Fintech

Fintech

-

Also: Fairway fires back at UWM, private equity goes big with mortgage deals, manufactured homes aid the inventory crisis and how servicers will navigate the CDC's eviction ban extension.

April 2 -

Top executives from the 49 companies that earned a spot in this year's ranking of the Best Fintechs to Work For cite the need for nimble shifts in business strategy, leadership style and recruiting tactics among the lessons they took away from the challenges of the coronavirus crisis.

March 31 -

Small, often intangible quality-of-life perks are a big part of what makes some fintechs the best ones to work for.

March 31 -

The Utah fintech encourages a playful attitude by devoting the first floor of its offices to entertainment and comfort with video games, Ping- Pong, a pool table and a lounge area.

March 31 -

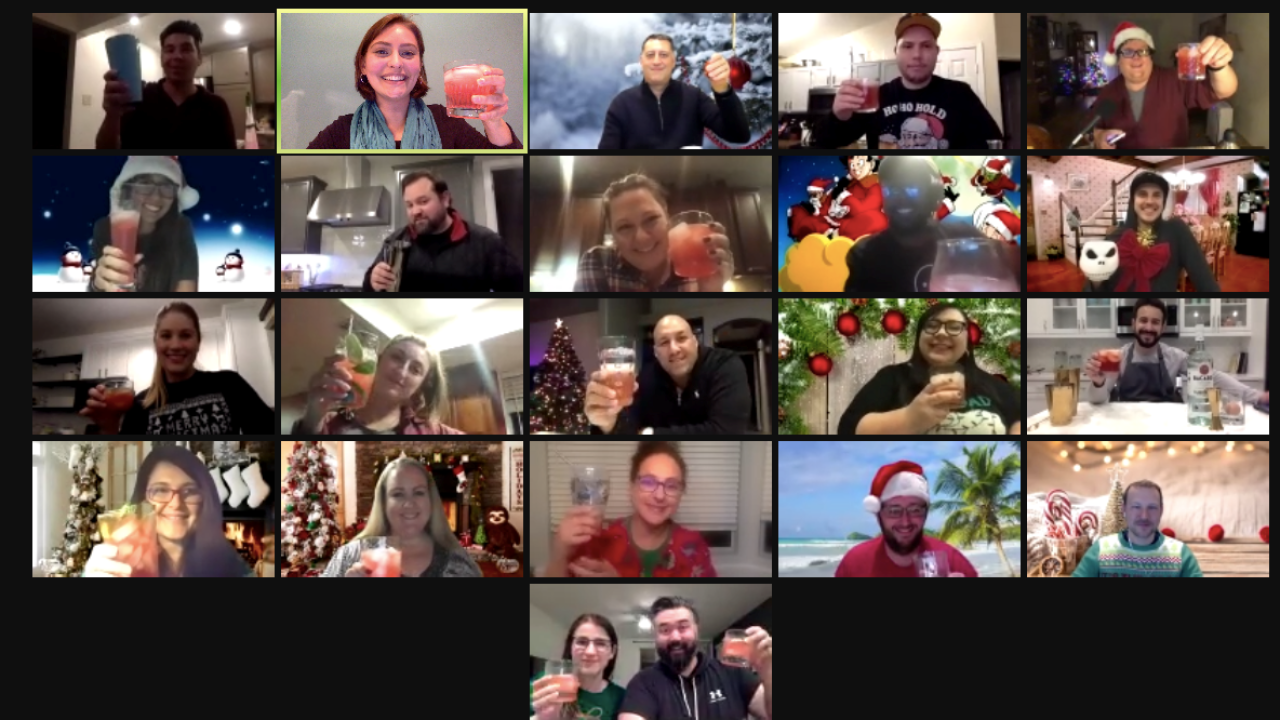

Without its funhouse office, annual trips or volunteering events, the executive found ways to engage his staff virtually.

March 31 -

Known for giving away its signature canary-hued Converse to employees and clients, this small API-centric fintech is poised to become a significant player in open banking thanks to parent company Mastercard and its vendor status with Fannie Mae and Freddie Mac.

March 31 -

Half of Facet Wealth’s employees haven’t met face-to-face. Here is how the fintech is working to strengthen community.

March 31 -

This venture-backed company, which specializes in creating banking and payment platform APIs for other fintechs, attracts new recruits through a culture of learning.

March 31 -

As credit remains tight, Opportunity Financial’s work with consumer financial services Brightside firm aims to offer a wider swath of borrowers access to small loans.

March 31 -

Five transactions in the past week provided cash infusions for tech companies that are developing products for real estate finance.

March 26 -

The Military Urban Development Initiative, which is also open to civilians, allows buyers to select a lot, house design and mortgage.

March 22 -

Proptech CEOs and investors fully expect a huge year for the sector due to the pandemic’s “watershed” effect on digitization, according to Keefe, Bruyette & Woods.

March 18 -

The American Fintech Council and the Financial Technology Association say they’ll promote responsible innovation, fair access to financial services and more. Their dozens of members include some of the biggest names in fintech.

March 17 -

-

With extreme winter weather about to give way to ballooning insurance and mortgage forbearance claims in Texas, servicers will need to get through their pipelines with urgency while weeding out fraud.

February 25 -

The company received an undisclosed amount of Series A funding from two investors to expand technology currently focused on helping lenders with timelines that are, on average, spinning out of control.

February 22 -

The acquisition of the mortgage fintech aligns with growing customer expectations surrounding a fully digital homebuying experience.

February 18 -

Like so many other businesses, Credit Karma was not spared by the pandemic and its rippling effects on the economy. Their business was prone to the same macro conditions, particularly the tightening of lending standards and credit limits. Join Paul Centopani, National Mortgage News' reporter and Andy Taylor, Credit Karma's General Manager of Home & Mortgage as they discuss how FinTechs can pivot to adapt to the new normal.

-

Mike Cagney’s blockchain lending startup Figure Technologies plans to raise $250 million through a new blank-check company, according to an SEC filing.

February 12 -

Financial inclusion is a key enabler to reducing poverty and Fintech is leading the way forward. New businesses and creative banking services are emerging with new means of providing financial services to the financially underserved. But technology is just part of the equation, not the whole solution. Join Daniel Wolfe, Editor-in-Chief of PaymentSource as he explores the issues surrounding financial services as infrastructure and how it can address the wealth gap in various communities with our special guests Wole Coaxum, Founder & CEO of MoCaFi and Marc Weill, Partner & Senior Advisor at Two Sigma Ventures.