-

The former president and CEO of GE Capital’s restructuring and strategic ventures group was named executive vice president and chief risk officer soon after the departure of Fannie EVP Andrew Bon Salle.

January 22 -

Despite that decline, the company notched its second-best quarterly earnings ever over that period.

January 21 -

The investments, part of a post-merger effort to wring out more profits, include new commercial and mortgage lending platforms.

January 21 -

The company’s 4Q originations were down from the same time in 2019 and the number of overall loans for 2020 marked a decline from the year before.

January 19 -

Upcoming changes to underwriting regulations, as well as the end of the QM patch, in addition to growing home values, all add up for this market to have a good year.

January 19 -

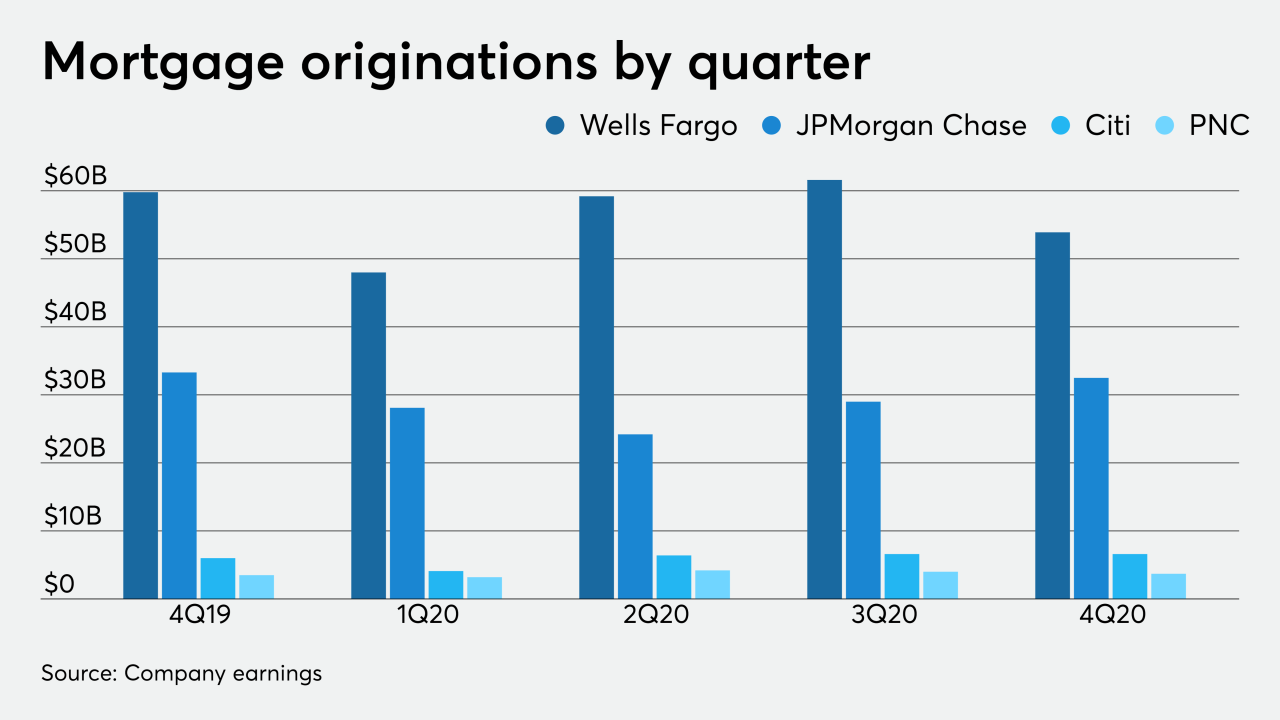

While some industry forecasts predicted origination volumes would fall 7% quarter-to-quarter in 4Q, early earnings numbers from Wells Fargo, JPMorgan Chase, Citi and PNC Bank show they were down just 3% when purchased loans are excluded.

January 15 -

The weighted average seasoning is 34 months, well above that of prior Invictus-sponsored deals on the Verus shelf that are typically new originations under 10 months.

January 13 -

After doubling its valuation in five months, Blend plans to use its latest funding to strengthen its digital lending experiences for banking and mortgages.

January 13 -

The transaction finances the loan portion of a $989.5 million acquisition of warehouse and distribution properties located in nine states.

January 13 -

But will the company's second attempt to go public come to fruition in a market where two lenders already put their offerings on hold?

January 12 -

If you are underbanked you probably have limited access to mainstream financial services normally offered by retail banks. Many fintech startups offer alternative ways to measure credit risk, and assert that their products can help extend financial services to consumers who have not been well-served by traditional banks.

-

The volume of Ginnie securities issued in December marked the first time more than $80 billion has been issued in a month.

January 11 -

Fitch and Trepp reported that overall commercial mortgage-backed security delinquencies were down, while the MBA reported a slight increase.

January 8 -

A new path forward for digital banks and their customers.

-

The transaction features a pool of non-qualified mortgages with a higher-than-average delinquency rate driven by COVID-19 relief plans.

January 8 -

The Swiss banking giant is expected to set aside $850 million for litigation costs stemming from a long-running dispute with bond issuer over the sale of mortgage-backed securities.

January 8 -

The first commercial mortgage securitization is backed by eight recently acquired garden-style apartments in five states.

January 6 -

The largest U.S. shopping center became delinquent on its debt last year after its owner Triple Five Group began skipping mortgage payments, citing hardships from the COVID-19 pandemic.

January 6 -

The company had canceled its planned pricing of the deal at the end of October over stock market volatility.

January 5 -

While the balance of newly delinquent loans fell by 50% from November, the ratings agency warned that many borrowers will likely struggle to bring loans current under ongoing pandemic conditions.

January 5