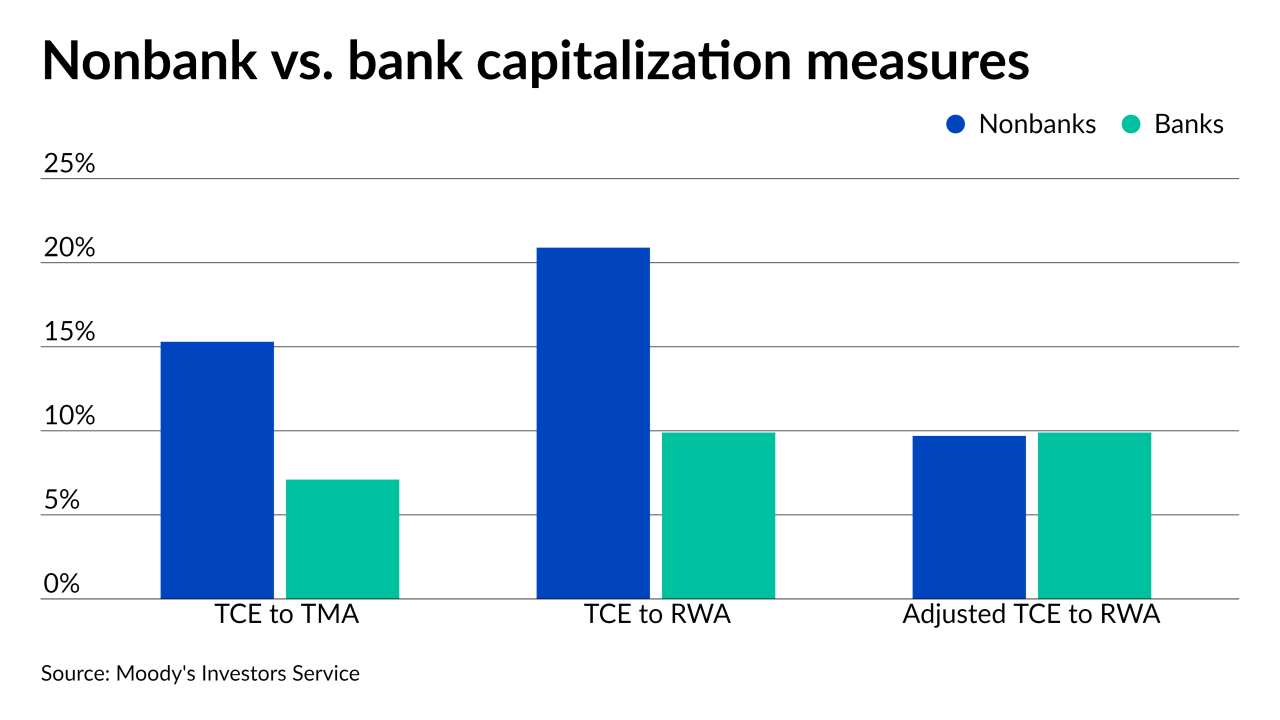

Improved capitalization and smaller balance sheets should help several weather the likely consolidation that is coming, Moody's said.

September 3 -

Low pool concentrations of loans on properties located in Ida's path, plus robust property insurance are expected to rein in impacts and insulate noteholders.

September 3 -

The extension in the number of days investors are locked out of the process comes amid a broader push by the Biden administration to boost access to affordable housing.

September 1 -

A majority of the deal was underwritten to a less-than-full documentation standard, but meets ATR standards. Almost half of the loans are on California homes.

September 1 -

By some current measures, nonbank capitalization looks strong compared to banks, but the way a Ginnie Mae proposal aims to assess the value of mortgage servicing rights would change that, Moody’s Investors Service reported Tuesday.

August 31 -

Dave banking app originally created to do away with overdraft charges has taken the industry by storm. It's on a mission to advance financial opportunities for all Americans. Join Penny Crosman, Executive Editor of American Banker and Jason Wilk, CEO and Co-Founder of Dave as they talk about how this app is changing the way people manage their money and what’s in store for the future of one-stop-shops for finances.

-

The deal appears to take advantage of a shift in federal rules reducing the level of non-owner-occupied loans Fannie Mae and Freddie Mac can purchase.

August 26 -

Even as lenders increased purchase share, higher expenses and margin compression related to pricing competition led to smaller quarterly net gains.

August 24 -

The digital provider of commercial mortgage closing documentation hired a Guaranteed Rate executive and announced plans to add staff and integrate more loan operating systems.

August 24 -

The proceeds from the trust’s certificates will refinance some CMBS debt, among other balance sheet uses.

August 24