-

The conduit transaction will carry a $120 million portion of a $750 million debt financing package for Facebook's newly built Oculus R&D center near San Francisco.

April 13 -

However, companies were largely unable to use that cash infusion to make investments that lower their costs, since they had to pay out more in compensation.

April 13 -

The diverse group of loans in the servicing rights portfolio offers a potentially attractive recapture opportunity and would be a sizable transaction for their era.

April 12 -

The inaugural securitization includes 447 30-year loans with average balances of $863,206.

April 12 -

With independent title companies scoring the largest market share gain last year, the sector saw a 22% increase in premiums overall, the American Land Title Association said.

April 9 -

The digital lender’s valuation ballooned to $6 billion from $4 billion less than five months after closing a $200 million fundraise.

April 8 -

Banks can mitigate damage from slowing origination activity by putting excess cash to work, Keefe, Bruyette & Woods said.

April 6 -

One year after its internal merger, the fintech and fulfillment services provider’s COO Debora Aydelotte discusses the company’s support for community banks and its placement in the ranking of Best Fintechs to Work For.

April 6 -

Horizon Land Co. is securitizing a $488 million single-asset, single-borrower loan that will fund its purchase of 93 rent-site communities in the Midwest and Southwest regions.

April 5 -

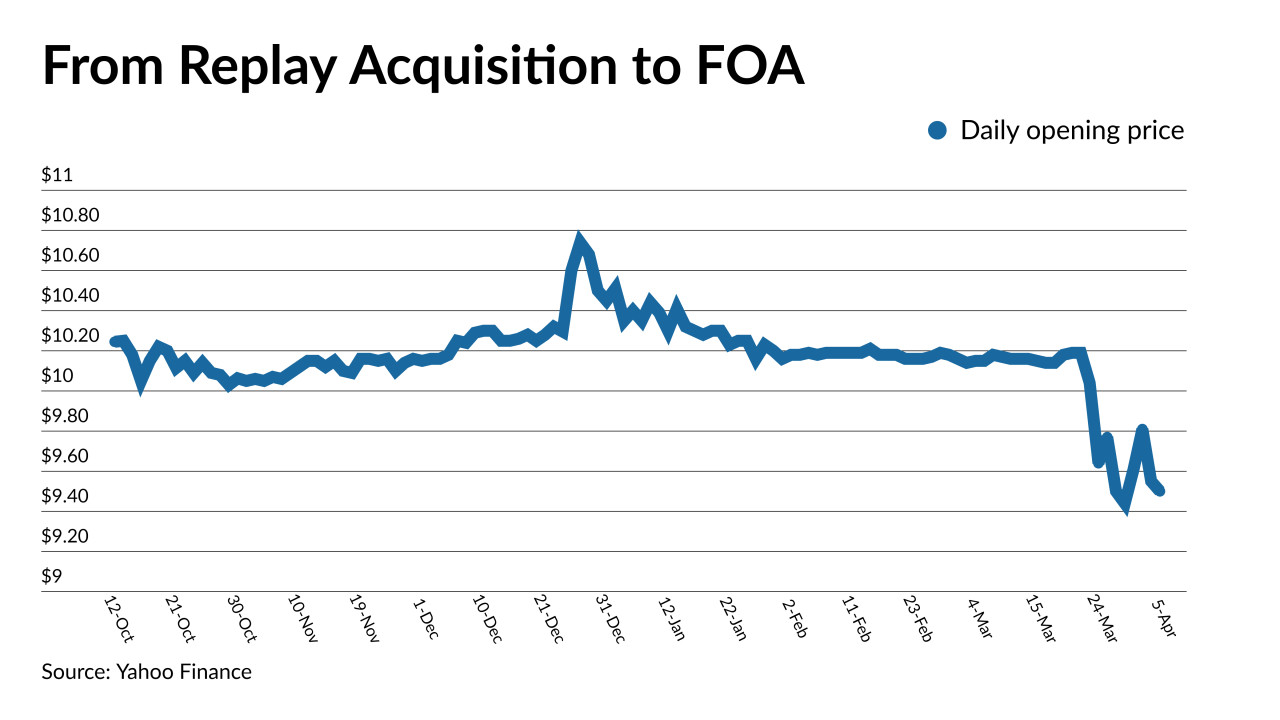

The forward and reverse mortgage lender completed its merger with blank check company Replay Acquisition Corp. on April 1.

April 5 -

The financial-technology firm Plaid is close to a new round of funding at a valuation of about $13 billion, almost three months after scrapping its sale to Visa, according to people familiar with the matter.

April 5 -

Securitization is a sound delivery model for any lender when combined with adequate research and preparation and it offers unique benefits, too — especially in terms of greater control and efficiencies, writes Black Knight’s managing director of pipeline analytics, James Baublitz.

April 1 Black Knight

Black Knight -

The Michigan company recently paid $70 million to close the books on a matter dating to the last financial crisis.

March 31 - LIBOR

A white paper released Monday by the Alternative Reference Rates Committee outlined how issuers could (and perhaps should) model new floating-rate transactions using a compounded version of the interbank overnight rate instead of Libor.

March 30 -

The lasting effects of work-from-home practices driven by the COVID-19 pandemic could slash some office property values to less than half of their original value – and lead to rating downgrades on affected CMBS transactions, according to Fitch Ratings.

March 30 -

As the U.S. economy swings from pandemic lows to a vaccine- and stimulus-induced rebound, the window of opportunity for discounted deals is closing before it ever really opened.

March 29 -

The forced liquidation of more than $20 billion of positions linked to the firm roiled stocks from Baidu Inc. to ViacomCBS Inc., casting a spotlight on the opaque world of leveraged trading strategies facilitated by some of Wall Street’s biggest names.

March 29 -

The proceeds are expected to be reinvested into agency mortgage-backed securities, which already make up 93% of Annaly's portfolio.

March 26 -

But UWM says the provision is designed to protect against a broker double-locking the loan and is used by other lenders.

March 24 -

Volumes were at a record high in the final quarter of 2020 but lenders didn’t make quite as much since gains on loan sales to the secondary market fell.

March 23