-

The newly public company expects a 20% overall loss in adjusted earnings this year.

May 13 -

Expansion of an existing translation clearinghouse is among steps that could be taken, the Mortgage Bankers Association suggested in a letter sent to the leaders of the House Financial Services Committee on Wednesday.

May 12 -

Guild announced the $196.7 million acquisition after reporting that it more than doubled its net income in the first quarter, compared to the last three months of 2020.

May 11 -

Despite a 1Q decline in origination volume, Chairman Mat Ishbia is optimistic for the second quarter, saying the company received 17,000 more submissions in April's higher interest rate environment than it had in February.

May 11 -

After massive fundraises and IPO rumors swirled, the originator and servicer announced it will merge with Aurora Acquisition Corp. and go public in the fourth quarter of 2021.

May 11 -

Altisource Portfolio Solutions’ bottom line took a larger hit in the first quarter compared to Q4 2020, causing the company to cut costs.

May 10 -

While the first quarter is typically the weakest period for the title business, the sector benefited from strong refinance volumes that were driven by low interest rates.

May 10 -

While the product was hard to find after the start of the pandemic, the Consumer Financial Protection Bureau’s recent changes to Appendix Q are giving a pair of large wholesalers the chance to offer it as a qualified mortgage.

May 10 -

The company is shifting some of its conforming-focused call center resources not just into the growing non-QM channel but to Veterans Affairs products as well.

May 7 -

The real estate investment trust has been buying residential business-purpose loans from the company since 2017.

May 6 -

The company touted its investments in the wholesale channel while also reporting a slight quarterly drop in overall originations and gains on sale during an earnings call this week.

May 6 -

Fluctuating rules are redirecting some government-related loans to a disparate private market.

May 6 -

The company aims to use the additional capacity to get its non-qualified mortgage business back to producing $125 million per month, and anticipates more purchases of mortgage servicing rights, representatives said in its Q1 earnings call.

May 5 -

The 30-acre luxury retail development is among four investment-grade-worthy loans included in the multiborrower deal.

May 5 -

Loans bought on the secondary market have become increasingly important as borrower demand has ebbed and companies have sought to obtain mortgages through additional outlets to maintain production levels.

May 4 -

Short-term late payment rates rose again and later stage delinquencies remain at elevated levels compared to those prior to the pandemic, the Mortgage Bankers Association said.

May 3 -

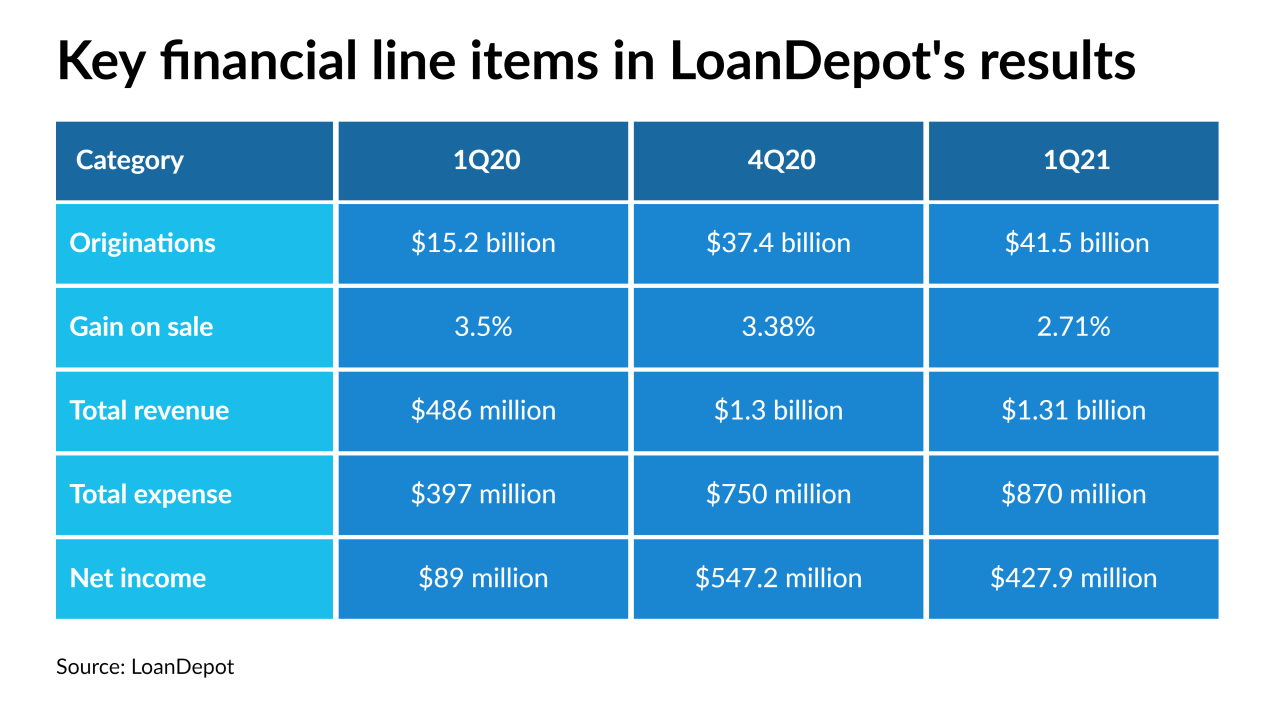

The unusually strong production numbers seen in the first quarter of this year show loanDepot is emerging as a contender in the battle for loan volume and market share amid an industry price war.

May 3 -

The mortgage insurance business had adjusted operating income of $126 million in the first quarter, down from $148 million one year ago.

April 30 -

Hedge accounting will align Fannie’s reporting with competitor Freddie Mac, and will address a mismatch between the recorded value of financial instruments used to offset interest-rate volatility on mortgages and the loans themselves.

April 30 -

The West Palm Beach, Fla.-based lender sees an opportunity for even more growth after its deal to acquire a servicing portfolio from Texas Capital Bank.

April 29